- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Cash Management

- Cash Clearing – Accounting Entries

Cash Clearing – Accounting Entries

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Learn the steps and accounting entries that gets generated during the cash clearing process.

Cash Clearing Account

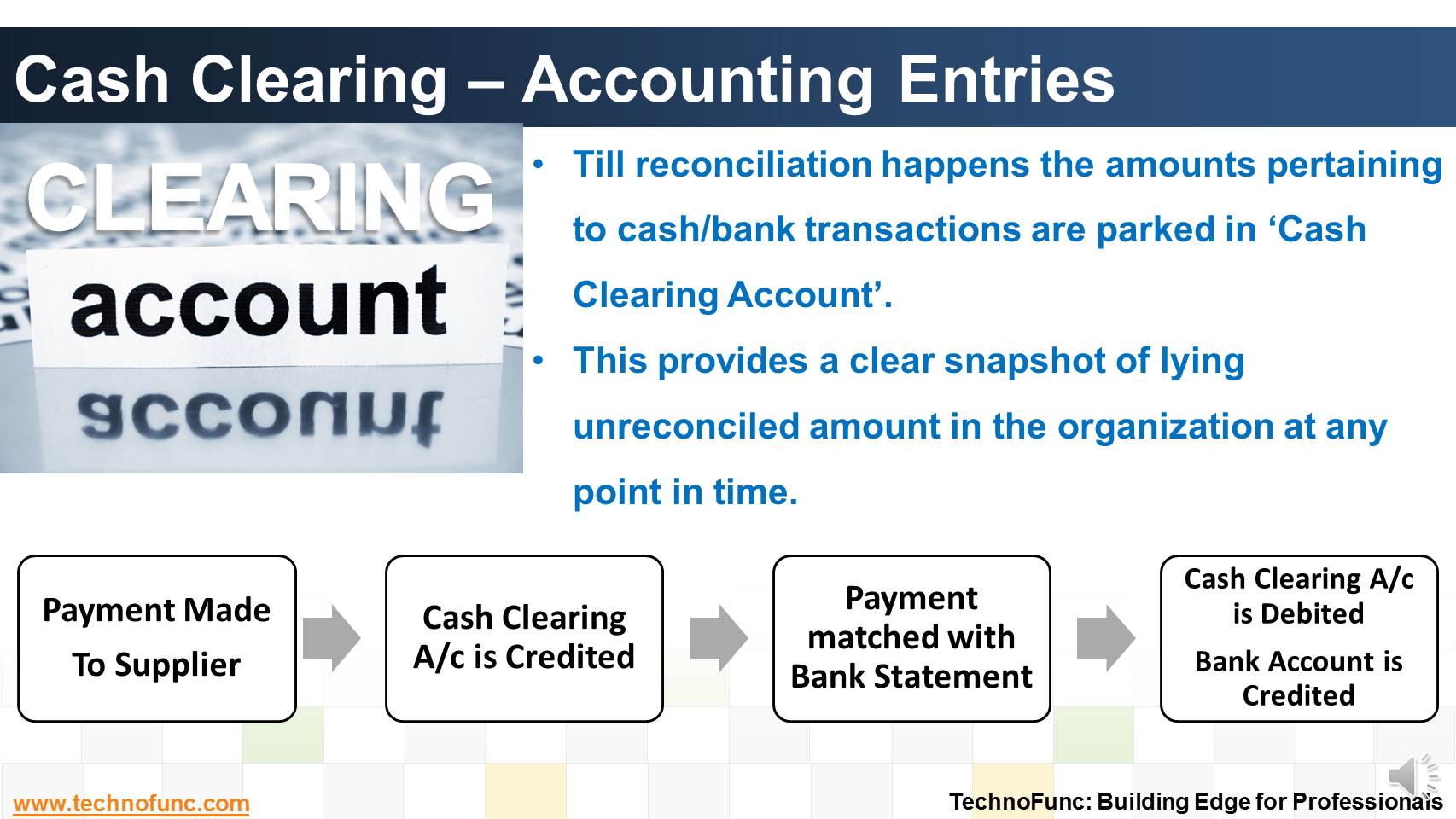

Till reconciliation happens the amounts pertaining to cash/bank transactions are parked in 'Cash Clearing Account'.

This method focuses on the use of a special cash-clearing control account to help provide an accurate cash-on-hand balance by including the effect of cash/bank transactions that have been issued, but have not yet cleared the bank in reconciliation system.

This provides a clear snapshot of lying unreconciled amount in the organization at any point in time.

For example – when you release payment to any supplier for his due invoice

You typically Dr Supplier A/c and Credit Bank Account

However in Cash Clearing Method – when you issue payment

You will Dr Supplier A/c and Credit Cash Clearing Account

Later when you receive the bank statement and reconcile the payment – at that point you will generate another accounting entry:

That is Cash Clearing A/c is Debited and Bank Account is Credited

Hence at this stage the payment hits your bank account – keeping it always reconciled.

Accounting Entries – Cash Clearing Process

The Cash Clearing process creates accounting entries for each scheduled payment that has been paid, reconciled, and cleared for bank accounts using cash clearing method of reconciliation.

These accounting entries are then posted to the general ledger.

Cash/Bank Clearing account is used to record unidentified debits and credits in bank statement.

At the time of reconciliation process, we have to debit or credit main account and offsetting will be done to Cash/Bank Clearing account.

Then only balance in the main account will match with Bank Statements.

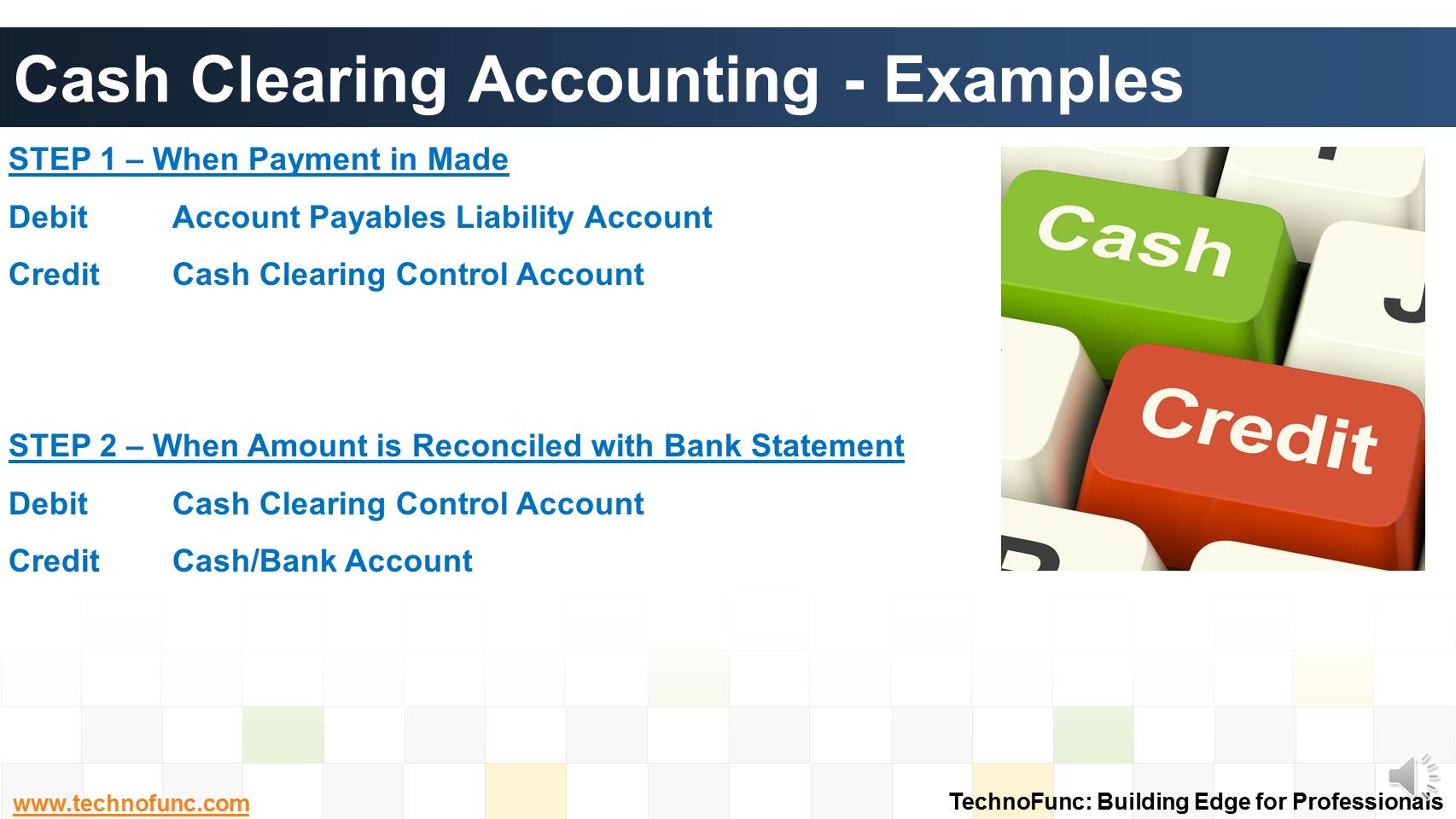

Cash Clearing Accounting Examples

Cash clearing accounting for cash/bank transactions is a two-step process.

Step 1

When the payment is issued and posted, the accounts payable liability account is debited, and the cash clearing control account (as opposed to the actual cash account) is credited for the payment amount.

Step 2

Later, when the cash clearing request is processed, a pair of balanced accounting entries are created to clear the net cash amount of the issued payment for each payment that has been reconciled.

To determine the actual cash balance, add any debit or credit residue in the cash clearing control account from payment or deposit amounts that have not yet been cleared to the cash account balance.

Related Links

You May Also Like

-

So many codes in the lines that are there in a Bank Statement. It contain lots and lots of meaningful information that can help automated many tasks. Explore more!

-

The topic for this lesson is "Introduction to Cash Management Process". We start with the learning objectives for building requisite functional expertise in cash management process.

-

Introduction to Bank Reconciliation Process

These set of articles provide a brief introduction to Bank Reconciliation Process. This topic not only discusses the meaning of bank reconciliation process but also discusses how this process in handled in new age ERPs and Automated Reconciliation Systems.

-

Cash Clearing – Accounting Entries

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Learn the steps and accounting entries that gets generated during the cash clearing process.

-

Treasury Management - Functions

Treasury management has become an specialized function. Treasury function helps in managing the Risk-return profile as well as the tax-efficiency of investment instruments. In larger firms, it may also include trading in bonds, currencies and financial derivatives. Learn about the various tasks, activities and imperatives, undertaken by treasuries in in today's context.

-

Complete Bank Reconciliation Process

Bank Reconciliation Process is a eight step process starting from uploading the Bank Statement to finally posting the entries in General Ledger. Learn the Eight Steps in Detail!

-

The objective of Financial risk management is to protect assets and cash flows from any risk. Treasury function works to accurately assess financial risks by identifying financial exposures including foreign exchange, interest rate, credit, commodity and other enterprise risks. Learn about the various risks that are managed by treasury.

-

Bank Reconciliation is a PROCESS to Validate the bank balance in the general ledger With Bank Statement. Learn the bank recon process.

-

Why enterprises need cash management. What is the purpose of having a well defined cash management process?

-

Unravel the mystery behind clearing. Why we use clearing accounts. Find the relevance of word "Clearing" in business context.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved