- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Treasury Management

- Clearing V/s Suspense Account

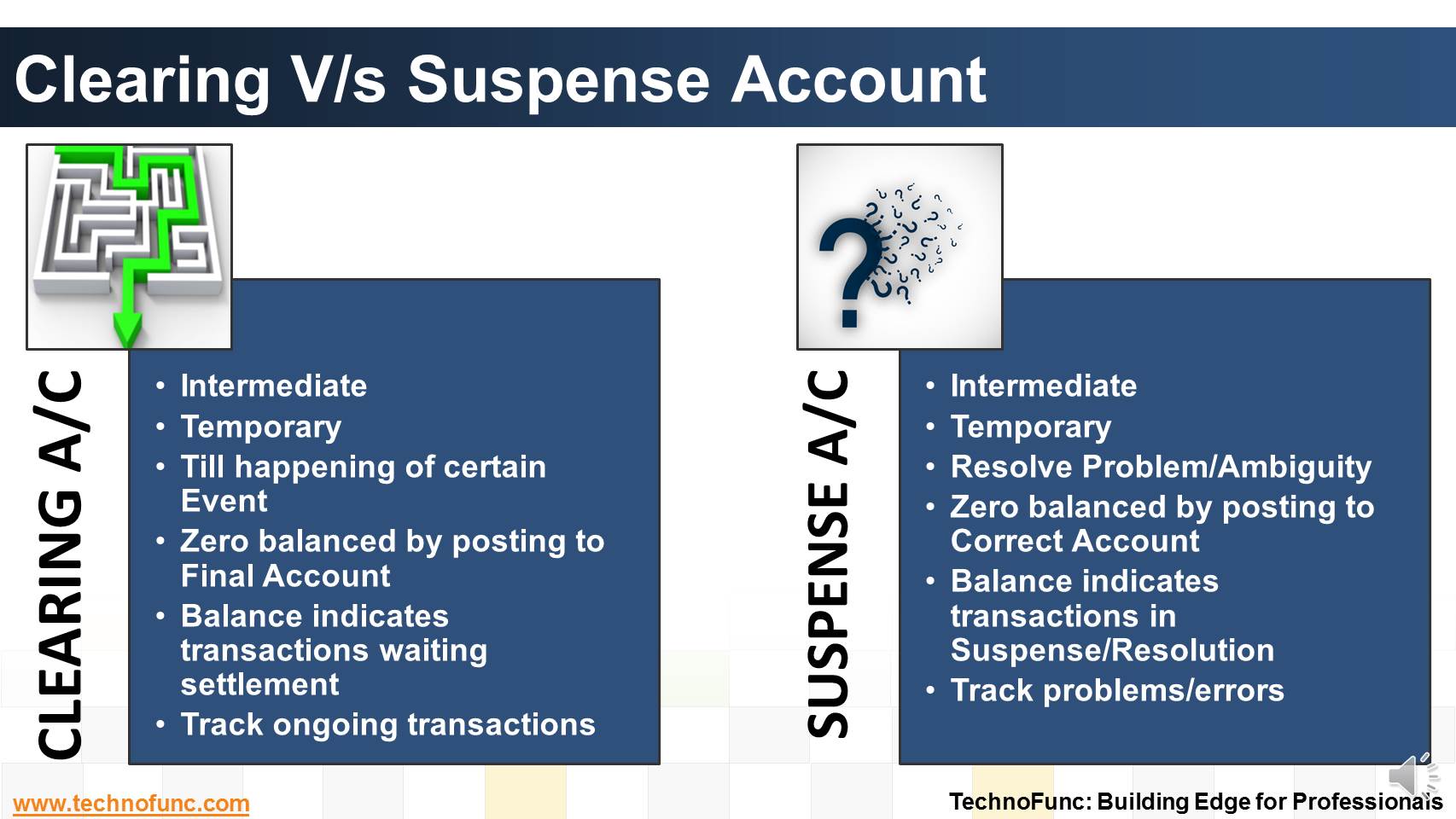

Clearing V/s Suspense Account

Suspense and clearing accounts resemble each other in many respects but there exists important fundamental difference between the two. Read more to explore these differences.

Suspense and clearing accounts resemble each other in many respects but there exists one important fundamental difference.

Both are temporary accounts. Transactions are entered and finally transferred to the appropriate account.

Suspense and clearing accounts have entirely different functions.

Clearing accounts are used to hold transactions for later posting and ensure information is recorded correctly and completely.

A suspense account is used when there appears to be a problem. It serves to record an amount until the problem is resolved.

Both suspense and clearing accounts are "zeroed out" periodically. This means everything in an account is moved to other accounts, leaving a zero balance.

Suspense A/c is used for tracking Uncertainties – to hold transactions when there is some ambiguity involved.

For example, customer has deposited payment in the bank account and you are unable to identify the customer from available information,

You can put the transaction in a suspense account until you determine where it belongs.

Whereas Clearing Accounts are used for tracking transactions on a temporary basis until it's time to post them to a more permanent account.

Taking the same example, now the customer has sent payment against many outstanding invoices and you know it belongs to a particular customer but not to which invoice.

This may be parked in a clearing account until the confirmation is received from customer and amount applied to correct invoice.

Just to keep track of correct outstanding past due invoices.

Related Links

You May Also Like

-

Although there is no straight forward answer to the question, how to best organize a treasury function, this article provides an generic view of the way large MNCs creates departments or sub-functions within the treasury function.

-

Account Reconciliation – How? Learn the three key attributes to perfom account reconciliation.

-

Cash Clearing – Accounting Entries

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Learn the steps and accounting entries that gets generated during the cash clearing process.

-

Have you ever wondered what is actually a Bank Statement and why it is needed. What is the information that is available in a bank statement?

-

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Till reconciliation happens the amounts are parked in 'Cash Clearing Account'.

-

In the previous article we talked about the meaning of the account reconciliations. Now as you now the definition of account reconciliation, in this article let us see why it is carried out.

-

So many codes in the lines that are there in a Bank Statement. It contain lots and lots of meaningful information that can help automated many tasks. Explore more!

-

What is Account Reconciliation?

Before you understand the Bank Reconciliation Process it is important to understand what is account reconciliation and why it is carried out.

-

Disbursement Float is the time taken from payment creation to settlement. Collection float is the sum total of time taken by Payment Float; Mail Float; Processing Float and Availability Float. Learn more!

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved