- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Treasury Management

- Automated Clearing

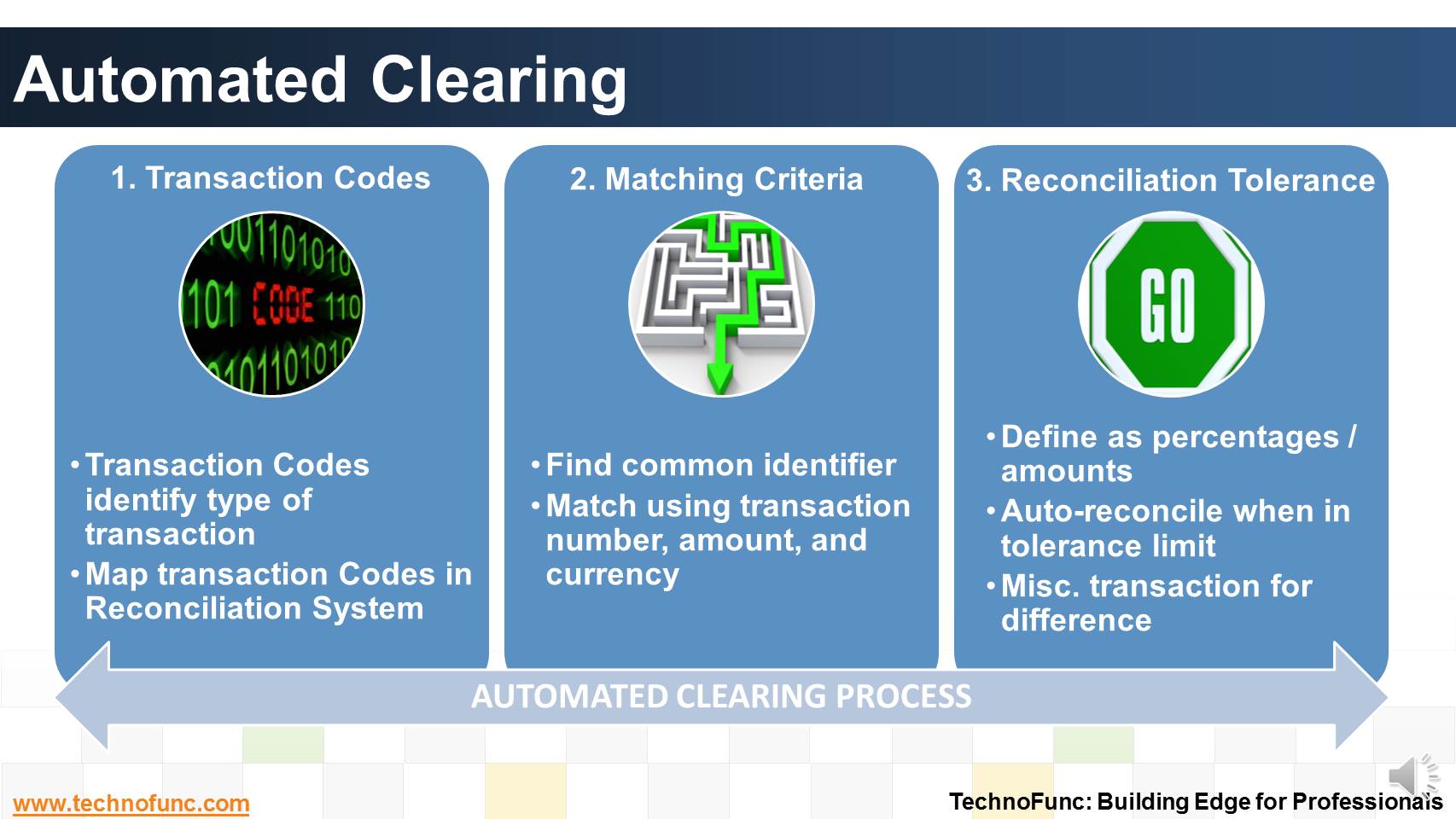

Automated Clearing

In automated clearing, Bank statement details are automatically matched and reconciled with system transactions. Learn how this process works and what are the perquisites to enable the same.

Automated Clearing

In automated clearing, Bank statement details are automatically matched and reconciled with system transactions.

This method is ideally suited for bank accounts that have a high volume of transactions.

The following three are the basic steps are involved in Automated Clearing Process:

1 Map Transaction Codes

Bank statement lines are coded to identify the type of transaction the line represents. Since each bank might use a different set of transaction codes, the first step towards automatic clearing is to map each code that is used by a particular bank for which the transactions need to be reconciled.

2 Matching Criteria

Automated matching can only be done if you can find a common identifier between the transaction details as recorded in your sub ledgers and the bank statement.

Automated systems generally match a bank statement line against a payables payment transaction, receivables receipt transaction, payroll disbursals and miscellaneous transactions using a transaction number (such as the payment or deposit number), bank account, amount, and currency.

3 Reconciliation Tolerance:

Reconciliation tolerances are defined in the system as percentages and/or amounts.

If tolerance is defined then the difference between the statement line and sub-ledger transaction line will be auto-reconciled when it is within the tolerance limit. The system also creates a miscellaneous transaction for the difference between the remittance batch amount and the bank statement line.

Related Links

You May Also Like

-

In automated clearing, Bank statement details are automatically matched and reconciled with system transactions. Learn how this process works and what are the perquisites to enable the same.

-

The terms Treasury Management and Cash Management are sometimes used interchangeably, while, in fact, the scope of treasury management is larger and includes funding and investment activities as well. Learn all about Treasury Management here!

-

Introduction to Bank Reconciliation Process

These set of articles provide a brief introduction to Bank Reconciliation Process. This topic not only discusses the meaning of bank reconciliation process but also discusses how this process in handled in new age ERPs and Automated Reconciliation Systems.

-

Unravel the mystery behind clearing. Why we use clearing accounts. Find the relevance of word "Clearing" in business context.

-

What are the various sources of cash in an organization. Which sources increase the cash available with the enterprise and which sources results in outflow of the cash? Let us explore!

-

The topic for this lesson is "Introduction to Cash Management Process". We start with the learning objectives for building requisite functional expertise in cash management process.

-

Treasury Management - Benefits

Effectively using treasury management with cash management and trade finance products brings tangible benefits to both corporates and financial institutions. Let us discuss some tangible benefits of treasury function.

-

Why enterprises need cash management. What is the purpose of having a well defined cash management process?

-

What is Invoice to Cash Process

In this article, we will explore the business process area known as; Invoice to Cash; Also known as I2C. Learning objectives for this lesson are: Meaning of Invoice to Cash Process; Sub Processes under Invoice to Cash; Process Flow for Invoice to Cash; Key Transactions Fields; Key Setups/Master Data Requirements.

-

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Till reconciliation happens the amounts are parked in 'Cash Clearing Account'.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved