- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- Network Organizational Structures

Network Organizational Structures

The newest, and most divergent, team structure is commonly known as a Network Structure (also called "lean" structure) has central, core functions that operate the strategic business. It outsources or subcontracts non-core functions. When an organization needs to control other organizations or agencies whose participation is essential to the success, a network structure is organized.

The newest, and most divergent, team structure is commonly known as a Network Structure (also called "lean" structure) has central, core functions that operate the strategic business. It outsources or subcontracts non-core functions. When an organization needs to control other organizations or agencies whose participation is essential to the success, a network structure is organized. In this, the main organization creates a network of relevant agencies and it influences in different ways.

A network structure has little bureaucracy and features decentralized decision making. This structure is very flexible, and it can adapt to new market challenges almost immediately. Flexibility is one of the main reasons why firms pursue network organizational structure in the first place. This allows them to change its production techniques, quantity, products’ designs or stop the production completely without facing any major problems.

Such an organization works like an advanced computer network where many autonomous organizational units interact with each other and the external world to deliver outcomes. Goals and strategy is set by central management but there involvement is limited to building on the capabilities of network units and monitoring progress. Network structure is widely used in non-business organizations which have sociopolitical objectives.

For instance, the National Industrial Development Corporation assigned with the task of rapid industrial development in the country may resort to a network structure in their objective to build an industrial estate. They will act as the lead agency and involve the various other agencies like Electricity Boards, Municipal Authorities, Land Development Authorities, Authorities for Water & Sewage Control, Department for communication facilities etc. They will also need to establish a network with people who would ultimately be using the industrial estate. It would also use the services of an advertising agency to promote the industrial estate and attract maximum number of entrepreneurs. For the construction of sheds and factories they may have to utilize the services of private construction agencies. Thus, a network structure envisages the utilization of a number of different services offered by different agencies. There is need to coordinate the different inputs and synchronize them towards the ultimate objective.

A network structure is meant to promote communication and the free flow of information between different parts of the organization as needed. Managers coordinate and control relations both internal and external to the firm. A social structure of interactions is fostered to build and manage formal and informal relationships. The goal of this structure is to achieve rapid organizational evolution and adaptation to constantly changing external and internal environments. But there's an almost inevitable loss of control due to its dependence on third parties, and all the potential problems that come from managing outsourced or subcontracted teams.

An organization that has been using network structure is H&M (Hennes & Mauritz), a very popular brand that has followers world over. H&M has outsourced the production and processing of their goods to different countries majorly Asian and South East Asian countries. H&M is the core company in its case. As it can be seen, the core company distributes its functions to different companies which, in this case, are present in different countries: product development company in Australia, Call center company in New Zealand, the Accounting company in Australia, Distribution company in Singapore and Manufacturing company in Malaysia.

Related Links

You May Also Like

-

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

-

Legal Structures in Businesses

Businesses not only vary in size and industry but also in their ownership. Most businesses evolve from being owned by just one person to a small group of people and eventually being managed by a large numbers of shareholders. Different ownership structures overlap with different legal forms that a business can take. A business’s legal and ownership structure determines many of its legal responsibilities.

-

GL - Recurring Journal Entries

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

-

Business Metrics for Management Reporting

Business metric is a quantifiable measure of an organization's behavior, activities, and performance used to access the status of the targeted business process. Traditionally many metrics were finance based, inwardly focusing on the performance of the organization. Businesses can use various metrics available to monitor, evaluate, and improve their performance across any of the focus areas like sales, sourcing, IT or operations.

-

Driving Business Efficiency through Divisions and Departments

In case of a multi-divisional organizational structure, there is one parent company, or head-office. And that parent owns smaller departments, under the same brand name. Dividing the firm, into several self-contained, autonomous units, provides the optimal level of centralization, in a company.

-

GL - Different Type of Journals

Two basic types of journals exist: general and special. In this article, the learner will understand the meaning of journalizing and the steps required to create a journal entry. This article will also discuss the types of journals and will help you understand general journals & special journals. In the end, we will explain the impact of automated ERPs on the Journalizing Process.

-

Different Types of Organizational Structures

Modern business organizations run multiple product and service lines, operate globally, leverage large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders.

-

What is a Business Eco System?

The goal of a business is to generate capital appreciation and profits for its owners or stakeholders by engaging in provision of goods and services to customers within the eco system/framework governed by respective laws(local/international). The eco system involves various entities that the business works with for delivery of a product or service.

-

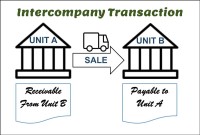

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

Trial Balance in General Ledger

One of the greatest benefits of using a double-entry accounting system is the capability to generate a trial balance. What do we mean by trial balance? As the name suggests a trial balance is a report that must have its debits equals to credits. Understand the importance of trial balance and why it is balanced. Learn how it is prepared and in which format.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved