- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Account Allocations

GL - Account Allocations

An allocation is a process of shifting overhead costs to cost objects, using a rational basis of allotment. Understand what is the meaning of allocation in the accounting context and how defining mass allocations simplifies the process of allocating overheads to various accounting segments. Explore types of allocations and see some practical examples of mass allocations in real business situations.

What is Account Allocation?

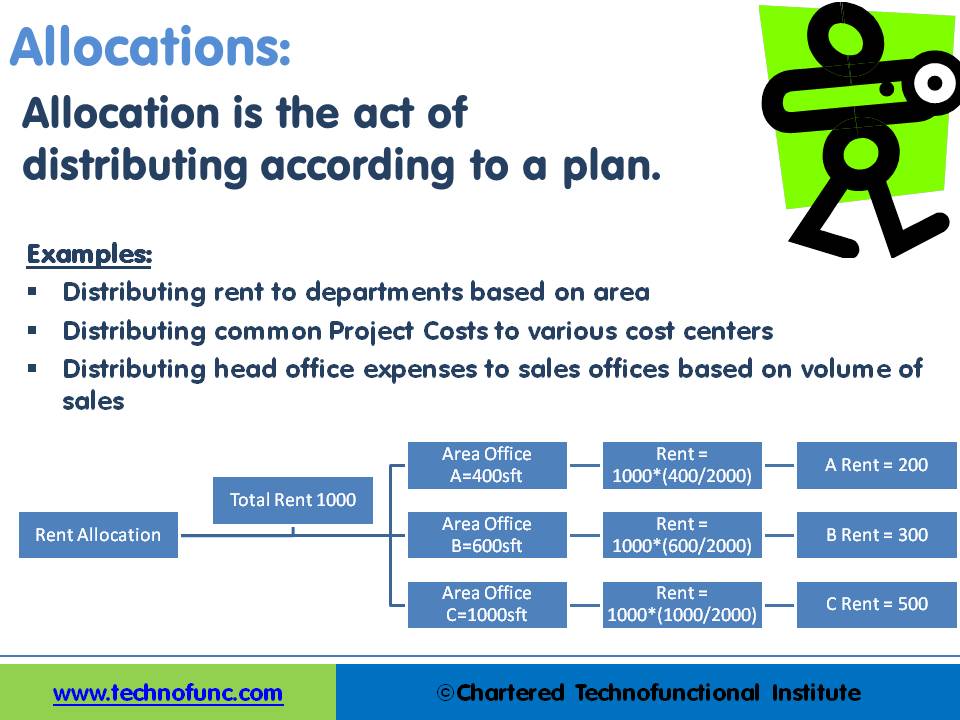

Allocation is the act of distributing according to a plan. As per the dictionary allocate means to set apart for a special purpose; designate; distribute according to a plan. From an accounting context, it means a system of dividing overhead expenses between the various departments of a business. Figuratively, earmarked is often used in regard to monetary allocations although it is heard in other contexts as well.

The allocation also refers to a piece of the pie, a share in the profits, a portion of whatever is being divided up and parceled out usually money, but in an accounting context is applicable to account balances. This expression probably has its origin in the graphic representation of budget allotments in circular, pie-shaped form, with various sized wedges or pieces indicating the relative size of allocations to different agencies, departments, etc.

Concept of Mass Allocations:

Mass allocations is a functionality offered by many automated systems and ERPs to distribute the account balances from one account to several others based on a formula or mathematic logic. Users can define a Mass Allocation formula to create journals that allocate revenues and expenses across a group of cost centers, departments, divisions, locations, and so on using any accounting dimension available. Users can include parent values in allocation formulas that can enable allocating to the child values referenced by the parent without having to enumerate each child separately.

Different Type of Allocations:

The commonly used allocations can be grouped as follows:

- Net Allocations: allocated amounts that reflect changes to the cost pool.

- Step–Down Allocations: distributing amounts from one allocation pool to a subsidiary allocation pool.

- Rate-Based Allocations: using current, historical, or estimated rates to allocate costs.

- Usage-Based Allocations: using statistics such as headcount, units sold, square footage, number of deliveries, or computer time consumed to calculate allocation amounts.

- Standard Costing Allocations: using statistics such as sales units, production units, number of deliveries or customers served to perform standard costing.

Examples of Allocation:

Allocations can be used in various practical business situations. For example, consolidated rent paid can be allocated to another division based on the area of usage, or, a pool of marketing costs can be allocated to several departments based on the ratio of department revenues to total revenues. Some of the commonly used examples are:

- Distributing rent to departments based on area

- Distributing common project costs to various cost centers

- Distributing head office expenses to sales offices based on the volume of sales

- Distributing marketing costs to product lines based on revenue

- Distributing common employee expenses to employee cost for assessments

In the example shown in the figure, we have a company which has taken a 1000 square feet office space on rent. The expenses for rent are borne by the head-office and payment to the landlord is also made by the head office. To know the true profitability of each of the departments (Department A, B & C) the rent needs to be allocated to each one of them.

Each department occupies different areas and the company has taken the measurement of the areas occupied by each of the departments. In the example shown here, the rent is being allocated to different departments based on their usage factor. This is an example of the concept of allocation and automated accounting systems help handle complex allocations programmatically.

Difference between Allocations & Recurring Journals:

Recurring Journals are for transactions that repeat every accounting period and allocation Journals are for single journal entry using an accounting or mathematical formula to allocate revenues and expenses across a group of accounting dimensions like cost centers, departments, divisions, locations, or product lines depending upon usage factors.

Related Links

You May Also Like

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

-

In most of the automated financial systems, you can define more than 12 accounting periods in a financial year. This article will explain the concept of the adjustment period and the benefits of having adjustment periods. Adjustment periods have their inherent challenges for the users of financial statements and there is a workaround for those who don’t want to use adjustment periods.

-

The sole trader organization (also called proprietorship) is the oldest form of organization and the most common form of organization for small businesses even today. In a proprietorship the enterprise is owned and controlled only by one person. This form is one of the most popular forms because of the advantages it offers. It is the simplest and easiest to form.

-

GL - Different Type of Journals

Two basic types of journals exist: general and special. In this article, the learner will understand the meaning of journalizing and the steps required to create a journal entry. This article will also discuss the types of journals and will help you understand general journals & special journals. In the end, we will explain the impact of automated ERPs on the Journalizing Process.

-

When the quantum of business is expected to be moderate and the entrepreneur desires that the risk involved in the operation be shared, he or she may prefer a partnership. A partnership comes into existence when two or more persons agree to share the profits of a business, which they run together.

-

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

-

Accrued expenses, sometimes referred to as accrued liabilities, are expenses that have been incurred but have not been recorded in the accounts. Discuss the need to record accrued liabilities and why they require an adjustment entry. Understand the treatment for these entries once the accounting period is closed and learn to differentiate when the commitments become liabilities.

-

GL - Understanding Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

-

What is a Business Eco System?

The goal of a business is to generate capital appreciation and profits for its owners or stakeholders by engaging in provision of goods and services to customers within the eco system/framework governed by respective laws(local/international). The eco system involves various entities that the business works with for delivery of a product or service.

-

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved