- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Treasury Management

- Cash Management - Integrations

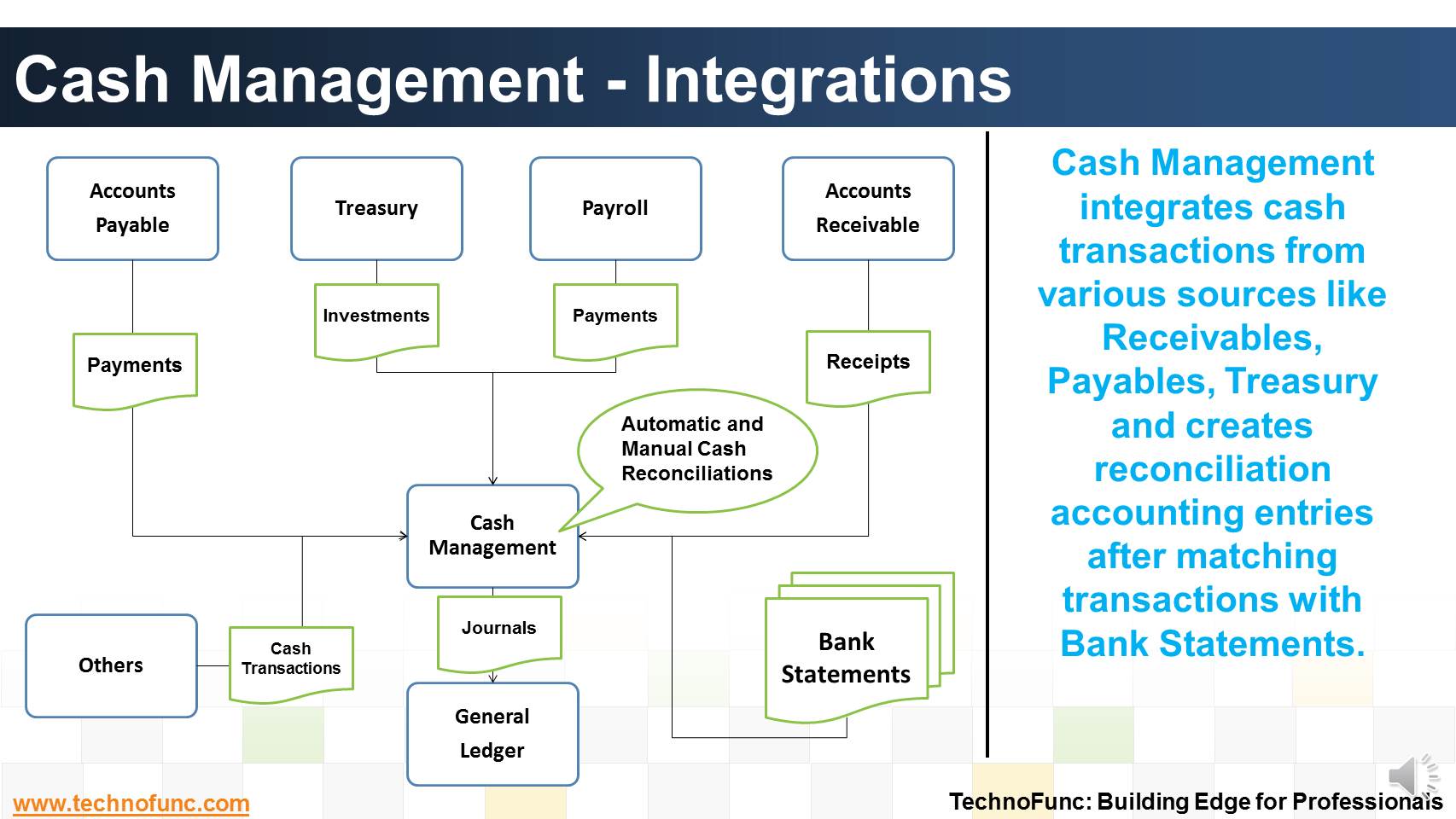

Cash Management - Integrations

Cash Management integrates cash transactions from various sources like Receivables, Payables, Treasury and creates reconciliation accounting entries after matching transactions with Bank Statements.

Cash Management receives payment information from Accounts Payables and you can then clear and reconcile payments. You can also create miscellaneous non-invoiced transactions, such as bank charges, debits, or credits.

Similarly, Cash management gets receipt information from Accounts Receivables. Using Cash Management, you can clear and reconcile receipts and create miscellaneous (non-invoiced) transactions, such as interest, debits, or credits.

Similarly, Cash management gets investment and deal information from Treasury. Using Cash Management, you can clear and reconcile investments.

You can get cash transactions from other sources like payroll or intercompany system.

Transactions are cleared and reconciled against a bank statement; reconciliation accounting entries are created after matching transactions and sent to General Ledger.

One of the most recurring theme in global transaction banking is the increasing integration of cash management and trade finance products.

This is possible only if the organization has a well defined Centralized Treasury Management System. This brings tangible benefits to both corporates and financial institutions.

To Learn more about how treasury and cash management integration can benefit organizations, please see our video on Treasury Management Process.

Related Links

You May Also Like

-

The Cash Management component ensures that the enterprise has sufficient liquidity for payments that are due and to monitor payment flows. Learn how treasury plays an important role in cash management for the enterprise.

-

Account Reconciliation – How? Learn the three key attributes to perfom account reconciliation.

-

In automated clearing, Bank statement details are automatically matched and reconciled with system transactions. Learn how this process works and what are the perquisites to enable the same.

-

Complete Bank Reconciliation Process

Bank Reconciliation Process is a eight step process starting from uploading the Bank Statement to finally posting the entries in General Ledger. Learn the Eight Steps in Detail!

-

Treasury Management - Benefits

Effectively using treasury management with cash management and trade finance products brings tangible benefits to both corporates and financial institutions. Let us discuss some tangible benefits of treasury function.

-

Effectively using cash management with trade finance products brings tangible benefits to both corporates and financial institutions.Learn the various benefits of cash management process.

-

Cash Management - Integrations

Cash Management integrates cash transactions from various sources like Receivables, Payables, Treasury and creates reconciliation accounting entries after matching transactions with Bank Statements.

-

Technology has enabled the treasury function by providing various solutions to manage it's complicated tasks. This article explains various types of treasury management systems available in the market.

-

Learning objectives for this lesson are: Meaning of Order to Cash Process; Sub Processes under Order to Cash; Process Flow for Order to Cash; Key Roles & Transactions; Key Setups/Master Data Requirements.

-

The objective of funding Management is to implement strategies that lead to the best borrowing rates and lower investment costs. Learn how treasury aids in loans and investment management functions.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved