- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Journal Entry & Import

GL - Journal Entry & Import

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

Recording Journals in General Ledger:

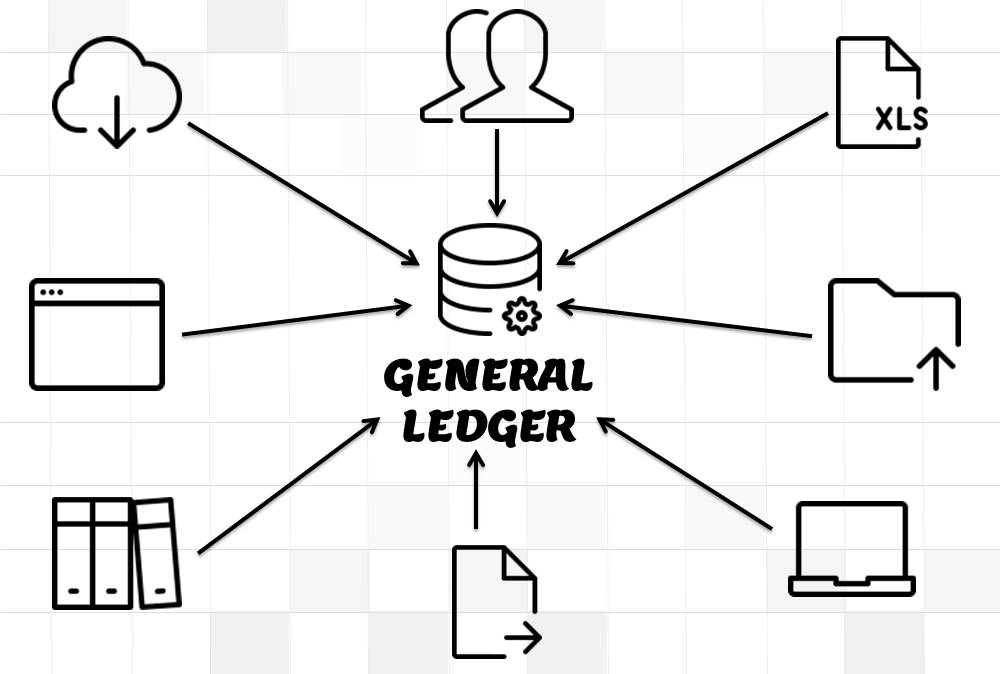

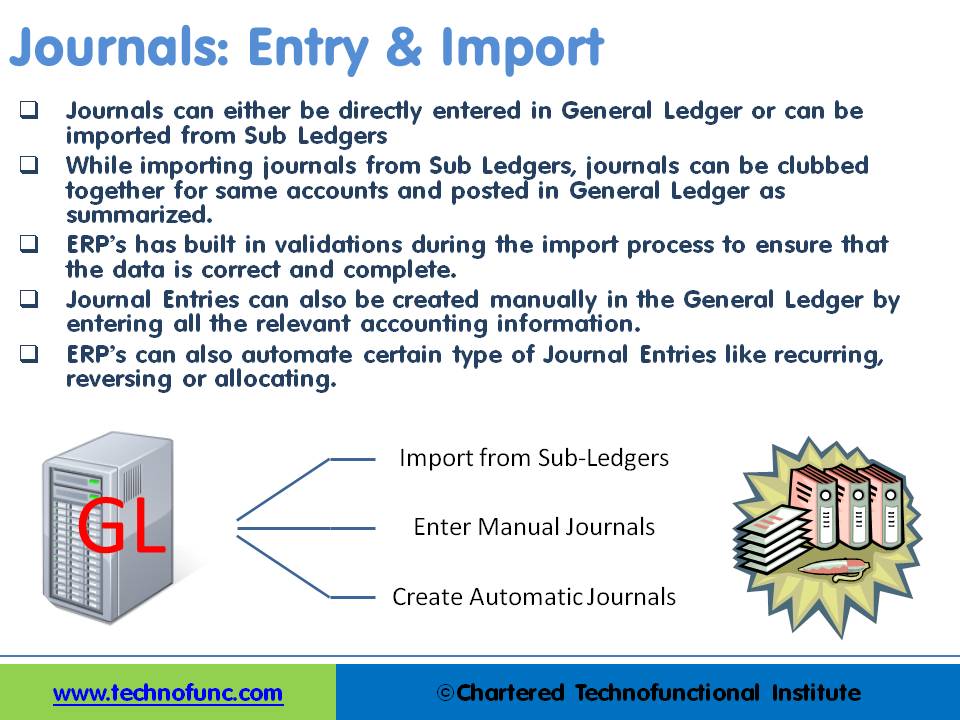

Journals can either be directly entered in General Ledger or can be imported from Sub Ledgers. Most of the journals are created along-with business transactions like sales, purchases, receipts, and payments and get recorded in respective sub-ledgers. As sub-ledgers generally capture data at a more granular level, the relevant accounting information must flow to the general ledger for posting and subsequent reporting. From sub-ledgers, they need to be imported to the general ledger for financial recording and reporting.

Journal Entries can also be created manually in General Ledger by entering all the relevant accounting information. ERPs can also automate certain types of Journal Entries like recurring, reversing, or allocating journals. In case of manual entry follow the steps and guidelines outlined in the Recording Journals tutorial.

Importing – Detail V/s Summarized:

While importing journals from Sub Ledgers, journals can be clubbed together for the same accounts and posted in General Ledger as summarized.

Various general ledger systems provide the functionality to create Summary Journals which summarize all transactions for the same account, period, and currency into one debit or credit journal line. This results in fewer transactions in the general ledger systems and makes financial reports more manageable in size. In the case of summary journal users, lose the one-to-one mapping of detail transactions in the sub-ledger to the summary journal lines created by the import process. However most of the organizations use this feature as this prevents too many transactions in GL Accounts and transactions get clubbed based on category, type, or transaction source.

Using the drill-down functionalities available in most of the modern general ledger systems, users can still perform various review and analysis functions, as even if the system creates summary journals, it can still maintain a mapping of how Journal Import summarizes sub-ledger detail transactions from feeder systems into general ledger journal lines.

Journal Import Validations:

ERP’s and automated accounting systems must have built in validations during the import process to ensure that the data is correct and complete. An effective Journal Import program should validate key accounting information before it creates journal entries in the General Ledger application to prevent errors and reconciliation efforts.

Given below are some of the common data validations that can happen during the GL Import process:

1. Suspense Posting:

Suspense posting puts the remaining amount in the suspense account in case the debits and credits of the journal are not matching. In case it is not required, Journal Import should reject all invalid lines that do not balance.

2. Duplicate Batch Name:

If the batch name is a unique field then Journal Import should ensure that a batch with the same name does not already exist for the same period in the General Ledger application. Similarly, it must also check to ensure that more than one journal entry with the same name does not exist for a batch.

3. Other Attributes:

Attributes that can be validated to ensure that journals contain the appropriate accounting data could be accounting books, period, source, currency, category, accounting date, reversal period, account validation, account code combinations, effective date, roll date, and any other required validations.

Import Using Excel:

In today’s accounting world, financial and operational data typically is stored in a variety of programs and formats. Excel is one of such tools, most widely used by the accountants! When accountants need to prepare a report based on data from various systems, the first step is to export the data into Excel. Many times accounting information is stored in chronological order in excels by the accountants, and examples include adjusting entries and recurring entries.

Benefits of using the excel upload feature are that it makes life much easier for data operator and accounts executives. The great flexibility of excel based application increases productivity and results in reduced training costs as most users are already familiar with the excel functionalities and also improves user acceptance for automated systems. The biggest benefit comes from the fact that excel upload can also work in disconnected environments.

Typically, most of the automated systems provide the functionality to import accounting data from Excel to the general ledger and create journals. Most ERPs provide the ability to upload journals using the MS Excel worksheet. You can create journals in Excel Template and upload directly to General Ledger.

Related Links

You May Also Like

-

Internally, an organization can be structured in many different ways, depending on their objectives. The internal structure of an organization will determine the modes in which it operates and performs. Organizational structure allows the expressed allocation of responsibilities for different functions and processes to different entities such as the branch, department, workgroup and individual.

-

Operational Structures in Business

Large organizations grow through subsidiaries, joint ventures, multiple divisions and departments along with mergers and acquisitions. Leaders of these organizations typically want to analyze the business based on operational structures such as industries, functions, consumers, or product lines.

-

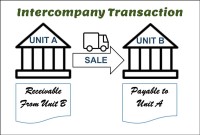

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

In some of the ERP tools, there are more than 12 accounting periods in a financial year. This article discusses the concept of accounting calendar and accounting periods. Learn why different companies have different accounting periods. Understand some of the commonly used periods across different organizations and the definition & use of an adjustment period.

-

Global Business Services (GBS) Model

Global business services (GBS) is an integrated, scalable, and mature version of the shared services model. Global Business Services Model is a result of shared services maturing and evolving on a global scale. It is represented by the growth and maturity of the Shared services to better service the global corporations they support.

-

Matrix Organizational Structures

In recent times the two types of organization structures which have evolved are the matrix organization and the network organization. Rigid departmentalization is being complemented by the use of teams that cross over traditional departmental lines.

-

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

-

GL - Journal Posting and Balances

In this tutorial, we will explain what we mean by the posting process and what are the major differences between the posting process in the manual accounting system compared to the automated accounting systems and ERPs. This article also explains how posting also happens in subsidiary ledgers and subsequently that information is again posted to the general ledger.

-

In this article, we will describe how to determine if an account needs adjustment entries due to the application of the matching concept. Learners will get a thorough understanding of the adjustment process and the nature of the adjustment entries. We will discuss the four types of adjustments resulting from unearned revenue, prepaid expenses, accrued expenses, and accrued revenue.

-

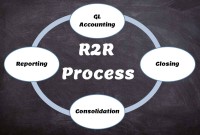

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved