- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - GAAP Accounting

GL - GAAP Accounting

Generally Accepted Accounting Principles define the accounting procedures, and understanding them is essential to producing accurate and meaningful records. In this article we emphasize on accounting principles and concepts so that the learner can understand the “why” of accounting which will help you gain an understanding of the full significance of accounting.

Why Generally Accepted Accounting Principles?

If every company’s accountants start recording and reporting financial data as they deem fit, without following some common accounting principles and practices, comparisons among the financial data of the different companies would become very difficult, if not impossible. Thus, financial accountants follow generally accepted accounting principles (GAAP) in preparing reports.

Since the purpose of accounting is to convey meaningful and understandable financial information to their stakeholders, the accounting profession has developed generally accepted accounting principles (GAAP) to respond to the need for standardization. These principles define accounting procedures, and understanding them is essential to producing accurate and meaningful records. Before we can understand the concepts of general ledger, understanding these principles is a prerequisite.

The success of any business, big or small, begins with an understanding of accounting. These reports based on the generally accepted accounting principles, allow investors and other stakeholders to compare one company to another. Accounting principles and concepts are developed from research, accepted accounting practices, and pronouncements of authoritative bodies.

Who Defines GAAP?

The Financial Accounting Standards Board (FASB) is the authoritative body having the primary responsibility for developing accounting principles. The FASB publishes Statements of Financial Accounting Standards as well as Interpretations of these Standards.

Apart from “Financial Accounting Standards Board” (FASB), the American Institute of Certified Public Accountants (AICPA), and the Securities and Exchange Commission (SEC) along with the statutory authoritative bodies of various countries (Example – Institute of Chartered Accountants of India, for India), all have all played an influential role in developing generally accepted accounting principles which span across boundaries of nation and have global acceptability.

Efforts are still going on to emerge globally accepted principles, as we still found variations in principles from countries to countries as well as from businesses to businesses that warrant a need to have different accounting methods.

The “Why” of Accounting:

In this article, we emphasize accounting principles and concepts so that the learner can understand the “why” of accounting which will help you define the “how” while designing automated accounting systems because this “why” will help you will gain an understanding of the full significance of accounting. In the following paragraphs, we discuss the five principles that are generally followed by accountants worldwide and they are the business entity concept, cost concept, the objectivity concept, the going-concern concept, and the monetary value principle. By applying generally accepted accounting principles in accounting practices, accountants make sure that their work is consistent and meaningful to others.

GAAP 1: The Business Entity Principle:

Under the business entity concept, the activities of a business are recorded separately from the activities of the stakeholders. The Business Entity Principle states that a business must be considered a separate entity, and only the transactions carried out by the business may be recorded in the accounting books. This ensures that the financial picture of the business represents the activities and events of the business; this reflects the economic impact and value of the business not of its stakeholders. The individual business unit is the business entity for which economic data are needed and must be identified so that the accountant can determine which economic data should be analyzed, recorded, and summarized in reports.

The business entity concept is important because it limits the economic data in the accounting system to data related directly to the activities of the business. In other words, the business is viewed as an entity separate from its owners, creditors, or other stakeholders.

GAAP 2: The Cost Principle:

The Cost Principle states that anything business purchases is recorded as the amount paid, regardless of its real or perceived value. This accounting principle requires the amounts in the accounts to be the actual cost rather than the current or future value. Accountants can show an amount less than cost due to conservatism in certain circumstances, but accountants are generally prohibited from showing amounts greater than cost. This eliminates guesswork or the possibility of recording inaccurate information.

To help you understand this concept let’s consider a real estate transaction. The business has acquired a building for $100,000 by paying the seller in cash after taking a loan from the bank. The Ask Price by the seller was $150,000 and the business was only willing to pay $90,000. As far as the valuation of the property by the corporation is concerned it was valued at $120,000 for property tax purposes. The business applied for a loan from the bank and the approved property assessor estimated the market value of the property to be $125,000. Bank only financed $75,000 against that valuation. After the business bought the property it received an offer of $135,000 the next day from a neighboring store for the same building. What should be the amount that should be entered into the business’s accounting records?

As per the cost principle, the cost of the building for the business here is $100,000 and the other amounts have no effect on the accounting records because they did not result in an exchange of the building from the seller to the buyer. The cost concept is the basis for entering the exchange price, or cost, into the accounting records for the business.

GAAP 3: The Objectivity Principle:

Using the cost concept involves two other important accounting concepts—objectivity and the unit of measure. The Objectivity Principle states that accounting operates on objective evidence. All transactions must have proof that they were carried out. The objectivity concept requires that the accounting records and reports be based upon objective evidence.

In an earlier real estate example, while negotiating the deal, both buyer and seller, try to get the best price. Only the final agreed-upon amount, on the basis of which the transfer of title was initiated, is objective enough for accounting purposes. If the amounts at which property was recorded were constantly being revised based on offers, appraisals, and opinions, accounting reports could soon become unstable and unreliable. The only reliable proof that a transaction occurred is found in source documents such as a sales slip or an invoice and in this case the agreement to sell or sales deed.

GAAP 4: The Unit of Measure Principle:

The unit of measure concept requires that economic data be recorded in monetary terms that are dollars or any other currency as applicable. Money is a common unit of measurement for reporting uniform financial data and reports. This principle also involves another linked principle of “Stable Monetary Unit of Measure “that states that the value of the monetary measure (dollar) does not change. This ensures that the unit of measure (dollar) is kept as a stable unit of measure for accounting purposes. It also makes it easier to compare financial statements over time.

GAAP 5: The Going-Concern Principle:

The 'going concern' concept directs accountants to prepare financial statements on the assumption that the business is not about to go broke or be liquidated. So, unless there is significant evidence to the contrary, accountants will base their valuations and their reporting of financial data on the assumption that the business will remain in existence for an indefinite period. An indefinite period means the foreseeable future or long enough for the business to meet its objectives and to fulfill its commitments.

The implication of this principle is that it establishes that a business is a continuing enterprise and that its buildings, land, or equipment cannot be sold without disrupting the business. So unless the buildings, land, or equipment are for sale, as in the case of liquidation, their market value is not recorded. This prevents distortion in the objective value of the business. Different bases of measurement may be appropriate when the entity is NOT expected to continue in operation for the foreseeable future. Where a company is NOT a going concern, the break-up basis is used where all assets and liabilities are stated at Net Realizable Value.

Related Links

You May Also Like

-

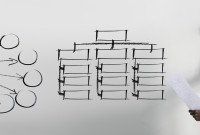

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

-

Understand what we mean by GAAP to STAT adjustments. This article discusses the different standards that are used for multiple representations of the financial results for global organizations. Understand the meaning of US GAAP, Local GAAP, STAT, IFRS, and STAT. Finally, understand why accounting differences arise and how they are adjusted for different financial representations.

-

In this article, we will describe how to determine if an account needs adjustment entries due to the application of the matching concept. Learners will get a thorough understanding of the adjustment process and the nature of the adjustment entries. We will discuss the four types of adjustments resulting from unearned revenue, prepaid expenses, accrued expenses, and accrued revenue.

-

What is a Business Eco System?

The goal of a business is to generate capital appreciation and profits for its owners or stakeholders by engaging in provision of goods and services to customers within the eco system/framework governed by respective laws(local/international). The eco system involves various entities that the business works with for delivery of a product or service.

-

In this article we will focus on and understand the accounting process which enables the accounting system to provide the necessary information to business stakeholders. We will deep dive into each of the steps of accounting and will understand how to identify accounting transactions and the process for recording accounting information and transactions.

-

Legal Structures in Businesses

Businesses not only vary in size and industry but also in their ownership. Most businesses evolve from being owned by just one person to a small group of people and eventually being managed by a large numbers of shareholders. Different ownership structures overlap with different legal forms that a business can take. A business’s legal and ownership structure determines many of its legal responsibilities.

-

General Ledger - Advanced Features

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

-

Defining Organizational Hierarchies

A hierarchy is an ordered series of related objects. You can relate hierarchy with “pyramid” - where each step of the pyramid is subordinate to the one above it. One can use drill up or down to perform multi-dimensional analysis with a hierarchy. Multi-dimensional analysis uses dimension objects organized in a meaningful order and allows users to observe data from various viewpoints.

-

An allocation is a process of shifting overhead costs to cost objects, using a rational basis of allotment. Understand what is the meaning of allocation in the accounting context and how defining mass allocations simplifies the process of allocating overheads to various accounting segments. Explore types of allocations and see some practical examples of mass allocations in real business situations.

-

In this article we will discuss various types of "Management Entities". Various types of operational units, are created by management, to effectively run, manage and control their business. Different types of functional units, and divisional units, are widely used across industry.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved