- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Asset Management

- Asset Maintenance – Tagging & Physical Verification

Asset Maintenance – Tagging & Physical Verification

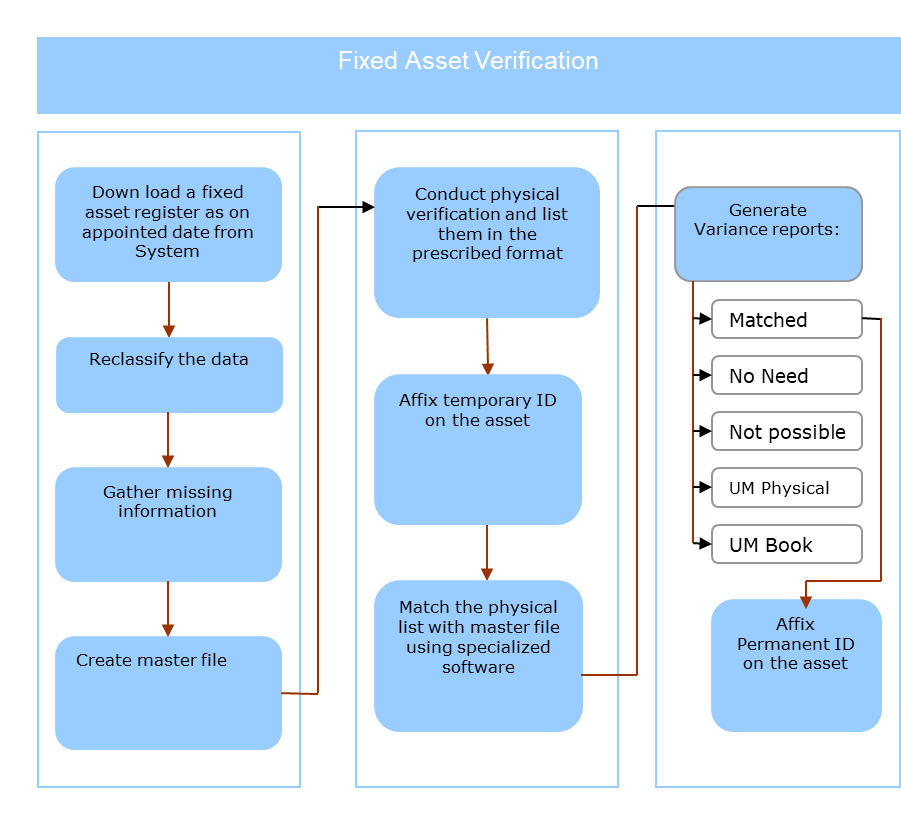

Most organizations need to deal with hundreds or even thousands of physical assets. In such a case, it’s important to know the operating condition and location of the assets owned by them at periodical intervals. Identifying, tracking, and controlling assets are a critical step in ‘Asset Maintenance’.

Tracking of available physical assets such as furniture and fixtures, plant and machinery, IT assets, etc. and compare with Fixed Asset Register. The process of tracking is performed by proper tagging of the assets using bar-code or such other human-readable numbers. To generate various reports and take corrective action

Tagging of Fixed Assets

Once the asset is procured/ placed in service, the organization affixes asset tags with descriptive information such as asset number, expenditure code, asset description, cost center, and a bar code.

Tagging Best Practices:

- Affix temporary ID at the time of physical listing

- Create a permanent ID for matched assets after the matching process using the system asset number.

- Permanent ID will be printed on flexible labels like a bar-coded sticker, metal plates, etc. that will conform to the asset, which will also withstand harsh conditions including chemicals, abrasion, solvents and high temperatures.

- The label used shall ensure easy tracking, accurate and reliable reads for the years to come.

- Size and type of label shall be decided depending on the nature of the asset

- Approved size and type of label shall be affixed on the matched assets

- Update Cost center, Location, Machine serial number, part number, etc in System

- Update Inventory particulars in System for future reference

- Ensure authenticity in depreciation calculation for income tax and companies act purposes

- Correct valuations for each location insurance purposes

- Suggest modifications in Standard operating procedure for capitalization, transfer, and disposal of the asset so as to ensure on line updating in System

Physical Verification:

All entities conduct a physical count of all fixed assets at periodic intervals (ranging from 1 to 5 years) to verify actual assets in hand and value and ensure the accuracy of related financial records. PV of assets helps in identifying obsolete, abandoned and unused assets, control capital expenditure, obtain confirmation letters from the third parties, and support for corrective action on unmatched assets.

1. Unmatched assets

- Available physically but not found in the asset register

- Available in asset register not found physically

Reason for discrepancy identified

- Not possible to verify

- Physically discarded/disposed of not removed in the asset register

- Low-value assets

- Assets available with third parties

2. Idle Asset Review:

Organizations make efforts to make full utilization of fixed assets in their possession and control. Hence they must make efforts to identify and make available idle, excess, and underutilized equipment to other departments that may need them.

Post Verification Adjustments

A. Impairment:

Impairment exists when the carrying amount of a fixed asset exceeds its fair value and is non-recoverable. Specific events/changes could trigger an impairment of an asset like a significant decrease in the market price of a fixed asset, a change in how the company uses an asset or changes in the business climate that could affect the asset’s value.

B. Asset Adjustments:

Adjustments to existing asset information are often needed to be made. Events may occur that can change the depreciable basis of an asset like there may be improvements or repairs made to assets that either add value to the asset or extend its economic life. Expenditure that increases the future benefits from the existing asset beyond its previously assessed standard of performance is included in the gross book value, e.g., an increase in capacity.

C. Asset Revaluation:

The purpose of a revaluation is to bring into the books the fair market value of fixed assets. Events may occur that can lead the organization to revalue its assets for change in asset value due to inflation, deflation, or appreciation.

Related Links

You May Also Like

-

Key challenges in managing FA process

As organizations grow in scale they need a more detailed justification of capital expenditure. This leads to many functions getting involved in the fixed asset management process with significant “hand-offs” at each step/stage. In this chapter, we will address a broad array of issues involved in the process of fixed assets in any large scale organization.

-

A fixed asset register (FAR) is accounting book with a list of fixed assets belonging to particular entity. Traditionally the fixed asset register was maintained in written form by the accountant using a book that was set aside specifically for tracking fixed assets. Now with the advent of IT systems for bookkeeping it is more often held in electronic format. Learn the importance of maintaining a FAR.

-

Physical assets are frequently out in the field for use; undergo repairs, sold, updated, removed or stolen. From purchase to disposal and all of the steps in between, an asset’s history can be easily traced and reviewed using an asset management system that utilizes asset tags or asset labels.

-

Asset Maintenance – Tagging & Physical Verification

Most organizations need to deal with hundreds or even thousands of physical assets. In such a case, it’s important to know the operating condition and location of the assets owned by them at periodical intervals. Identifying, tracking, and controlling assets are a critical step in ‘Asset Maintenance’.

-

Fixed Assets - Key Terminology

In this article, we have explained the meaning and usage of key generic terms that are used in almost every FA management system/ Fixed Assets process. Understanding these terms is a prerequisite to building a solid understanding of the fixed assets business process.

-

Introduction to Capital Asset Planning

Before you purchase an asset in any organization, you must justify the decision to purchase the asset and get requisite approvals to make investment and release the funds. These series of analysis steps where cost-benefit analysis is performed to justify the decision to purchase a prospective asset is called the process of capital asset planning or simply as capital budgeting.

-

An asset is anything that will probably bring future economic benefit. Every company must take actions to safeguard, control, and manage the assets it owns. Cash Assets needs to be managed effectively to safeguard and utilize them efficiently. In this section, we will start with understanding what are assets, what are various classification of assets and then we will focus on Asset Management.

-

“Fixed Assets” is a six-step process and starts with initiating and approving the request to acquire the asset and after maintaining and depreciating for useful life ends with the final disposal of the fixed asset. These steps are cyclic in nature and most of them happen in any fixed management lifecycle. Some optional steps may happen only in certain business scenarios or in specific industries.

-

Costs subsequent to acquisition of fixed assets

Costs related to plant assets that are incurred after the asset is placed in use are either added to the fixed asset account (capitalized) or charged against operations (expensed) when incurred. In this article, we will discuss underlying principles for this accounting event.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved