- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Cash Management

- Collection Float

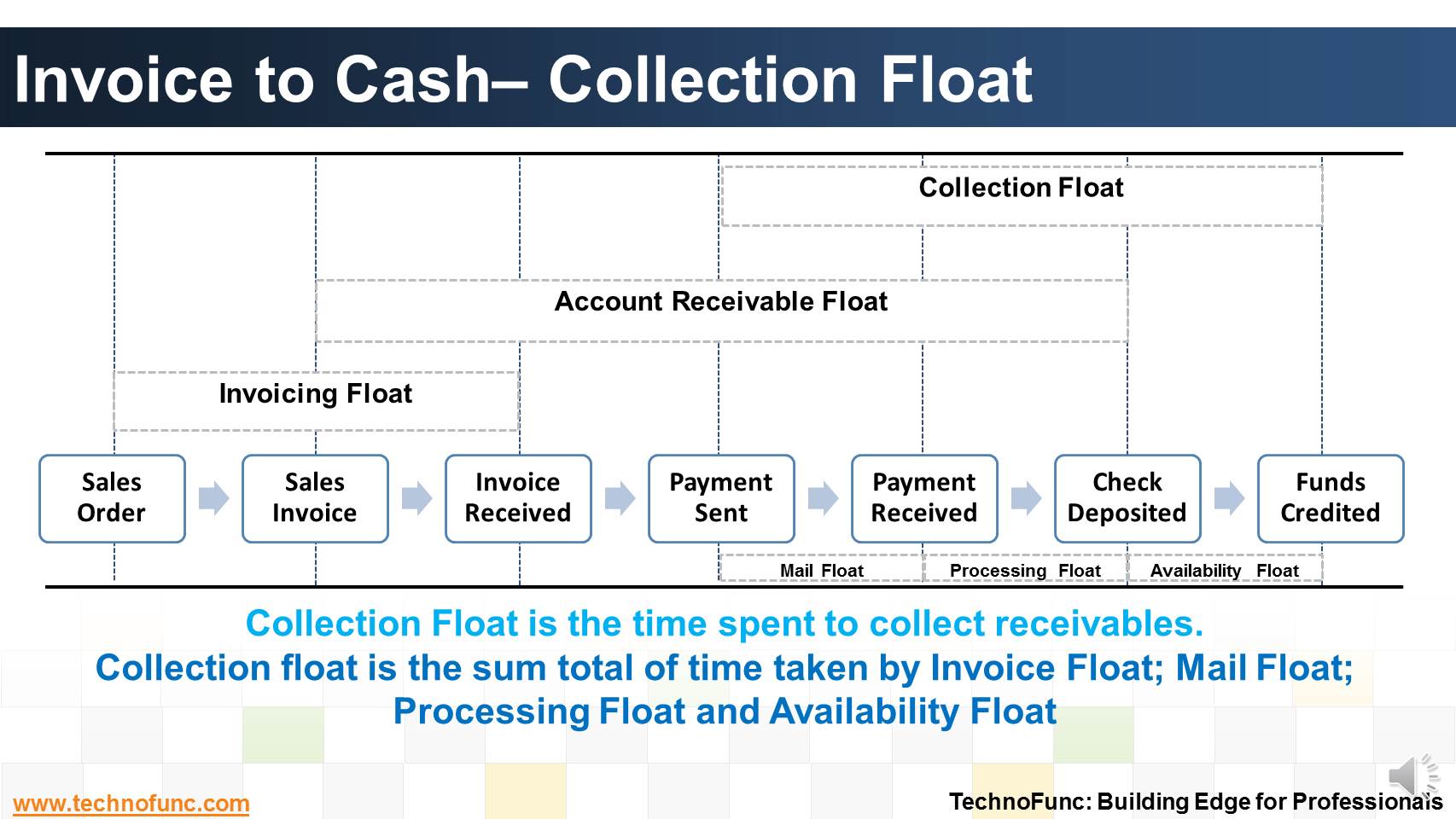

Collection Float

Collection Float is the time spent to collect receivables. Collection float is the sum total of time taken by Invoice Float; Mail Float; Processing Float and Availability Float. Explore more!

Invoice to Cash– Collection Float

Collection Float is the time spent to collect receivables.

Collection float is the sum total of time taken by Invoice Float; Mail Float; Processing Float and Availability Float

1. Invoicing float is the time period between the delivery of goods or services to the customer and the customer's receipt of the bill, generally by mail. It is the time it takes a company to record its delivery of service or

goods and then to produce and mail a bill.

2. Mail float is the time taken by Postal or Courier Service to deliver the customer's payment.

3. Processing float is the period between the receipt of the payment and its deposit into the company's bank account and includes the time it takes to record the payment in the accounting system.

4. Availability float is the time it takes the deposited check to clear the customer's account and for good funds to be available to the company for disbursement.

Related Links

You May Also Like

-

Disbursement Float is the time taken from payment creation to settlement. Collection float is the sum total of time taken by Payment Float; Mail Float; Processing Float and Availability Float. Learn more!

-

The Cash Management component ensures that the enterprise has sufficient liquidity for payments that are due and to monitor payment flows. Learn how treasury plays an important role in cash management for the enterprise.

-

Why enterprises need cash management. What is the purpose of having a well defined cash management process?

-

In manual clearing, Bank statement details are to be matched manually considering certain rules. Learn the steps involved in manual clearing of bank transactions.

-

The topic for this lesson is "Introduction to Cash Management Process". We start with the learning objectives for building requisite functional expertise in cash management process.

-

Collection Float is the time spent to collect receivables. Collection float is the sum total of time taken by Invoice Float; Mail Float; Processing Float and Availability Float. Explore more!

-

Bank reconciliation process is targeted to validate the bank balance in the general ledger and explain the difference between the bank balance shown in an organization's bank statement. Learn the reasons for existence of differences between the two.

-

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Till reconciliation happens the amounts are parked in 'Cash Clearing Account'.

-

Have you ever wondered what is actually a Bank Statement and why it is needed. What is the information that is available in a bank statement?

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved