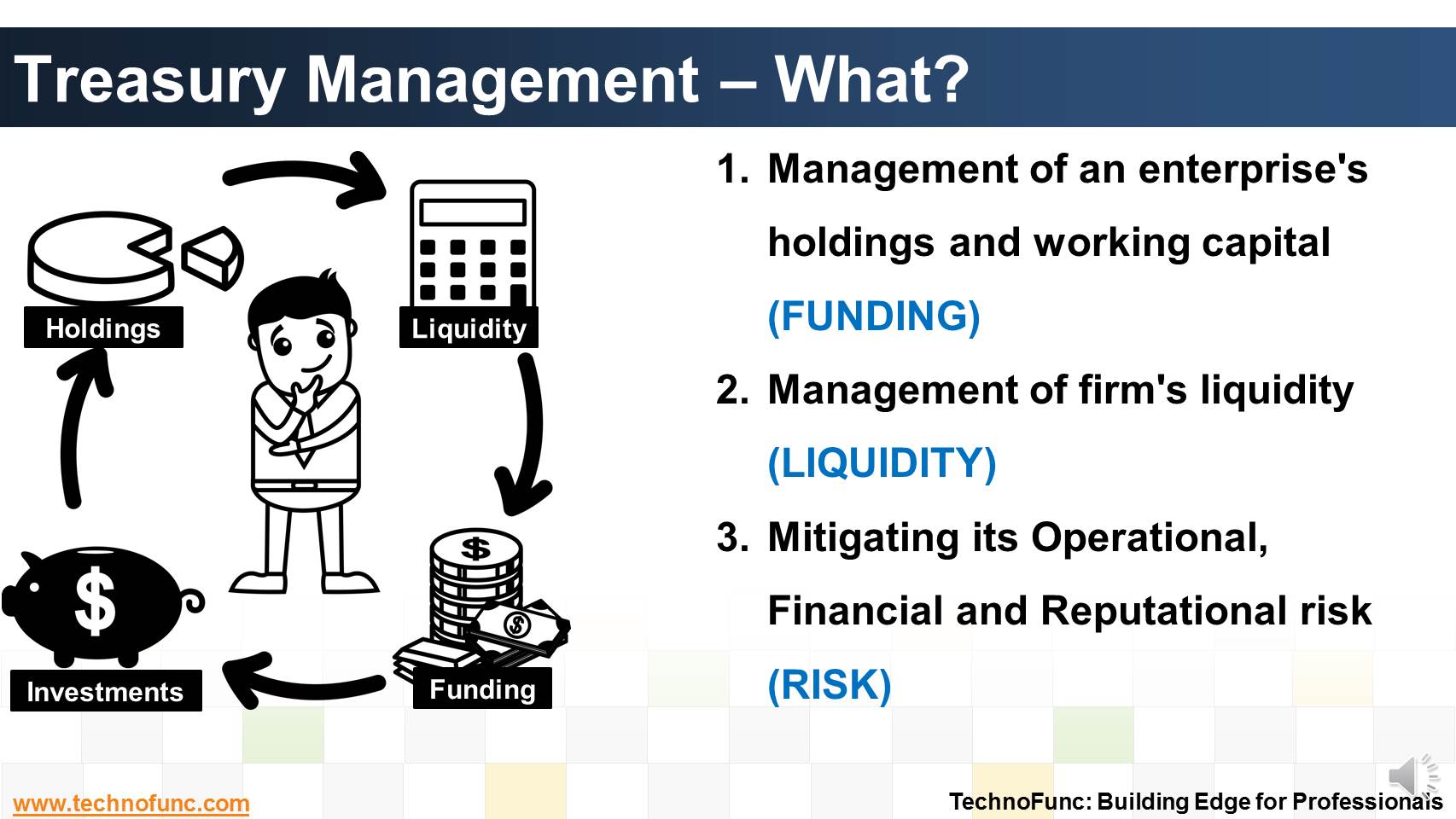

Treasury Management – What?

The terms Treasury Management and Cash Management are sometimes used interchangeably, while, in fact, the scope of treasury management is larger and includes funding and investment activities as well. Learn all about Treasury Management here!

Treasury management includes management of an enterprise's holdings, cash and working capital, with the ultimate goal of managing the firm's liquidity and mitigating its operational, financial and reputational risk.

Treasury Management provides greater insight and control over complex processes for managing funding, liquidity, and risk.

Until recently, large banks had the stronghold on the provision of treasury management products and services. however, large corporations are increasingly building in-house treasury management functions hiring seasoned treasury management professionals and using independent treasury management systems (TMS) that allows enterprises to conduct treasury management internally.

The terms Treasury Management and Cash Management are sometimes used interchangeably, while, in fact, the scope of treasury management is larger and includes funding and investment activities as well.

Treasury Management Functions:

- Management of an enterprise's holdings and working capital (FUNDING)

- Management of firm's liquidity (LIQUIDITY)

- Mitigating its Operational, Financial and Reputational risk (RISK)

The learning objectives of this capsule are:

- Learn the meaning of Treasury Management

- Financial Risk Management

- Cash Management

- Loans and Investment Management

- Understand how treasury function is organized

- Learn about various Treasury Management Systems

- Benefits of Treasury Management

Related Links

You May Also Like

-

The objective of funding Management is to implement strategies that lead to the best borrowing rates and lower investment costs. Learn how treasury aids in loans and investment management functions.

-

The terms Treasury Management and Cash Management are sometimes used interchangeably, while, in fact, the scope of treasury management is larger and includes funding and investment activities as well. Learn all about Treasury Management here!

-

Although there is no straight forward answer to the question, how to best organize a treasury function, this article provides an generic view of the way large MNCs creates departments or sub-functions within the treasury function.

-

Treasury has increasingly become a strategic business partner across all areas of the business, adding value to the operating divisions of the company. Managing activities that were traditionally carried out within the general finance function. Learn about the drivers for this change.

-

Treasury Management - Functions

Treasury management has become an specialized function. Treasury function helps in managing the Risk-return profile as well as the tax-efficiency of investment instruments. In larger firms, it may also include trading in bonds, currencies and financial derivatives. Learn about the various tasks, activities and imperatives, undertaken by treasuries in in today's context.

-

The objective of Financial risk management is to protect assets and cash flows from any risk. Treasury function works to accurately assess financial risks by identifying financial exposures including foreign exchange, interest rate, credit, commodity and other enterprise risks. Learn about the various risks that are managed by treasury.

-

Treasury Management - Benefits

Effectively using treasury management with cash management and trade finance products brings tangible benefits to both corporates and financial institutions. Let us discuss some tangible benefits of treasury function.

-

The Cash Management component ensures that the enterprise has sufficient liquidity for payments that are due and to monitor payment flows. Learn how treasury plays an important role in cash management for the enterprise.

-

Technology has enabled the treasury function by providing various solutions to manage it's complicated tasks. This article explains various types of treasury management systems available in the market.