- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Different Type of Journals

GL - Different Type of Journals

Two basic types of journals exist: general and special. In this article, the learner will understand the meaning of journalizing and the steps required to create a journal entry. This article will also discuss the types of journals and will help you understand general journals & special journals. In the end, we will explain the impact of automated ERPs on the Journalizing Process.

What do we mean by Journalizing?

Using the rules of debit and credit, transactions are initially entered in a record called a journal. In this way, the journal serves as a record of when transactions occurred and were recorded. The process of recording a transaction in the journal is called journalizing. The entry in the journal is called a journal entry.

Recording Journal Transactions:

As the business has events and activities that have an economic impact and they give rise to rights and obligations with the outside third parties, most businesses keep some form of diary or log of their activities. In Accounting terms, a general journal is a book that records all a business's transactions in chronological order. The general journal is also called "a book of original entry" because all transactions are entered here first. A journal can be thought of as a book of original entry. As soon as a transaction happens, it's recorded chronologically in a “Journal-Register” with a brief description and an indication of accounts to be debited and credited. Journals store information but in this sequential form, this transactional data doesn't provide useful accounting information. For example, from a journal, you can't determine the number of total sales made to a specific client over a period of one month.

In the manual system of accounting following steps are taken to record a journal:

Step 1: The date of the transaction is entered in the Date column.

Step 2: The title of the account to be debited is recorded at the left-hand margin under the Description column, and the amount to be debited is entered in the Debit column.

Step 3: The title of the account to be credited is listed below and to the right of the debited account title, and the amount to be credited is entered in the Credit column.

Step 4: A brief description may be entered below the credited account.

Step 5: The Post. Ref. (Posting Reference) column is left blank when the journal entry is initially recorded. This is completed once the journal is posted.

A journal can be thought of as being similar to an individual’s diary of significant day-to-day life events. In an ERP or Automated Accounting System, the basic concept of the Journal remains the same and the same steps are used to capture relevant information in the system. Apart from the above-mentioned steps additional information like Journal Source, Journal Category or Created By, etc. might also get stored in automated systems.

Oridinary Or General Journals:

A simple general journal entry contains a debit to one account and a credit to another account to balance it out under a double-entry accounting system. The number of line items in a journal entry may vary depending on how many accounts are affected by a given transaction. A business may choose to use a single general journal for documenting all transactions, or it may use several special journals in combination with a general journal. In the case of large businesses, we have to use special journals in conjunction with general journals to simplify the journalizing process. In the latter case, the general journal is used to post any transactions for which no special journal exists, may be limited to non-routine, closing, and adjusting entries.

A general journal is an essential part of any accounting process, whether it's the sole repository for transaction information or it's being used in conjunction with special journals. In either case, a general journal typically has five columns: date, description, posting reference, debit, and credit. Compound entries are necessary when a transaction involves more than two accounts. For example, if a sale involves the adjustment of the advance given earlier and a balance to be paid at a later date, it will affect the advance received account, the sales or revenue account, and the accounts receivable account.

Correcting, adjusting, and closing entries are recorded in the general journal, along with any other transactions for which there is no special journal. Adjusting entries include the depreciation of equipment and facilities or the accruals at the end of the period. Closing entries journal entries made at the end of an accounting period to return the balances of Income Statement accounts to zero.

Special Journals:

Special Journals are designed to facilitate the process of journalizing and posting transactions. They are used for the most frequent transactions in a business. For example, in retail businesses, companies acquire merchandise from wholesale vendors, and then in turn sell the merchandise to individuals. Sales and purchases are the most common transactions for retail businesses. A business such as a retail store will record the following transactions many times a day for sales on account and cash sales. The overall point of using special journals is to minimize work effort by grouping transactions with similar characteristics.

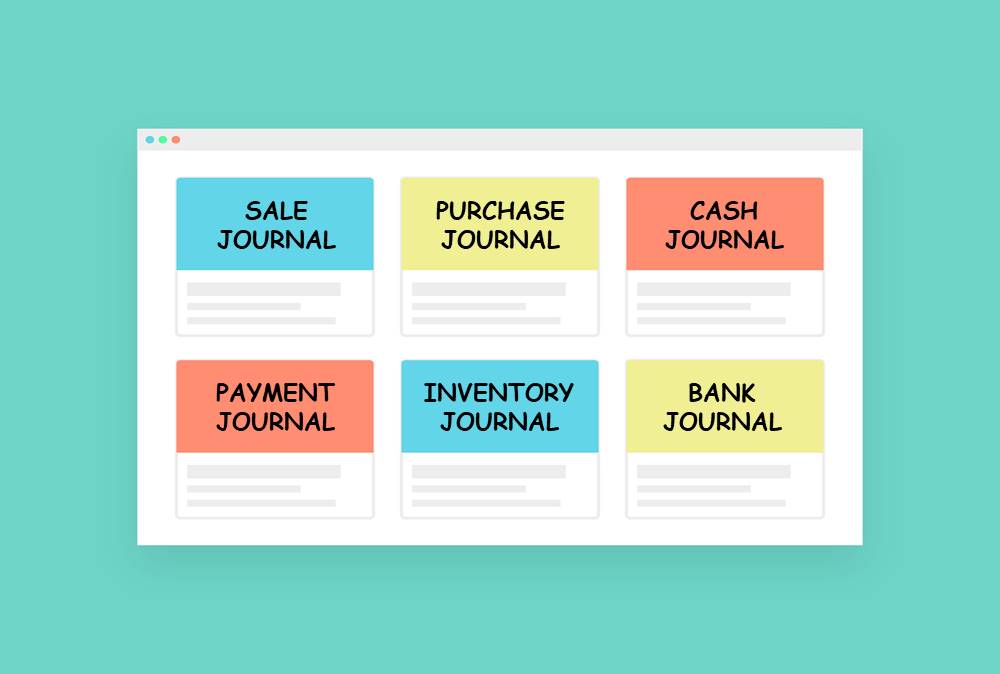

Types of Special Journals:

The types of Special Journals that a business uses are determined by the nature of the business. Special journals are designed as a simple way to record the most frequently occurring transactions. There are four types of Special Journals that are frequently used by most businesses: Sales journals (made on credit), Cash receipts journals (from cash sales and accounts receivable), Purchases journals (made on credit), and Cash payments journals (for purchases, accounts payable, or other cash payments).

1. Sales Journals:

Sales journals generally have just one line per transaction. In addition to the usual columns for date, description of the account that's affected, and posting reference, a Sales Journal is likely to contain an invoice number column. As a numbered invoice is typically associated with each sale, this allows for easy cross-referencing. Entries to the Sales Journal credit the sales account and debit accounts receivable. Sales journals also record the corresponding accounts receivable debit that will be entered in the Cash Receipts Journal. Some sales journals may also include columns for tracking sales taxes or the cost of goods.

2. Cash Receipts Journals:

The Cash Receipts Journal also has the standard columns that appear in most journals, dates, descriptions, and posting references. Cash receipts are entered as debits in the Cash/Dr. column because they increase an asset – cash.

3. Cash Disbursements Journals:

The Cash Disbursements Journal has columns for the date of the payment, the account debited, and the posting reference, as well as check number, as most purchases are paid by company check. Entries to the Cash Disbursements Journal are credits to the cash account.

4. Purchases Journal:

The Purchases Journal is strictly for purchases made on delayed terms. Apart from the standard date and reference number columns, it also has a column to track the accounts receivable credits that offset the purchase accounts debits entered.

Recording Transactions: Tips for Journalizing Transactions:

The following is a useful method for analyzing and journalizing transactions:

Step 1: Collect & Analyze Source Documents:

The first step towards making entries in the general journal is to understand the source of a transaction. Transactions must be supported with a proof, such as source documents. The use of source documents is warranted by the two generally accepted accounting principles discussed earlier, the Objectivity Principle and Cost Principle. The objectivity principle states that accounting information must be based on objective data and the Cost Principle demands that all goods and services are recorded at cost rather than any other perceived value.

Source documents are the business papers, and they represent the source of each transaction. Source documents provide objective proof that the transaction was carried out, and they contain useful information. Source documents include checks, invoices, sales slips, purchase orders, material receipt notes, dispatch orders, tax challans, bank statements, and payroll statements.

Step 2: Analyze the Accounting Impact of the Transaction:

Carefully read the description of the transaction to determine whether an asset, a liability, an owner’s equity, revenue, and expense, or a drawing account is affected. For each account affected by the transaction, determine whether the account increases or decreases. Determine whether each increase or decrease should be recorded as a debit or a credit, following the rules of debit and credit explained in the previous lesson.

Step3: Record the Transaction:

Once source documents are collected, and the accounting impact analyzed, the transactions are recorded, or journalized chronologically. The general journal is organized to record transaction information in a very efficient way. Only the necessary information is entered, such as the date of the transaction, a description of the transaction, the titles of the affected accounts, and the monetary amount of each debit and credit.

General journals and special journals store transaction information that is later on posted to the general ledger of a business. This article clubbed with the previous articles builds the foundation for us to move to the concept of General Ledger. In an ERP or an Automated Accounting System the fundamental activities as explained above remain the same, the only difference being the computer that is used to capture and record the information. Based on the nature of the transaction for most of the activities in an ERP, the accounting information can default from the setups created earlier.

Related Links

You May Also Like

-

GL - Different Type of Journals

Two basic types of journals exist: general and special. In this article, the learner will understand the meaning of journalizing and the steps required to create a journal entry. This article will also discuss the types of journals and will help you understand general journals & special journals. In the end, we will explain the impact of automated ERPs on the Journalizing Process.

-

Understand what we mean by GAAP to STAT adjustments. This article discusses the different standards that are used for multiple representations of the financial results for global organizations. Understand the meaning of US GAAP, Local GAAP, STAT, IFRS, and STAT. Finally, understand why accounting differences arise and how they are adjusted for different financial representations.

-

What is Accounting & Book Keeping

Accounting is a process designed to capture the economic impact of everyday transactions. Each day, many events and activities occur in an entity, these events and activities are in the normal course of business; however, each of these events may or may not have an economic impact. Events or activities that have an effect on the accounting equation are accounting events.

-

Horizontal or Flat Organizational Structures

Flat organizational structure is an organizational model with relatively few or no levels of middle management between the executives and the frontline employees. Its goal is to have as little hierarchy as possible between management and staff level employees. In a flat organizational structure, employees have increased involvement in the decision-making process.

-

Period End Accruals, Receipt Accruals, Paid Time-Off Accruals, AP Accruals, Revenue Based Cost Accruals, Perpetual Accruals, Inventory Accruals, Accruals Write Off, PO Receipt Accrual, Cost Accrual, etc. are some of the most complex and generally misconstrued terms in the context of general ledger accounting. In this article, we will explore what is the concept of accrual and how it impacts general ledger accounting.

-

What Is a General Ledger? General Ledger (also known in accounting as the GL or the Nominal Ledger) is at the heart of any accounting system. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. Ledger is the skillful grouping and presentation of the Journal entries. Learn the accounting fundamentals, general ledger process, and general ledger flow.

-

Introduction to Legal Entities Concept

Modern business organizations operate globally and leverage a large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders. Learn more about Legal Entities and their importance for businesses.

-

An organizational design is the process by which a company defines and manages elements of structure so that an organization can control the activities necessary to achieve its goals. Good organizational structure and design helps improve communication, increase productivity, and inspire innovation. Organizational structure is the formal system of task and activity relationships to clearly define how people coordinate their actions and use resources to achieve organizational goals.

-

In this article, we explain some commonly used subsidiary ledgers like accounts receivable subsidiary ledger, accounts payable subsidiary ledger or creditors' subsidiary ledger, inventory subsidiary ledger, fixed assets subsidiary ledger, projects subsidiary ledger, work in progress subsidiary ledger, and cash receipts or payments subsidiary ledger.

-

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved