- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Industry Knowledge

- Banking Domain

- Type of Banks: Different Types of Banks in India & their Functions

Type of Banks: Different Types of Banks in India & their Functions

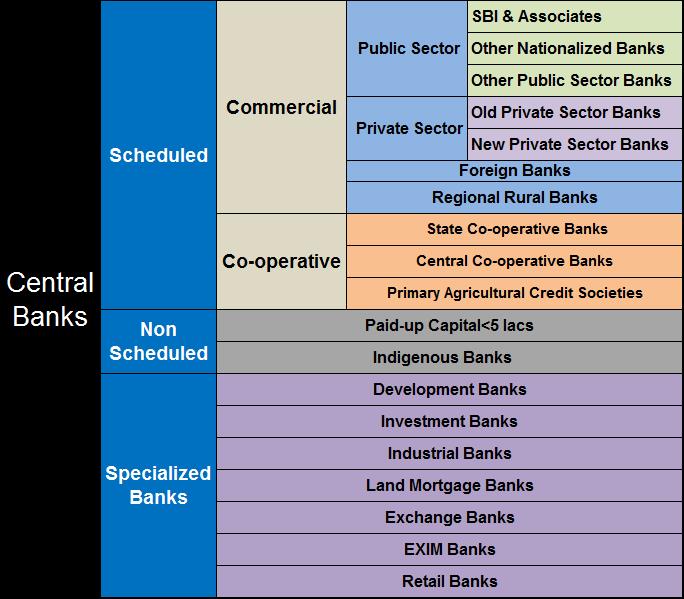

This article explains the banking structure in India and how different banks are classified as per RBI Norms. The Indian banking industry has been divided into two parts, organized and unorganized sectors. The organized sector consists of Reserve Bank of India, Commercial Banks and Co-operative Banks, and Specialized Financial Institutions (IDBI, ICICI, IFC, etc.). The unorganized sector, which is not homogeneous, is largely made up of money lenders and indigenous bankers. Learn what we mean by nationalized banks, scheduled banks, public sector banks, private banks, and foreign banks.

In this article, we present the types of banks applicable and prevalent in India. If you are looking for classification based on functions, products, or services offered please refer to our article “Types of Banks & their Functions. The focus of banking is varied, the needs diverse and methods different. Banking institutions offer an assortment of services from deposits in savings accounts to housing and business loans to check clearing, underwriting, and credit cards. The world is fast-changing and globalization in conjunction with technological advances is changing the landscape of the banking industry. Both individuals and business customers are demanding faster and innovative products & services. The Banking industry is also heavily regulated and has its own share of challenges to deliver financial objectives to people and organizations. Thus, distinctive kinds of banks are evolving to cater to various business demands, social needs, and global complexities. Different banking institutions conduct their operations in a different manner. Hence the banks can be classified in a variety of ways, according to applicable law and regulations, based on their domicile, on basis of ownership, on basis of function and structure.

In this article, we present the types of banks applicable and prevalent in India. If you are looking for classification based on functions, products, or services offered please refer to our article “Types of Banks & their Functions. The focus of banking is varied, the needs diverse and methods different. Banking institutions offer an assortment of services from deposits in savings accounts to housing and business loans to check clearing, underwriting, and credit cards. The world is fast-changing and globalization in conjunction with technological advances is changing the landscape of the banking industry. Both individuals and business customers are demanding faster and innovative products & services. The Banking industry is also heavily regulated and has its own share of challenges to deliver financial objectives to people and organizations. Thus, distinctive kinds of banks are evolving to cater to various business demands, social needs, and global complexities. Different banking institutions conduct their operations in a different manner. Hence the banks can be classified in a variety of ways, according to applicable law and regulations, based on their domicile, on basis of ownership, on basis of function and structure.

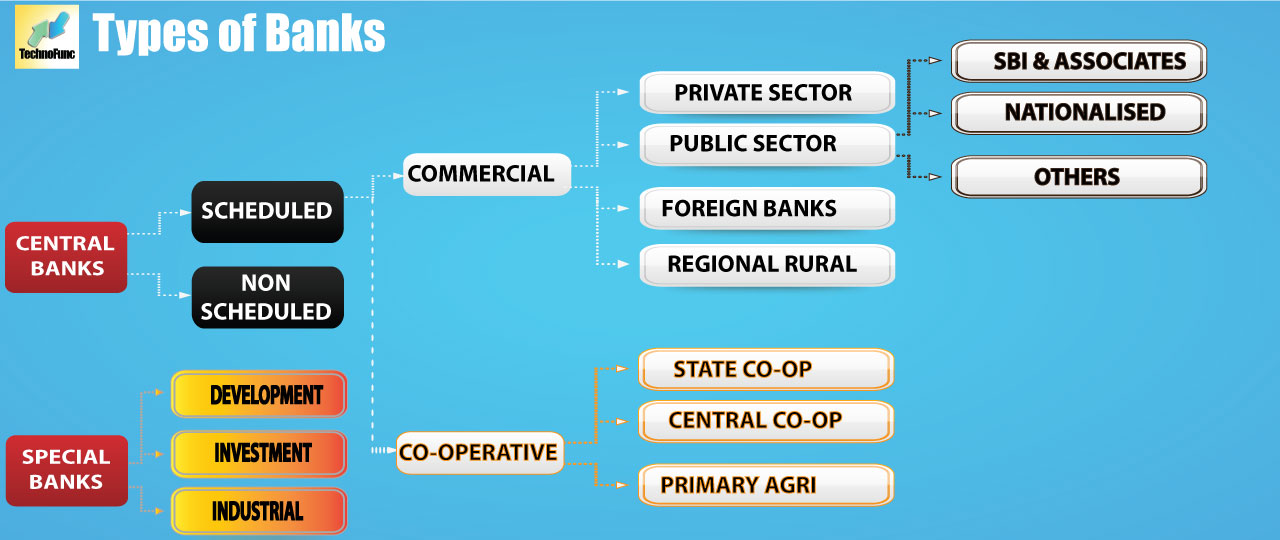

Structure of Banks in India

For the purpose of this article, we are presenting classification as applicable in India. However, if you are interested in classification on the basis of their functions, clientele served and products or services offered please refer to our article “Types of Banks & their Functions. The majority of banks are regulated by the Central Bank of the country (Reserve Bank of India for India). The Indian Banks can be classified as below (please refer to picture above for diagram): Now we will explain each of these banks in detail.

Central Banks

Every country has a Central Bank of its own generally regulated by a special act. Central banks are bankers’ banks, and these banks trace their history from the Bank of England. It is called a Central Bank because it occupies a central position in the banking system and acts as the highest financial authority. The main function of this bank is to regulate and supervise the whole banking system in the country. It is a banker's bank and controller of credit in the country. They guarantee stable monetary and financial policy from country to country and play an important role in the economy of the country. Typical functions include implementing monetary policy, managing foreign exchange and gold reserves, making decisions regarding official interest rates, acting as banker to the government and other banks, and regulating and supervising the banking industry. These banks buy government debt, have a monopoly on the issuance of paper money, and often act as a lender of last resort to commercial banks. The Central bank of any country supervises controls and regulates the activities of all the commercial banks of that country. It also acts as a government banker. It controls and coordinates the currency and credit policies of any country. In India, the Reserve Bank of India is the central bank. It is the apex bank and the statutory institution in the money market of the country.

Every country has a Central Bank of its own generally regulated by a special act. Central banks are bankers’ banks, and these banks trace their history from the Bank of England. It is called a Central Bank because it occupies a central position in the banking system and acts as the highest financial authority. The main function of this bank is to regulate and supervise the whole banking system in the country. It is a banker's bank and controller of credit in the country. They guarantee stable monetary and financial policy from country to country and play an important role in the economy of the country. Typical functions include implementing monetary policy, managing foreign exchange and gold reserves, making decisions regarding official interest rates, acting as banker to the government and other banks, and regulating and supervising the banking industry. These banks buy government debt, have a monopoly on the issuance of paper money, and often act as a lender of last resort to commercial banks. The Central bank of any country supervises controls and regulates the activities of all the commercial banks of that country. It also acts as a government banker. It controls and coordinates the currency and credit policies of any country. In India, the Reserve Bank of India is the central bank. It is the apex bank and the statutory institution in the money market of the country.

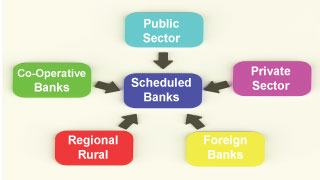

Scheduled & Non-Scheduled Banks

Scheduled Banks in India are those banks which have been included in the Second Schedule of Reserve Bank of India (RBI) Act, 1934. RBI in turn includes only those banks in this schedule which satisfy the criteria laid down vide section 42 (6) (a) of the Act. As of 30 June 1999, there were 300 scheduled banks in India having a total network of 64,918 branches. Scheduled commercial banks in India include State Bank of India and its associates (5), nationalized banks (20), foreign banks (45), private sector banks (32), co-operative banks and regional rural banks. "Scheduled banks in India" means the State Bank of India constituted under the State Bank of India Act, 1955 (23 of 1955), a subsidiary bank as defined in the State Bank of India (Subsidiary Banks) Act, 1959 (38 of 1959), a corresponding new bank constituted under section 3 of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970 (5 of 1970), or under section 3 of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980 (40 of 1980), or any other bank being a bank included in the Second Schedule to the Reserve Bank of India Act, 1934 (2 of 1934), but does not include a co-operative bank". Scheduled banks have paid-up capital and reserves of the value of not less than Rs 5 lakhs and are eligible for loans and other privileges from the central bank like membership to the clearinghouse.

Scheduled Banks in India are those banks which have been included in the Second Schedule of Reserve Bank of India (RBI) Act, 1934. RBI in turn includes only those banks in this schedule which satisfy the criteria laid down vide section 42 (6) (a) of the Act. As of 30 June 1999, there were 300 scheduled banks in India having a total network of 64,918 branches. Scheduled commercial banks in India include State Bank of India and its associates (5), nationalized banks (20), foreign banks (45), private sector banks (32), co-operative banks and regional rural banks. "Scheduled banks in India" means the State Bank of India constituted under the State Bank of India Act, 1955 (23 of 1955), a subsidiary bank as defined in the State Bank of India (Subsidiary Banks) Act, 1959 (38 of 1959), a corresponding new bank constituted under section 3 of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970 (5 of 1970), or under section 3 of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980 (40 of 1980), or any other bank being a bank included in the Second Schedule to the Reserve Bank of India Act, 1934 (2 of 1934), but does not include a co-operative bank". Scheduled banks have paid-up capital and reserves of the value of not less than Rs 5 lakhs and are eligible for loans and other privileges from the central bank like membership to the clearinghouse.

RBI has no specific control over non-scheduled banks as they are not included in the second schedule of RBI Act, 1934.

Scheduled banks can be further classified as:

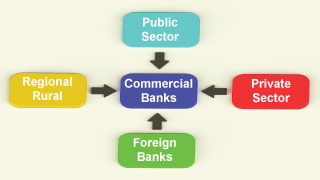

Commercial Banks

Banking means accepting deposits of money from the public for the purpose of lending or investment. Deposit-taking institutions take the form of commercial banks when they use the deposits for making commercial, real estate, and other loans. Commercial banks in modern capitalist societies act as financial intermediaries, raising funds from depositors and lending the same funds to borrowers. The commercial bank serves the interests of its depositors by utilizing the funds collected in profitable ventures and in-return offers a variety of services to its customers. Services provided by commercial banks include credit and debit cards, bank accounts, deposits and loans, and deposit mobilization. They also provide secured and unsecured loans. These commercial banks are the oldest institutions in banking history and generally have a wide network of branches spread throughout the area of their operations.

Banking means accepting deposits of money from the public for the purpose of lending or investment. Deposit-taking institutions take the form of commercial banks when they use the deposits for making commercial, real estate, and other loans. Commercial banks in modern capitalist societies act as financial intermediaries, raising funds from depositors and lending the same funds to borrowers. The commercial bank serves the interests of its depositors by utilizing the funds collected in profitable ventures and in-return offers a variety of services to its customers. Services provided by commercial banks include credit and debit cards, bank accounts, deposits and loans, and deposit mobilization. They also provide secured and unsecured loans. These commercial banks are the oldest institutions in banking history and generally have a wide network of branches spread throughout the area of their operations.

Commercial banks may either be owned by the government or maybe run in the private sector.

Based on their ownership structure they can be classified as:

Public Sector Banks

Public sector banks are those in which the government has a major stake and they usually need to emphasize social objectives than on profitability. The main objectives of public sector banks is to ensure there is no monopoly and control of banking and financial services by few individuals or business houses and to ensure compliance with regulations and promote the needs of the underprivileged and weaker sections of society, cater to the needs of agriculture and other priority sectors and prevent the concentration of wealth and economic power.

Public sector banks are those in which the government has a major stake and they usually need to emphasize social objectives than on profitability. The main objectives of public sector banks is to ensure there is no monopoly and control of banking and financial services by few individuals or business houses and to ensure compliance with regulations and promote the needs of the underprivileged and weaker sections of society, cater to the needs of agriculture and other priority sectors and prevent the concentration of wealth and economic power.

These banks play a revolutionary role in lending, particularly to the priority sector, constituting of agriculture, small scale industries, and small businesses. In India, there are 27 public sector banks that have been nationalized by the government to protect the interests of the majority of the citizens.

Some examples are State Bank of India, Union Bank of India, etc.

Public Sector banks can be further classified as:

SBI & Associates

State Bank of India is the oldest and the largest bank of India. State Bank of India (SBI) is a multinational banking and financial services company based in India. It is a government-owned bank with its headquarters in Mumbai, Maharashtra. As of December 2012, it had 15,003 branches, including 157 foreign offices, making it the largest banking and financial services company in India by assets.

State Bank of India is the oldest and the largest bank of India. State Bank of India (SBI) is a multinational banking and financial services company based in India. It is a government-owned bank with its headquarters in Mumbai, Maharashtra. As of December 2012, it had 15,003 branches, including 157 foreign offices, making it the largest banking and financial services company in India by assets.

Associates of State Bank of India:

SBI has five associate banks, which all use State Bank of India logo and "State Bank of" name, followed by the regional headquarters' name. There has been a proposal to merge all the associate banks into SBI to create a "megabank" and streamline the group's operations which have not taken shape to date.

The current five associates are:

- State Bank of Bikaner & Jaipur

- State Bank of Hyderabad

- State Bank of Mysore

- State Bank of Patiala

- State Bank of Travancore

Nationalized Banks

Even after Independence, there were many banks that were held privately. At that point in time, these private banks mostly concentrated on providing financial services. By the 1960s, the Indian banking industry has become an important tool to facilitate the development of the Indian economy. At the same time, it has emerged as a large employer, and a debate has ensued about the possibility to nationalize the banking industry. The government of India issued an ordinance and nationalized the 14 largest commercial banks with effect from the midnight of July 19, 1969. Within two weeks of the issue of the ordinance, the Parliament passed the Banking Companies (Acquisition and Transfer of Undertaking) Bill, and it received the presidential approval on 9 August 1969. The second step of the nationalization of 6 more commercial banks followed in 1980. The stated reason for the nationalization was to give the government more control of credit delivery. With the second step of nationalization, the GOI controlled around 91% of the banking business in India. Later on, in the year 1993, the government merged the New Bank of India with Punjab National Bank. It was the only merger between nationalized banks and resulted in the reduction of the number of nationalized banks from 20 to 19.

Even after Independence, there were many banks that were held privately. At that point in time, these private banks mostly concentrated on providing financial services. By the 1960s, the Indian banking industry has become an important tool to facilitate the development of the Indian economy. At the same time, it has emerged as a large employer, and a debate has ensued about the possibility to nationalize the banking industry. The government of India issued an ordinance and nationalized the 14 largest commercial banks with effect from the midnight of July 19, 1969. Within two weeks of the issue of the ordinance, the Parliament passed the Banking Companies (Acquisition and Transfer of Undertaking) Bill, and it received the presidential approval on 9 August 1969. The second step of the nationalization of 6 more commercial banks followed in 1980. The stated reason for the nationalization was to give the government more control of credit delivery. With the second step of nationalization, the GOI controlled around 91% of the banking business in India. Later on, in the year 1993, the government merged the New Bank of India with Punjab National Bank. It was the only merger between nationalized banks and resulted in the reduction of the number of nationalized banks from 20 to 19.

Other Public Sector Banks

There are a total of 27 Public Sector Banks in India. They can be further classified as nationalized banks(19) + SBI(1) & SBI Associates(5)+ Other Public Sector Banks (2). The rest two are IDBI Bank and Bharatiya Mahila Bank, which are categorized as other public sector banks.

Private Sector Banks

The private-sector banks are banks where the majority of their ownership is held by private shareholders and not by the government. Private sector banks are owned, managed, and controlled by private promoters and they are free to operate as per market forces. To ensure their safety and smooth functioning there are generally entry barriers and regulatory criteria set like the minimum net worth etc. This ensures the safety of public deposits entrusted with such institutions and they are also regulated by guidelines issued by Central Banks from time to time. Some examples of private sector banks in India are ICICI Bank, Yes Bank, and Axis Bank. Private sector banks in India can be classified as Private Indian Banks & Private Foreign Banks. Private Indian banks can be further classified as old and new private sector banks. They are defined below:

The private-sector banks are banks where the majority of their ownership is held by private shareholders and not by the government. Private sector banks are owned, managed, and controlled by private promoters and they are free to operate as per market forces. To ensure their safety and smooth functioning there are generally entry barriers and regulatory criteria set like the minimum net worth etc. This ensures the safety of public deposits entrusted with such institutions and they are also regulated by guidelines issued by Central Banks from time to time. Some examples of private sector banks in India are ICICI Bank, Yes Bank, and Axis Bank. Private sector banks in India can be classified as Private Indian Banks & Private Foreign Banks. Private Indian banks can be further classified as old and new private sector banks. They are defined below:

Old Private Sector Banks:

Not all private sector banks were nationalized in 1969, and 1980. The private banks which were not nationalized are collectively known as the old private sector banks and include banks such as The Jammu and Kashmir Bank Ltd., Lord Krishna Bank Ltd etc.

New Private Sector Banks:

The entry of private sector banks was however prohibited during the post-nationalization period. In July 1993, as part of the banking reform process and as a measure to induce competition in the banking sector, RBI permitted the private sector to enter into the banking system. This resulted in the creation of a new set of private sector banks, which are collectively known as the new private sector banks. As at end-March, 2009 there were 7 new private sector banks and 15 old private sector banks operating in India.

Foreign Banks

Foreign banks have their registered and head offices in a foreign country but operate their branches in India. The RBI permits these banks to operate either through branches; or through wholly-owned subsidiaries. The primary activity of most foreign banks in India has been in the corporate segment. However, some of the larger foreign banks have also made consumer financing a significant part of their portfolios. These banks offer products such as automobile finance, home loans, credit cards, household consumer finance, etc. Foreign banks in India are required to adhere to all banking regulations, including priority-sector lending norms as applicable to domestic banks. In addition to the entry of the new private banks in the mid-90s, the increased presence of foreign banks in India has also contributed to boosting competition in the banking sector.

Foreign banks have their registered and head offices in a foreign country but operate their branches in India. The RBI permits these banks to operate either through branches; or through wholly-owned subsidiaries. The primary activity of most foreign banks in India has been in the corporate segment. However, some of the larger foreign banks have also made consumer financing a significant part of their portfolios. These banks offer products such as automobile finance, home loans, credit cards, household consumer finance, etc. Foreign banks in India are required to adhere to all banking regulations, including priority-sector lending norms as applicable to domestic banks. In addition to the entry of the new private banks in the mid-90s, the increased presence of foreign banks in India has also contributed to boosting competition in the banking sector.

Regional Rural Banks

The government of India set up Regional Rural Banks (RRBs) on October 2, 1975. These are the banking organizations being operated in different states of India. They have been created to serve rural areas with banking and financial services. These banks support small and marginal farmers by extending credit to them in rural areas. They cater to the credit needs of small and marginal farmers, agricultural laborers, artisans, and small entrepreneurs. The RRB's are sponsored by scheduled banks, usually a nationalized commercial bank. Each RRB is owned jointly by the Central Government, concerned State Government, and a sponsoring public sector commercial bank. However, RRB's may have branches set up for urban operations and their area of operation may include urban areas too. They are also referred to as Grameen Banks/ Gramin Banks. Over the years, the Government has introduced a number of measures of improving the viability and profitability of RRBs, one of them being the amalgamation of the RRBs of the same sponsored bank within a State. This process of consolidation has resulted in a steep decline in the total number of RRBs to 56, as compared to 196 at the end of March 2005.

The government of India set up Regional Rural Banks (RRBs) on October 2, 1975. These are the banking organizations being operated in different states of India. They have been created to serve rural areas with banking and financial services. These banks support small and marginal farmers by extending credit to them in rural areas. They cater to the credit needs of small and marginal farmers, agricultural laborers, artisans, and small entrepreneurs. The RRB's are sponsored by scheduled banks, usually a nationalized commercial bank. Each RRB is owned jointly by the Central Government, concerned State Government, and a sponsoring public sector commercial bank. However, RRB's may have branches set up for urban operations and their area of operation may include urban areas too. They are also referred to as Grameen Banks/ Gramin Banks. Over the years, the Government has introduced a number of measures of improving the viability and profitability of RRBs, one of them being the amalgamation of the RRBs of the same sponsored bank within a State. This process of consolidation has resulted in a steep decline in the total number of RRBs to 56, as compared to 196 at the end of March 2005.

Cooperative Banks

Cooperative banks are private sector banks. Co-operative banks are also mutual savings banks meant essentially for providing cheap credit to their members. A cooperative bank is a voluntary association of members for self-help and caters to their financial needs on a mutual basis. They accept deposits and make mortgages and other types of loans to their members. These banks are also subject to control and inspection by the Reserve Bank of India but they are generally governed by a different statue, which is more flexible and easy to comply with compared to central bank acts. In India, they are governed by the provisions of the State Cooperative Societies Act. Another type is credit unions, which are cooperative organizations that issue share certificates and make member (consumer) and other loans. These institutions are an important source of rural credit i.e., agricultural financing in India. Co-operative banks get their resources from the issuance of their shares, accepting public deposits, and also taking loans from the state cooperative banks. They also get short and medium-term loans from the Reserve Bank of India. To enhance safety and public confidence in cooperative banks, the Reserve Bank of India has extended the Credit Guarantee Scheme to cooperative banks. Cooperative banks can be further classified as:

Cooperative banks are private sector banks. Co-operative banks are also mutual savings banks meant essentially for providing cheap credit to their members. A cooperative bank is a voluntary association of members for self-help and caters to their financial needs on a mutual basis. They accept deposits and make mortgages and other types of loans to their members. These banks are also subject to control and inspection by the Reserve Bank of India but they are generally governed by a different statue, which is more flexible and easy to comply with compared to central bank acts. In India, they are governed by the provisions of the State Cooperative Societies Act. Another type is credit unions, which are cooperative organizations that issue share certificates and make member (consumer) and other loans. These institutions are an important source of rural credit i.e., agricultural financing in India. Co-operative banks get their resources from the issuance of their shares, accepting public deposits, and also taking loans from the state cooperative banks. They also get short and medium-term loans from the Reserve Bank of India. To enhance safety and public confidence in cooperative banks, the Reserve Bank of India has extended the Credit Guarantee Scheme to cooperative banks. Cooperative banks can be further classified as:

- State Co-operative Banks

- Central Co-operative Banks

- Primary Agricultural Credit Societies

State Co-operative Banks

At present, there are 31 state co-operative banks in India. State co-operative banks are part of the short-term cooperative credit structure. These are registered and governed by state governments under the respective co-operative societies' acts of the concerned states. Since they are also covered by the provisions of the Banking Regulation Act, 1949, they come under the control of the RBI as well. These banks are also included in the Second Schedule of the RBI Act 1934.

Central Co-operative Banks

These banks are located at district headquarters or prominent towns. They accept deposits from the public, have a share capital, and can take loans and advances from state co-operative banks. They perform banking functions and fulfill the credit requirements of member societies.

Primary Agricultural Credit Societies

This is the smallest unit in the entire co-operative credit structure prevalent in India. It works at the village level and depends on central co-operative and state co-operative banks for its funding requirements. We currently have more than 90000 credit societies operative in India.

Specialized Banks:

Specialized banks are dedicated banks that excel in a particular product, service or sector and provide mission-based services to a section of society. Some examples of specialized banks are industrial banks, land development banks, regional rural banks, foreign exchange banks, and export-import banks etc. addressing specific needs of these unique areas. These banks provide distinctive services or products like financial aid to industries, heavy turnkey projects, and foreign trade. Some specialized banks are discussed below:

Investment Banks:

An investment bank is a financial institution that assists individuals, corporations, and governments in raising capital by underwriting and/or acting as the client's agent in the issuance of securities. An investment bank may also assist companies involved in mergers and acquisitions, and provide ancillary services such as market making, trading of derivatives, fixed income instruments, foreign exchange, commodities, and equity securities. Investment banks aid companies in acquiring funds and they provide advice for a wide range of transactions. These banks also offer financial consulting services to companies and give advice on mergers and acquisitions and management of public assets.

An investment bank is a financial institution that assists individuals, corporations, and governments in raising capital by underwriting and/or acting as the client's agent in the issuance of securities. An investment bank may also assist companies involved in mergers and acquisitions, and provide ancillary services such as market making, trading of derivatives, fixed income instruments, foreign exchange, commodities, and equity securities. Investment banks aid companies in acquiring funds and they provide advice for a wide range of transactions. These banks also offer financial consulting services to companies and give advice on mergers and acquisitions and management of public assets.

Industrial Banks:

Industrial banks target to promote rapid industrial development. They provide specialized medium and long term loans to the industrial sector backed by consultancy, supervision, and expertise. They support industrial growth by rendering other services like project identification, preparation of project reports, providing technical advice and managerial services, etc. They also do underwriting of public issues by the corporate sector or help industrial units get finance through a consortium or provide a guarantee to other financial institutions. We have a number of such banks in India like the Industrial Development Bank of India (IDB), Industrial Finance Corporation of India (IFCI), Industrial Credit and Investment Corporation of India Ltd. (ICICI), Industrial Reconstruction Bank of India (IRBI), etc.

Industrial banks target to promote rapid industrial development. They provide specialized medium and long term loans to the industrial sector backed by consultancy, supervision, and expertise. They support industrial growth by rendering other services like project identification, preparation of project reports, providing technical advice and managerial services, etc. They also do underwriting of public issues by the corporate sector or help industrial units get finance through a consortium or provide a guarantee to other financial institutions. We have a number of such banks in India like the Industrial Development Bank of India (IDB), Industrial Finance Corporation of India (IFCI), Industrial Credit and Investment Corporation of India Ltd. (ICICI), Industrial Reconstruction Bank of India (IRBI), etc.

Retail Banks:

Retail banks provide basic banking services to individual consumers.

Retail banks provide basic banking services to individual consumers.

Examples include savings accounts, recurring and fixed deposits, and secured and unsecured loans. Products and services offered by retail banks include safe deposit boxes, checks and savings accounting, certificates of deposit (CDs), mortgages, consumer and car loans, personal credit cards, etc.

Retail Banks can be further classified as:

1. Community Development Banks:

Provide services to underserved markets or populations, for example, Rural Banks in India, generally incentivized and regulated by the government.

2. Private Banks:

Some private retail banks manage the assets of high-net-worth individuals and provide specialized services like wealth management.

3. Savings Banks:

These are deposit oriented branches, also could be an extension counter of an existing bank branch that accepts savings deposits and provide basic banking.

4. Postal Savings Banks:

Postal banks are the banks operated and controlled by National Postal Departments and provide basic banking services to retail customers. These banks are very effective in small towns and villages and provide financial inclusion to a section of society which otherwise would not have been catered by other banks.

Land Development Banks:

These banks support the development of agriculture and land. They provide long-term credit to agriculture for purposes such as pump sets, tractors, digging up wells, land improvement, etc. These banks get funding by issuing debentures, which are generally subscribed by the State Bank Group, other commercial banks, LIC, and Reserve Bank of India. These banks grant loans to farmers against the security of their land.

These banks support the development of agriculture and land. They provide long-term credit to agriculture for purposes such as pump sets, tractors, digging up wells, land improvement, etc. These banks get funding by issuing debentures, which are generally subscribed by the State Bank Group, other commercial banks, LIC, and Reserve Bank of India. These banks grant loans to farmers against the security of their land.

Import – Export Banks:

Import-Export banks are generally set up by the government like central banks to promote trade activities in import and export. They support exporters and importers by providing financial assistance, acting as principal financial institutions, coordinating the working of other institutions engaged in export and import to facilitate the growth of international trade. They provide traditional export finance and also do financing of export-oriented units. The bank finances and insures foreign purchases of goods for customers unable or unwilling to accept credit risk. Some examples are Export-Import Bank of India (Exim Bank), Export-Import Bank of the United States, etc.

Import-Export banks are generally set up by the government like central banks to promote trade activities in import and export. They support exporters and importers by providing financial assistance, acting as principal financial institutions, coordinating the working of other institutions engaged in export and import to facilitate the growth of international trade. They provide traditional export finance and also do financing of export-oriented units. The bank finances and insures foreign purchases of goods for customers unable or unwilling to accept credit risk. Some examples are Export-Import Bank of India (Exim Bank), Export-Import Bank of the United States, etc.

Banking Domain Knowledge - Resources

Related Links

You May Also Like

-

Definition of Bank: Meaning of the term Bank and the Business of Banking

What do we mean by the word bank? How did the word bank originate? What is the most simple and concise definition of a bank that explains the fundamentals of the banking process? Does the definition of banking vary from country to country? What are the key differentiators between any other business and a Bank? Get answers to all these questions and explore the basics of bank and banking as an industry.

-

History of Banking: Evolution of Banking as an Industry

Banking is one of the oldest industries and banking in the form that we know of began at about 2000BC of the ancient world. It started with merchants making grain loans to farmers and traders while carrying goods between cities. Since then, the banking industry has evolved from a simplistic barter system and gift economies of earlier times to modern complex, globalized, technology-driven, and internet-based e-banking model. In this article, we will take you through the major events and developments in the history of the banking industry.

-

History of Banking: Famous Banks from the Past

Seven hundred years ago a bank was established in Venice, which made transactions resembling modern banking. In 1407, another bank was founded in Italy under the name of Banco di San Giorgio which was one of the oldest chartered banks in Europe. Sveriges Riksbank (Riksbanken), is the central bank of Sweden and the world's oldest central bank. The Bank of England is the second oldest central bank in the world, and most modern central banks have been based on that model. Let us explore some interesting events as we learn more about these early banking institutions.

-

History of Banking: The Gold Standard & Fractional Reserve Banking

Gold has always been considered as a safe economic investment and treated like a currency. All of the economically advanced countries of the world were on the gold standard for a relatively brief time. Under a gold standard, the value of a unit of currency, such as a dollar, is defined in terms of a fixed weight of gold and banknotes or other paper money are convertible into gold accordingly. Explore the fascinating history of the gold standard through the lens of history and also learn why banks hold back a certain fraction of deposits as reserves.

-

Overview of Banking Industry: The Industry Basics

Banks play a key role in the entire financial system by mobilizing deposits from households spread across the nation and making these funds available for investment, either by lending or buying securities. Today the banking industry has become an integral part of any nation’s economic progress and is critical for the financial wellbeing of individuals, businesses, nations, and the entire globe. In this article, we will provide an overview of key industry concepts, main sectors, and key aspects of the banking industry’s business model and trends.

-

Banking Sector, Segments & It's Classifications

The banking industry players deal in a variety of products from savings accounts to loans and mortgages, offer various services from check cashing to underwriting, caters to different types of customers from individuals to large corporates, serve diverse geographies from rural villages to cross-border operations. Thus the banking industry is made up of several types of banks, with their own objectives, roles, and functions. In this article, we will explore the various sectors, segments, and classifications of banking based on parameters like products, customers, types, etc.

-

Type of Banks: Different Types of Banks in India & their Functions

This article explains the banking structure in India and how different banks are classified as per RBI Norms. The Indian banking industry has been divided into two parts, organized and unorganized sectors. The organized sector consists of Reserve Bank of India, Commercial Banks and Co-operative Banks, and Specialized Financial Institutions (IDBI, ICICI, IFC, etc.). The unorganized sector, which is not homogeneous, is largely made up of money lenders and indigenous bankers. Learn what we mean by nationalized banks, scheduled banks, public sector banks, private banks, and foreign banks.

-

Types of Banks: Different Banks & their Classifications (Global)

The banking industry caters to various sections of society thus the focus of banking becomes varied, catering to the diverse needs of clients through different products, services, and methods. To meet this, we need distinctive kinds of banks addressing complex business & social needs. In this article, we will explain various types of banking institutions ranging from retail banks, commercial banks, co-operative banks, investment banks, central banks to various other types of specialized banks.

-

Banking Operations: Understanding Various Transactions & Activities

Banks perform a variety of operations ranging from basic or primary functions like day to day transactions at a branch to others that maybe the agency or general utility services in nature. The transactions that are incidental to revenue/sales or sustaining the business are an important element of the banking industry value chain. In this article, we will look at the key operations performed in the course of banking.

-

Banking Industry Business Model - Understanding How the Banking System Works

Banks are commercial profitable institutions and need to increase their business, grow their revenue, and provide returns to their owners. Unlike other stores and shops, banks are providing services rather than selling their products. Learn how banks get their funds and how they make money on services. Read more to learn how the banks earn their profit!

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved