- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Concept of Subsidiaries

Concept of Subsidiaries

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation.

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation. The controlling entity is called its parent company, parent, or holding company. Subsidiaries are a common feature of business life, and all multinational corporations organize their operations in this way.

A subsidiary may itself have subsidiaries, and these, in turn, may have subsidiaries of their own. A parent and all its subsidiaries together are called a "group", although this term can also apply to cooperating companies and their subsidiaries with varying degrees of shared ownership. Examples include holding companies such as Berkshire Hathaway, Time Warner, or Citigroup; as well as more focused companies such as IBM or Xerox. These, and other MNCs, organize their businesses into national and functional subsidiaries, often with multiple levels of subsidiaries.

Subsidiaries are separate, distinct legal entities for the purposes of taxation, regulation, and liability. For this reason, they differ from divisions, which are businesses fully integrated within the main company, and not legally or otherwise distinct from it. A parent company may own one or more subsidiaries, in which case each of its subsidiaries are known as ‘sister’ companies to one another.

For the purposes of liability, taxation and regulation, subsidiaries are distinct legal entities. A subsidiary can sue and be sued separately from its parent and its obligations will not normally be the obligations of its parent. If a parent company owns a foreign subsidiary, the company under which the subsidiary is incorporated must follow the laws of the country where the subsidiary operates, and the parent company still carries the foreign subsidiary's financials on its books (consolidated financial statements).

Foreign Subsidiary:

In subsidiary structure the inbound company incorporates a wholly owned subsidiary in the foreign country, making it a distinct legal entity separate from the parent company. Subsidiary incorporated by a foreign company generally is not subject to specific restrictions/limitations with respect to its activities other than the general limitations applicable to domestic entities as well. The profits earned by a foreign subsidiary are liable to tax as per the local laws and regulations of the country of operation.

The Walt Disney Company has more than 50 Subsidiaries (https://www.sec.gov/Archives/edgar/data/1001039/000100103917000198/fy2017_q4x10kxex21.htm).

Given below are some of its foreign subsidiaries:

- Disney FTC Services (Singapore) Pte. Ltd, Singapore

- Euro Disney Associes S.C.A. France

- Hong Kong Disneyland Management Limited, Hong Kong

- Shanghai International Theme Park Company Limited, China

- UTV Software Communications Limited, India

Related Links

You May Also Like

-

Period End Accruals, Receipt Accruals, Paid Time-Off Accruals, AP Accruals, Revenue Based Cost Accruals, Perpetual Accruals, Inventory Accruals, Accruals Write Off, PO Receipt Accrual, Cost Accrual, etc. are some of the most complex and generally misconstrued terms in the context of general ledger accounting. In this article, we will explore what is the concept of accrual and how it impacts general ledger accounting.

-

As the business grows, the company may want to transition to a branch structure as branches are allowed to conduct a much broader range of activity than representative offices. Branches can buy and sell goods, sign contracts, build things, render services, and generally everything that a regular business can do. A company expands its business by opening up its branch offices in various parts of the country as well as in other countries.

-

The sole trader organization (also called proprietorship) is the oldest form of organization and the most common form of organization for small businesses even today. In a proprietorship the enterprise is owned and controlled only by one person. This form is one of the most popular forms because of the advantages it offers. It is the simplest and easiest to form.

-

In this article we will help you understand the double-entry accounting system and state the accounting equation and define each element of the equation. Then we will describe and illustrate how business transactions can be recorded in terms of the resulting change in the elements of the accounting equation.

-

An organizational design is the process by which a company defines and manages elements of structure so that an organization can control the activities necessary to achieve its goals. Good organizational structure and design helps improve communication, increase productivity, and inspire innovation. Organizational structure is the formal system of task and activity relationships to clearly define how people coordinate their actions and use resources to achieve organizational goals.

-

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

-

Network Organizational Structures

The newest, and most divergent, team structure is commonly known as a Network Structure (also called "lean" structure) has central, core functions that operate the strategic business. It outsources or subcontracts non-core functions. When an organization needs to control other organizations or agencies whose participation is essential to the success, a network structure is organized.

-

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

-

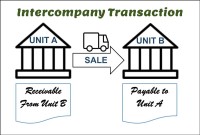

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved