- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Industry Knowledge

- Insurance Domain

- Importance of Insurance

Importance of Insurance

Insurance policies are a safeguard against the uncertainties of life. Insurance policy helps in not only mitigating risks but also provides a financial cushion against adverse financial burdens suffered. From a macro perspective Insurance industry turns capital accumulates as premiums into productive investments thereby promoting trade and commerce activities which result in the sustainable economic growth of the economy.

The insurance has become an integral part of the business and human life and is a vital force in securing the well-being of both individuals and businesses. Insurance actively promotes the health and security of the economy and business environment around the world. At a macro level, insurance improves the investment climate and contributes to the economic growth of businesses and economies in a number of ways including protecting the financial health of businesses and encouraging domestic production and trade. Insurance also helps reduce the risk to major infrastructure projects and developing capital markets by investing premiums. Insurance also covers the risks at the individual level and helps individuals lead a quality of life in case of contingencies and unforeseeable circumstances.

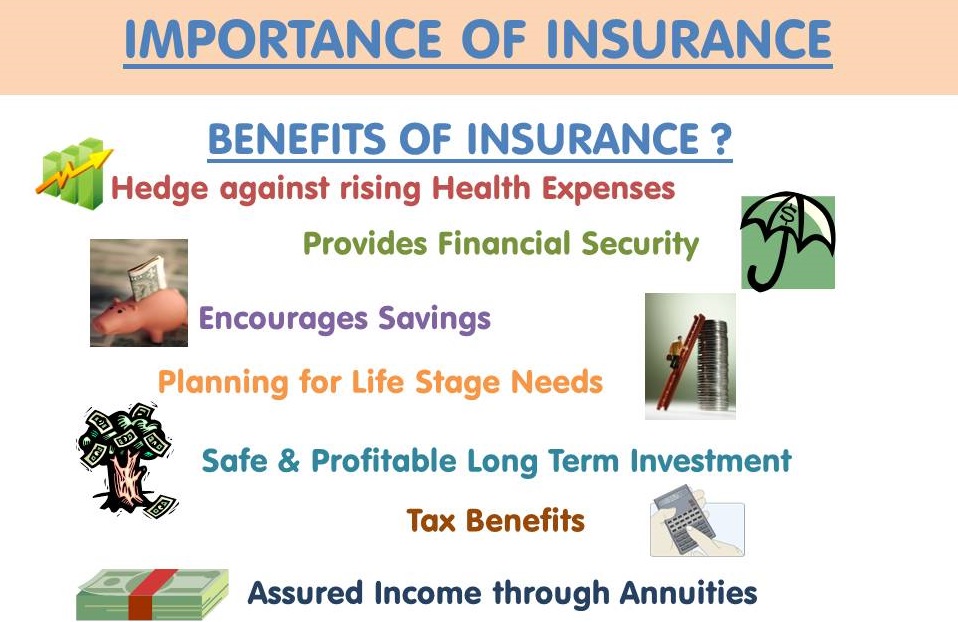

Benefits of Insurance:

Let us try and understand some common benefits of taking an Insurance Policy:

1. Business Risk:

The success of any business is based on the mitigation and controlling risk it encounters. For example, airlines carry an enormous amount of risk when they fly planes full of passengers each day. The plane itself is very expensive, the passengers can face injury and death in case of a crash, and the baggage could get lost or damaged in the normal course of operations. Airlines carry all these types of risks and they buy insurance policies to manage all this risk. Insurance allows businesses to take necessary risks without fear of huge financial loss.

2. Safety by Awareness:

Insurance is not just about paying losses that occur but also preventing losses in the first place from occurring. Insurers are better educated and aware of the causes of various losses and they can offer professional assistance for avoiding the most common causes of losses. Insurance companies generally require assessments as part of the process of getting coverage. This helps b bring awareness of the risks you have and help you plan ahead to mitigate those risks. Insurance companies organize information for policyholders and prospective clients. This information keeps the public informed about their risks and raises awareness of issues.

3. Economic Stimulation:

The premium is received regularly in installments. Large funds are collected by way of premium. It helps in collecting saving from a large number of persons. The funds can be gainfully employed in the industrial development of a country. Generally, insurers are required by state governments to maintain a cash reserve equal to or greater than a certain percentage of their liabilities. While they possess this money, they tend to invest it in a wide range of endeavors, from government securities to short-term and long-term bonds to stock markets. They reinvest it in various community projects. The monies provided by the insurance companies fund many things, from new construction to scholarships. Local, state, federal, and international economies are all bolstered by insurance companies when they use their pooled capital to fund other projects until it is needed to cover a loss.

4. Providing Security:

Insurance helps in decreasing the likelihood of financial hardship in case of a disaster or loss. Life as well as businesses today faces a lot of uncertainties. There is always a fear of sudden loss. There may be a fire in the factory, storm in the sea, or loss of life. In all these cases it becomes difficult to bear the loss. Insurance provides a cover against any sudden loss. Life Insurance ensures that your loved ones continue to enjoy a good quality of life against any unforeseen event. If you do not have insurance and disaster strikes, you can face thousands or even millions of dollars in court, medical, and asset replacement/repair costs. Insurance, therefore, protects you from financial loss and creates stability in difficult times. This stability translates to the ability to continue to invest in the economy, which stabilizes the financial situation of the entire country and greatly influences foreign trade relationships.

5. Planning and Peace of Mind:

Insurance encourages the behavior to plan in advance for life stage needs. Not having insurance sometimes means you have to dip into investments or assets to meet expenses, such as legal bills, medical costs, fire loss, burglary loss, etc. In some cases, a lack of insurance you’re your dependents at risk -- for example, with no medical insurance, a spouse or child may not get the treatment they need. This creates worry and stress. With insurance, you know that you have a cushion on which you can rely, giving you peace of mind. It helps you and gives you an instrument to plan your life goals and ambitions such as buying a new house, getting married, securing your child’s future, etc. When you take out an insurance policy, you assume responsibility for the financial issues and do not expect other members of society to foot your bills. This personal sense of accountability keeps you independent and reduces the burden you put on others bringing you peace of mind.

6. Investment:

Lenders do not provide funds and support for individuals and businesses unless they have some evidence that their investment is safe because they do not want to risk financial loss. Insurance shows lenders that they have some guarantee of getting money back in the event of a disaster. This makes it more likely that the lender will invest because they see you as less of a liability. Insurance in such scenarios helps you get personal loans or house loans as lenders have an assurance that they will be paid back by the insurance company in case of any misfortune. It also encourages safe & profitable long term Investment as traditional insurance policies are viewed both by the distributors as well as the customers as a long term commitment; these policies help the policyholders meet the dual need of protection and long term wealth creation efficiently.

7. Spreading Risk:

The basic principle of insurance is to spread risk among a large number of peoples. A large number of persons get the insurance policies and pay a premium to the insurer .whenever a loss occurs, it is compensated out of the fund to the insurer. This helps in spreading risk from one individual to society at large.

8. Health and Wellness:

Given the increasing incidence of lifestyle diseases and escalating medical costs, Insurance provides the benefits of protection against critical diseases and hospitalization expenses. From a business standpoint, providing health insurance to employees is a valuable tool to attract and retain the best employees. It also makes your company more attractive if your coverage is more comprehensive than that of your competitors. It's not unusual for employees to stick with a particular job or employer, because the health care coverage is comprehensive and affordable.

9. Encourages Savings:

As some amount of premium needs to be periodically paid against an insurance policy, it leads to compulsive saving behavior. It inculcates the habit of saving among people while planning for a better future. Hence, insurance does not only protect the risks but it provides the investment channel too. Life insurance provides a mode of investment. In the case of fixed time policies, the insured gets a lump sum amount after the maturity of the policies.

Tax Benefits: Pre-tax benefits are added advantages to the policyholders. These benefits help them to save a large portion of their tax payment. When the tax-payment gets reduced, their disposable income increases. Insurance policies also help plan your retirement. Retirement insurance ensures that you or your family members receive a regular pension amount post a retirement date. You have the flexibility to choose the retirement date and the manner in which you receive the pension.

Related Links

You May Also Like

-

The insurance industry classifies the different products it offers by sector. The insurance sector is made up of companies that offer risk management in the form of insurance contracts. There are four main insurance sectors: Life & Health Insurance Industry, General Insurance Industry, Specialty Insurance Industry & Reinsurance Industry. This article describes the current insurance industry sectors and their associated activities, products, and services.

-

BFSI is an acronym for Banking, Financial Services, and Insurance and popular as an industry term for companies that provide a range of such products/services and is commonly used by IT/ITES/BPO companies and technical/professional services firms that manage data processing, application testing, and software development activities in this domain. Banking may include core banking, retail, private, corporate, investment, cards, and the like. Financial Services may include stock-broking, payment gateways, mutual funds, etc. The insurance covers both life and non-life.

-

Insurance is categorized based on risk, type, and hazards. Logically, any risk that can be quantified can potentially be insured. Understand the importance of insurance and the different types of insurances like Life Insurance or Personal Insurance, Property Insurance, Marine Insurance, Fire Insurance, Liability Insurance, Guarantee Insurance.

-

A primary insurer purchases reinsurance to limit its exposure, usually to one specific type of risk, thereby diversifying its book of risk. Businesses in this industry focus on assuming all or part of the risk associated with existing insurance policies originally underwritten by direct insurance carriers. In other words, the primary activity of this industry is insuring insurance companies. Reinsurance occurs when multiple insurance companies share risk by purchasing insurance policies from other insurers.

-

An article to explain key terms used in the Insurance Industry and Insurance Business. Also, learn about various operational and performance metrics used in the insurance domain. Learn the definition and meaning of insurance industry terms like insured, insurer, claim, reinsurance, policy, and policy premium, etc.

-

Parties in the Contract of Insurance

There are two parties in the contract of Insurance. Understand these parties and their definition in the contract of insurance. Learners will learn about the key stakeholders in the insurance business along with a classification of internal and external stakeholders.

-

What is Life & Health Insurance Industry?

Insurers in this industry directly underwrite insurance policies relating to life, health, accident, and medical risks. Life and annuity insurance covers not only life and annuities but also health and disability. Read more about the health and life insurance industry. Life and health insurers generate revenue not only through the specific activity of insurance underwriting but also by investing premiums.

-

What is General Insurance Industry?

General Insurance industry providers perform an essential function in today's economy. General insurance is typically defined as any insurance that is not determined to be life insurance. Depending on the type of occupation, risk exposure, and the money involved, the insurance could be different for each industry or business. In underwriting insurance policies, general insurers earn premiums that they further invest.

-

The Business Model of Insurance Industry

The insurance industry business model can be further categorized into two types of main activities, service domain, and support domain. Service domain activities make up the company's value chain and the support domain provides the infrastructure and support to sustain the value chain. Support activities may include corporate services, finance, human resources, or information systems, and technology.

-

This article helps the student to understand the legal principles and provisions of the insurance law. Starting with the fundamentals from which law is derived, this article helps the student to understand the salient aspects of any insurance contract, the rights and obligations of parties to the contract, and the legal environment within which insurance practice is carried out. Explore the seven most important principles of insurance.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved