- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Cash Management

- Cash Management - Integrations

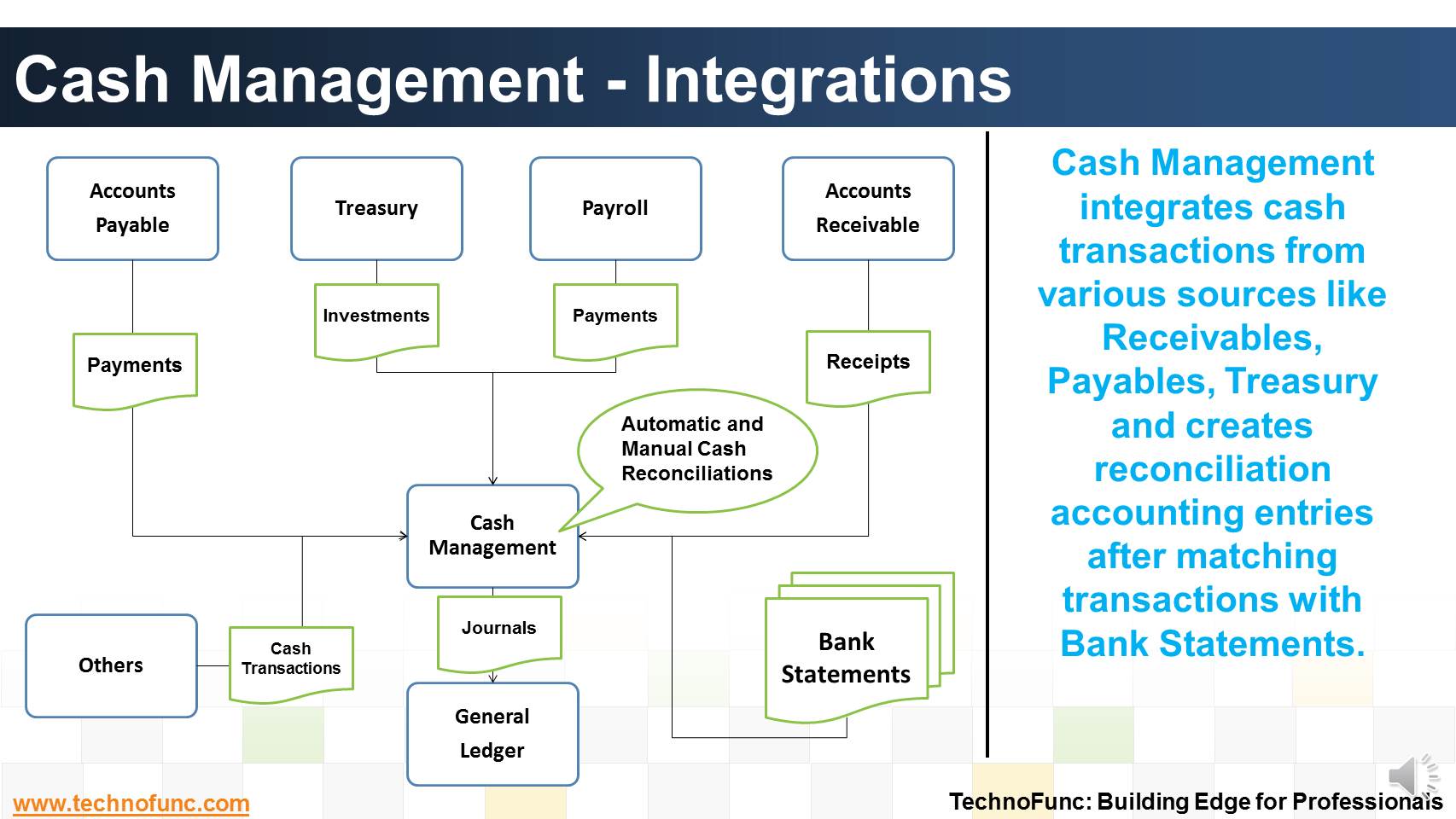

Cash Management - Integrations

Cash Management integrates cash transactions from various sources like Receivables, Payables, Treasury and creates reconciliation accounting entries after matching transactions with Bank Statements.

Cash Management receives payment information from Accounts Payables and you can then clear and reconcile payments. You can also create miscellaneous non-invoiced transactions, such as bank charges, debits, or credits.

Similarly, Cash management gets receipt information from Accounts Receivables. Using Cash Management, you can clear and reconcile receipts and create miscellaneous (non-invoiced) transactions, such as interest, debits, or credits.

Similarly, Cash management gets investment and deal information from Treasury. Using Cash Management, you can clear and reconcile investments.

You can get cash transactions from other sources like payroll or intercompany system.

Transactions are cleared and reconciled against a bank statement; reconciliation accounting entries are created after matching transactions and sent to General Ledger.

One of the most recurring theme in global transaction banking is the increasing integration of cash management and trade finance products.

This is possible only if the organization has a well defined Centralized Treasury Management System. This brings tangible benefits to both corporates and financial institutions.

To Learn more about how treasury and cash management integration can benefit organizations, please see our video on Treasury Management Process.

Related Links

You May Also Like

-

Technology has enabled the treasury function by providing various solutions to manage it's complicated tasks. This article explains various types of treasury management systems available in the market.

-

How the inflow and outflow of cash is linked to the operating cycles of the business? Learn the cash management process in an enterprize and it's key components.

-

Have you ever wondered what is actually a Bank Statement and why it is needed. What is the information that is available in a bank statement?

-

The Cash Management component ensures that the enterprise has sufficient liquidity for payments that are due and to monitor payment flows. Learn how treasury plays an important role in cash management for the enterprise.

-

Disbursement Float is the time taken from payment creation to settlement. Collection float is the sum total of time taken by Payment Float; Mail Float; Processing Float and Availability Float. Learn more!

-

Before we dive into cash management, let us fist understand what we mean by cash and what constitutes cash in context of cash management process.

-

Unravel the mystery behind clearing. Why we use clearing accounts. Find the relevance of word "Clearing" in business context.

-

Learning objectives for this lesson are: Meaning of Order to Cash Process; Sub Processes under Order to Cash; Process Flow for Order to Cash; Key Roles & Transactions; Key Setups/Master Data Requirements.

-

The objective of funding Management is to implement strategies that lead to the best borrowing rates and lower investment costs. Learn how treasury aids in loans and investment management functions.

-

The topic for this lesson is "Introduction to Cash Management Process". We start with the learning objectives for building requisite functional expertise in cash management process.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved