- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Cash Management

- Collection Float

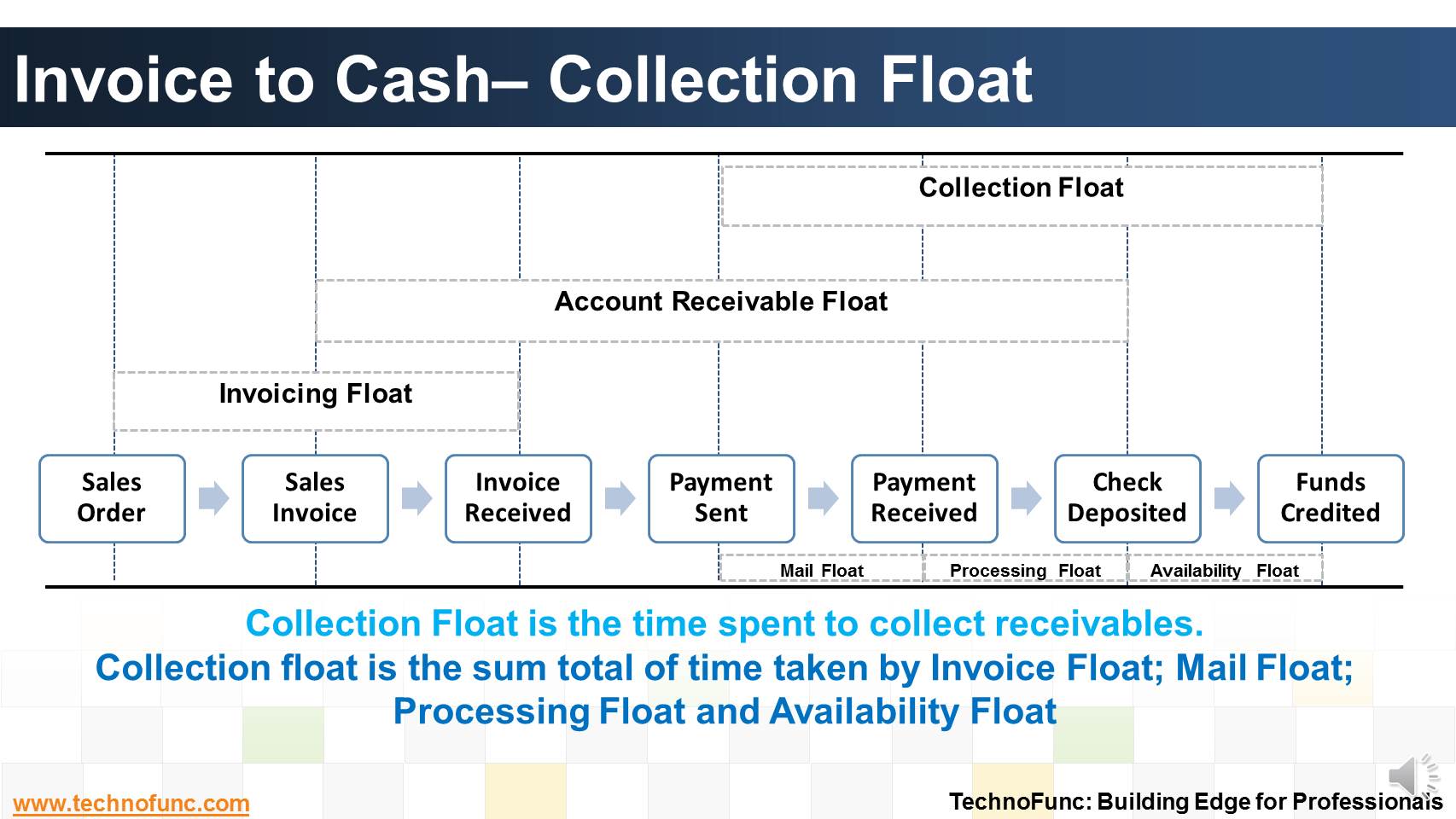

Collection Float

Collection Float is the time spent to collect receivables. Collection float is the sum total of time taken by Invoice Float; Mail Float; Processing Float and Availability Float. Explore more!

Invoice to Cash– Collection Float

Collection Float is the time spent to collect receivables.

Collection float is the sum total of time taken by Invoice Float; Mail Float; Processing Float and Availability Float

1. Invoicing float is the time period between the delivery of goods or services to the customer and the customer's receipt of the bill, generally by mail. It is the time it takes a company to record its delivery of service or

goods and then to produce and mail a bill.

2. Mail float is the time taken by Postal or Courier Service to deliver the customer's payment.

3. Processing float is the period between the receipt of the payment and its deposit into the company's bank account and includes the time it takes to record the payment in the accounting system.

4. Availability float is the time it takes the deposited check to clear the customer's account and for good funds to be available to the company for disbursement.

Related Links

You May Also Like

-

Introduction to Cash Clearing Process

Unravel the mystery behind clearing accounts. Learn why clearing accounts are used in finance and accounting. Learn why so many clearing accounts are defined in ERPs and Automated Accounting Systems.

-

What is Invoice to Cash Process

In this article, we will explore the business process area known as; Invoice to Cash; Also known as I2C. Learning objectives for this lesson are: Meaning of Invoice to Cash Process; Sub Processes under Invoice to Cash; Process Flow for Invoice to Cash; Key Transactions Fields; Key Setups/Master Data Requirements.

-

Introduction to Bank Reconciliation Process

These set of articles provide a brief introduction to Bank Reconciliation Process. This topic not only discusses the meaning of bank reconciliation process but also discusses how this process in handled in new age ERPs and Automated Reconciliation Systems.

-

Treasury Management - Functions

Treasury management has become an specialized function. Treasury function helps in managing the Risk-return profile as well as the tax-efficiency of investment instruments. In larger firms, it may also include trading in bonds, currencies and financial derivatives. Learn about the various tasks, activities and imperatives, undertaken by treasuries in in today's context.

-

Suspense and clearing accounts resemble each other in many respects but there exists important fundamental difference between the two. Read more to explore these differences.

-

Before we dive into cash management, let us fist understand what we mean by cash and what constitutes cash in context of cash management process.

-

Effectively using cash management with trade finance products brings tangible benefits to both corporates and financial institutions.Learn the various benefits of cash management process.

-

In manual clearing, Bank statement details are to be matched manually considering certain rules. Learn the steps involved in manual clearing of bank transactions.

-

Technology has enabled the treasury function by providing various solutions to manage it's complicated tasks. This article explains various types of treasury management systems available in the market.

-

The terms Treasury Management and Cash Management are sometimes used interchangeably, while, in fact, the scope of treasury management is larger and includes funding and investment activities as well. Learn all about Treasury Management here!

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved