- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Cash Management

- Clearing Account

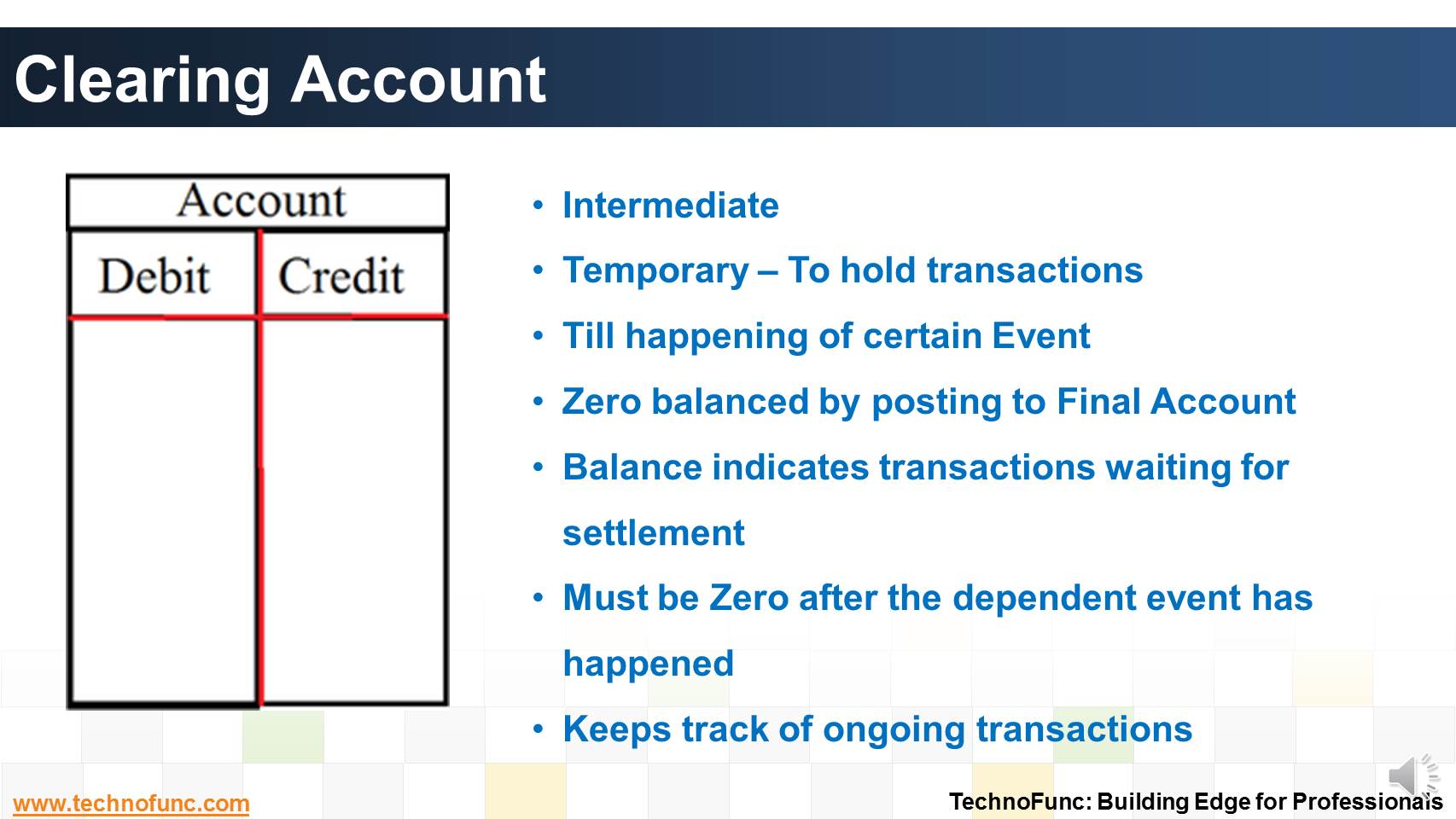

Clearing Account

Many different accounts are used in finance. Understand the representation and nature of clearing account in context of accounting, finance and ERP Systems.

Many different types of accounts exist in the general ledger.

Each account hold information of a specific nature - relating to a company's business transactions.

Many companies use clearing account, which is an intermediate account

- One that retains information for a temporary amount of time, till a certain event happens

- After which, the balance is moved to other final account.

- Clearing accounts can created for just about any transaction in the accounting system.

- Controllership may also use clearing account to implement segregation of duties.

- One of the most used clearing account is the Cash Clearing Account.

Related Links

You May Also Like

-

Disbursement Float is the time taken from payment creation to settlement. Collection float is the sum total of time taken by Payment Float; Mail Float; Processing Float and Availability Float. Learn more!

-

What are the various sources of cash in an organization. Which sources increase the cash available with the enterprise and which sources results in outflow of the cash? Let us explore!

-

What is Account Reconciliation?

Before you understand the Bank Reconciliation Process it is important to understand what is account reconciliation and why it is carried out.

-

How the inflow and outflow of cash is linked to the operating cycles of the business? Learn the cash management process in an enterprize and it's key components.

-

Although there is no straight forward answer to the question, how to best organize a treasury function, this article provides an generic view of the way large MNCs creates departments or sub-functions within the treasury function.

-

Treasury has increasingly become a strategic business partner across all areas of the business, adding value to the operating divisions of the company. Managing activities that were traditionally carried out within the general finance function. Learn about the drivers for this change.

-

Bank reconciliation process is targeted to validate the bank balance in the general ledger and explain the difference between the bank balance shown in an organization's bank statement. Learn the reasons for existence of differences between the two.

-

Cash Clearing – Accounting Entries

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Learn the steps and accounting entries that gets generated during the cash clearing process.

-

The Cash Management component ensures that the enterprise has sufficient liquidity for payments that are due and to monitor payment flows. Learn how treasury plays an important role in cash management for the enterprise.

-

Treasury Management - Benefits

Effectively using treasury management with cash management and trade finance products brings tangible benefits to both corporates and financial institutions. Let us discuss some tangible benefits of treasury function.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved