- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Cash Management

- Treasury - Cash Management

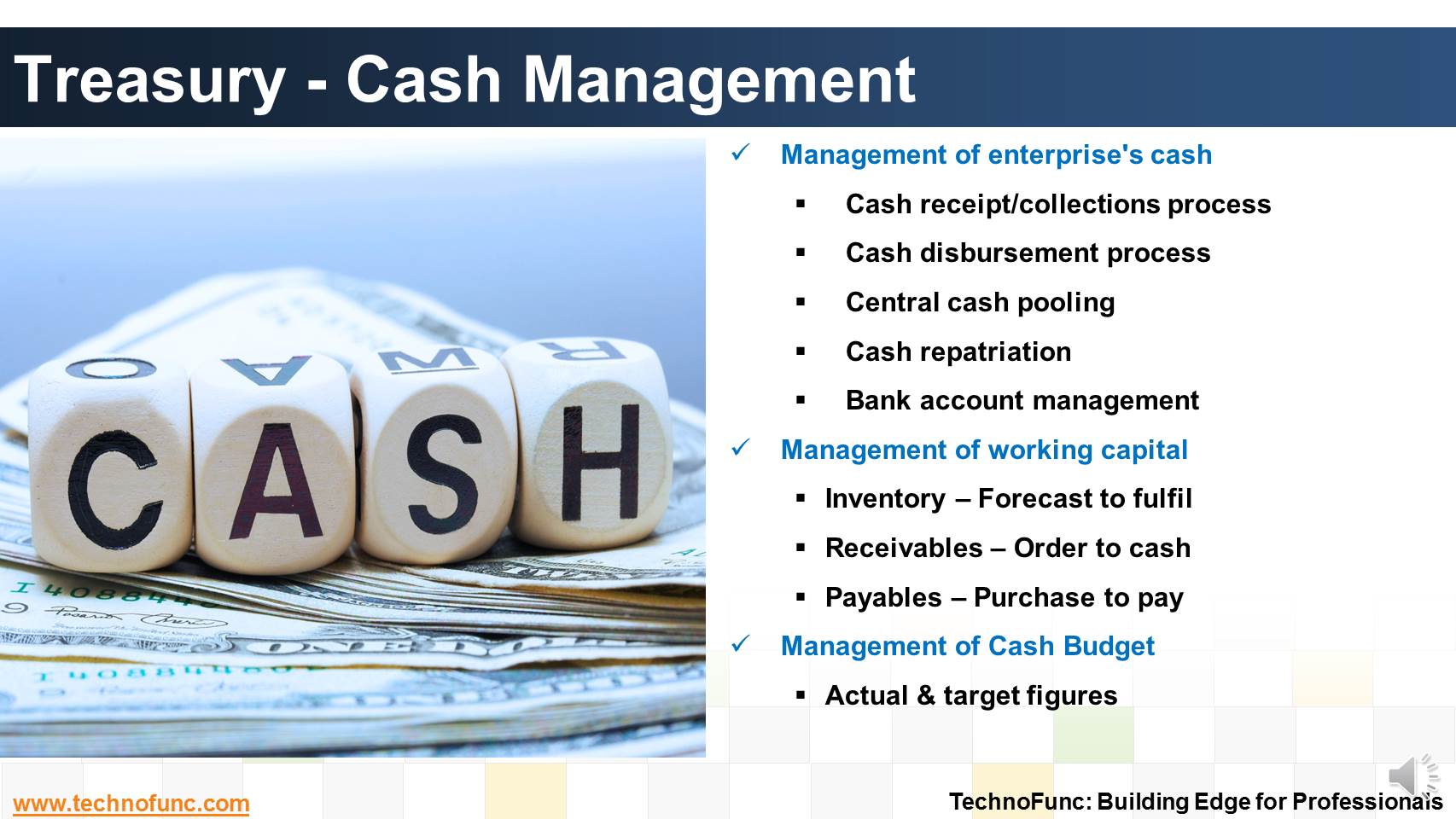

Treasury - Cash Management

The Cash Management component ensures that the enterprise has sufficient liquidity for payments that are due and to monitor payment flows. Learn how treasury plays an important role in cash management for the enterprise.

The Cash Management component ensures that the enterprise has sufficient liquidity for payments that are due and to monitor payment flows.

The cash position and liquidity forecast functions are used to track the movements on the various accounts.

It is very important to correctly assess local and international liquidity needs and cash availability.

Management of enterprise's cash

- Treasury function manages liquidity by accessing and using data from multiple systems and processes.

- With centralized cash management at enterprise level there is greater transparency into global cash flow that helps in optimizing Cash receipt and disbursement process to improve efficiencies

- Central in-house cash control reduces dependency on external funding and improves processes for transferring cash to operations worldwide.

- Position transparency and liquidity management is achieved through position management like Central cash pooling

- Cash and capital repatriation is also managed under treasury function.

Management of working capital

- Inventory – Forecast to fulfil

- Analyze sales forecast processes and evaluate production and material execution plans

- Receivables – Order to cash

- Enterprise wide visibility and consistency throughout the order to cash process by generating value from credit and collections

- Payables – Purchase to pay

- Vendor payments management and analyze company expenditure and spending patterns

Cash Budget Management

- The objective of the Cash Budget Management component is to monitor and secure liquidity in the medium to long term.

- It delivers the actual and target figures for reviewing plans, analyzing deviations and as a basis for future planning.

-

Technology has enabled the treasury function by providing various solutions to manage it's complicated tasks. This article explains various types of treasury management systems available in the market.

-

Effectively using cash management with trade finance products brings tangible benefits to both corporates and financial institutions.Learn the various benefits of cash management process.

-

Why enterprises need cash management. What is the purpose of having a well defined cash management process?

-

What is Account Reconciliation?

Before you understand the Bank Reconciliation Process it is important to understand what is account reconciliation and why it is carried out.

-

The Cash Management component ensures that the enterprise has sufficient liquidity for payments that are due and to monitor payment flows. Learn how treasury plays an important role in cash management for the enterprise.

-

Treasury has increasingly become a strategic business partner across all areas of the business, adding value to the operating divisions of the company. Managing activities that were traditionally carried out within the general finance function. Learn about the drivers for this change.

-

Bank reconciliation process is targeted to validate the bank balance in the general ledger and explain the difference between the bank balance shown in an organization's bank statement. Learn the reasons for existence of differences between the two.

-

Disbursement Float is the time taken from payment creation to settlement. Collection float is the sum total of time taken by Payment Float; Mail Float; Processing Float and Availability Float. Learn more!

-

Although there is no straight forward answer to the question, how to best organize a treasury function, this article provides an generic view of the way large MNCs creates departments or sub-functions within the treasury function.

-

Many different accounts are used in finance. Understand the representation and nature of clearing account in context of accounting, finance and ERP Systems.

Related Links

You May Also Like

-

The objective of funding Management is to implement strategies that lead to the best borrowing rates and lower investment costs. Learn how treasury aids in loans and investment management functions.

-

The terms Treasury Management and Cash Management are sometimes used interchangeably, while, in fact, the scope of treasury management is larger and includes funding and investment activities as well. Learn all about Treasury Management here!

-

Although there is no straight forward answer to the question, how to best organize a treasury function, this article provides an generic view of the way large MNCs creates departments or sub-functions within the treasury function.

-

Treasury Management - Benefits

Effectively using treasury management with cash management and trade finance products brings tangible benefits to both corporates and financial institutions. Let us discuss some tangible benefits of treasury function.

-

The objective of Financial risk management is to protect assets and cash flows from any risk. Treasury function works to accurately assess financial risks by identifying financial exposures including foreign exchange, interest rate, credit, commodity and other enterprise risks. Learn about the various risks that are managed by treasury.

-

Technology has enabled the treasury function by providing various solutions to manage it's complicated tasks. This article explains various types of treasury management systems available in the market.

-

Treasury Management - Functions

Treasury management has become an specialized function. Treasury function helps in managing the Risk-return profile as well as the tax-efficiency of investment instruments. In larger firms, it may also include trading in bonds, currencies and financial derivatives. Learn about the various tasks, activities and imperatives, undertaken by treasuries in in today's context.

-

The Cash Management component ensures that the enterprise has sufficient liquidity for payments that are due and to monitor payment flows. Learn how treasury plays an important role in cash management for the enterprise.

-

Treasury has increasingly become a strategic business partner across all areas of the business, adding value to the operating divisions of the company. Managing activities that were traditionally carried out within the general finance function. Learn about the drivers for this change.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved