- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Cash Management

- Disbursement Float

Disbursement Float

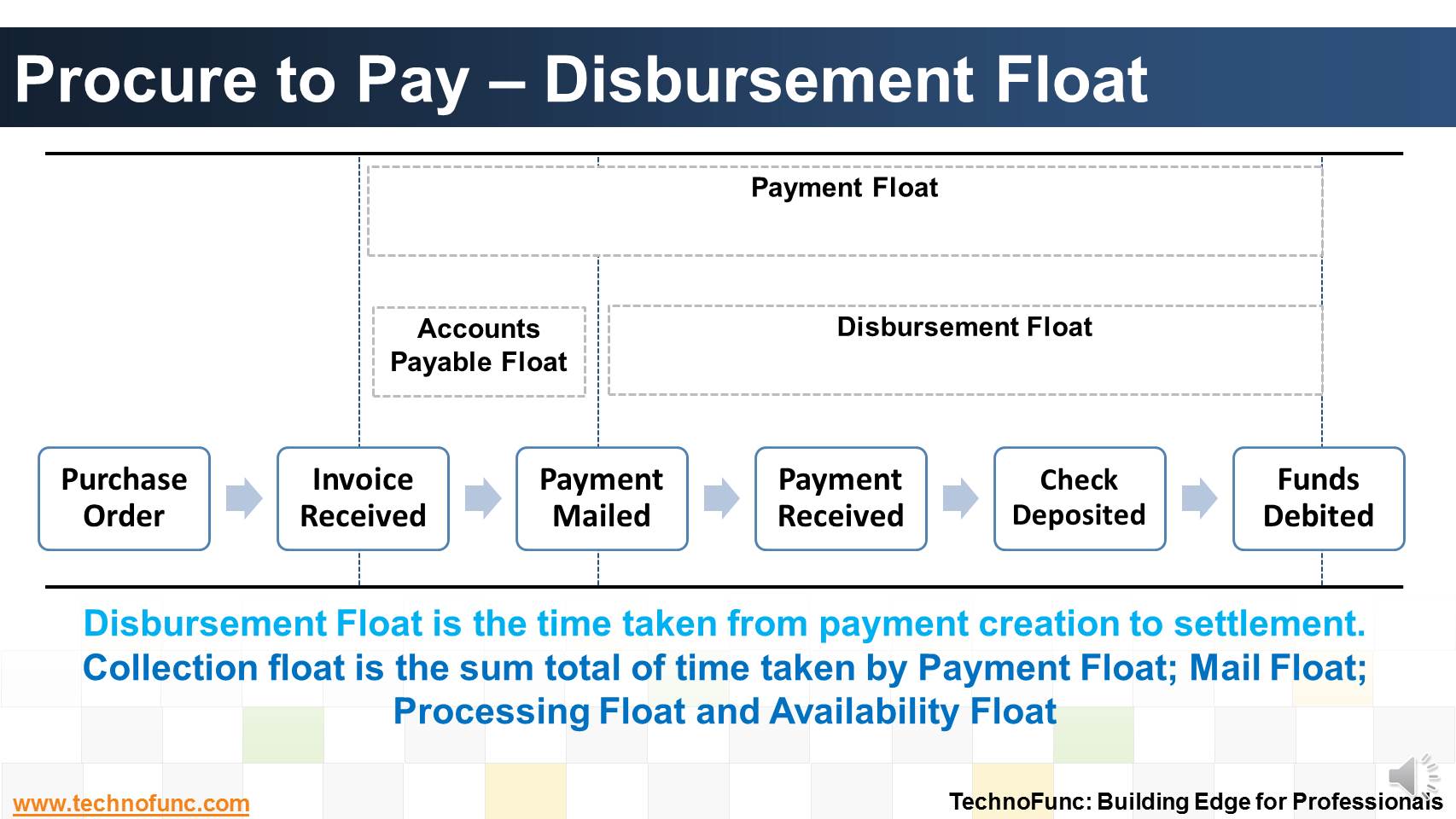

Disbursement Float is the time taken from payment creation to settlement. Collection float is the sum total of time taken by Payment Float; Mail Float; Processing Float and Availability Float. Learn more!

Disbursement Float is the time it takes a company's payment to be created, mailed, received, deposited and presented to the drawee bank for settlement.

Thus collection float and disbursement float refer to the same processes and time intervals depending on point of view; one as a customer and another as a supplier.

For the company receiving a payment, collection float represents the time it takes an invoice to be prepared, to reach the customer, to receive payment and for the payment to clear the bank.

For the company making the payment, that same interval is disbursement float.Disbursement float consists of the following four components:

1. Invoicing and payment processing float includes both the time it takes the supplier to prepare and send the invoice, as well as the time the accounts payable department requires to process the invoice and create the payment.

2. Mail float is the time taken by postal or courier service to deliver the payment to the vendor.

3. Processing float is the time it takes the vendor to record the payment and deposit it into the bank.

4. Availability float is the time it takes the bank to clear the check and deduct the funds from the payee's bank balance.

Cash management focuses on shortening collection float and extending disbursement float, without impacting the positive customer and vendor relationships.

The skillful management of float contributes real bottom-line impact and benefit to the company.

Related Links

You May Also Like

-

Cash Management - Integrations

Cash Management integrates cash transactions from various sources like Receivables, Payables, Treasury and creates reconciliation accounting entries after matching transactions with Bank Statements.

-

The terms Treasury Management and Cash Management are sometimes used interchangeably, while, in fact, the scope of treasury management is larger and includes funding and investment activities as well. Learn all about Treasury Management here!

-

The Cash Management component ensures that the enterprise has sufficient liquidity for payments that are due and to monitor payment flows. Learn how treasury plays an important role in cash management for the enterprise.

-

The topic for this lesson is "Introduction to Cash Management Process". We start with the learning objectives for building requisite functional expertise in cash management process.

-

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Till reconciliation happens the amounts are parked in 'Cash Clearing Account'.

-

So many codes in the lines that are there in a Bank Statement. It contain lots and lots of meaningful information that can help automated many tasks. Explore more!

-

Introduction to Cash Clearing Process

Unravel the mystery behind clearing accounts. Learn why clearing accounts are used in finance and accounting. Learn why so many clearing accounts are defined in ERPs and Automated Accounting Systems.

-

Technology has enabled the treasury function by providing various solutions to manage it's complicated tasks. This article explains various types of treasury management systems available in the market.

-

Collection Float is the time spent to collect receivables. Collection float is the sum total of time taken by Invoice Float; Mail Float; Processing Float and Availability Float. Explore more!

-

Account Reconciliation – How? Learn the three key attributes to perfom account reconciliation.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved