- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

General Ledger

General Ledger – Record to Report Process

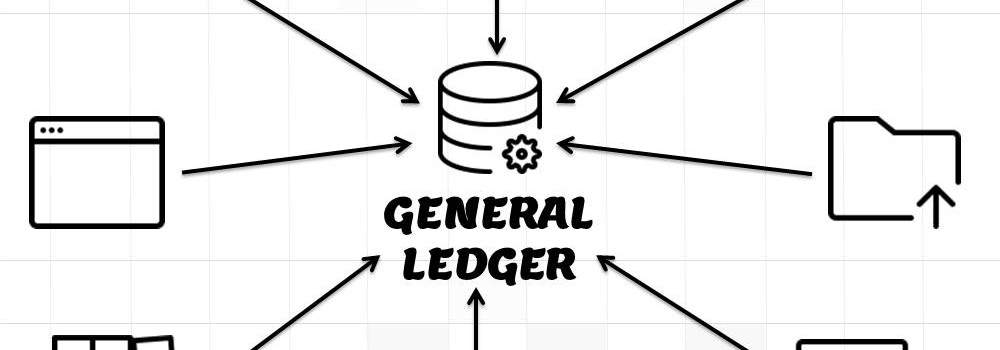

The ‘Record to Report’ process, also referred to as ‘Account to Report’ or simply as general ledger process, refers to the maintenance of the general ledger right from recording of transactions to preparation of unit trial balances and reporting company’s consolidated financial results.

Bookkeeping is a critical accounting activity that provides the solid financial foundation on which an organization stands. The correctness and integrity of the financial statements that an organization produces largely depend on the correctness and integrity of its bookkeeping activities. Entry of Journals and review and posting to ledgers are the two core bookkeeping activities. The journals are where all transactions are first recorded on a daily basis. Information from a journal is then posted to the ledgers to update each account. Various accounts in the ledgers are then summarized, tested, and validated, and used for producing financial statements at the end of an accounting period.

Here we will help you understand the basic accounting concepts and expose you to the general ledger process of entry of journals, review, posting summarization, reconciliation and finally reporting and closing of an accounting period. This section from TechnoFunc will help you understand the fundamentals of an effective automated general ledger system and subsequently explain all the important GL concepts including how to analyze a transaction, record it in the appropriate journal, and then post it to the ledgers. We assure you this is the best place to learn the record to report process!!

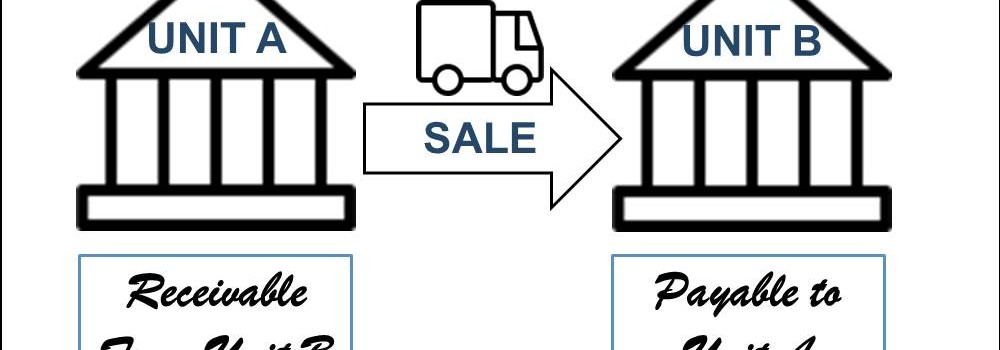

GL - Intercompany Accounting

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

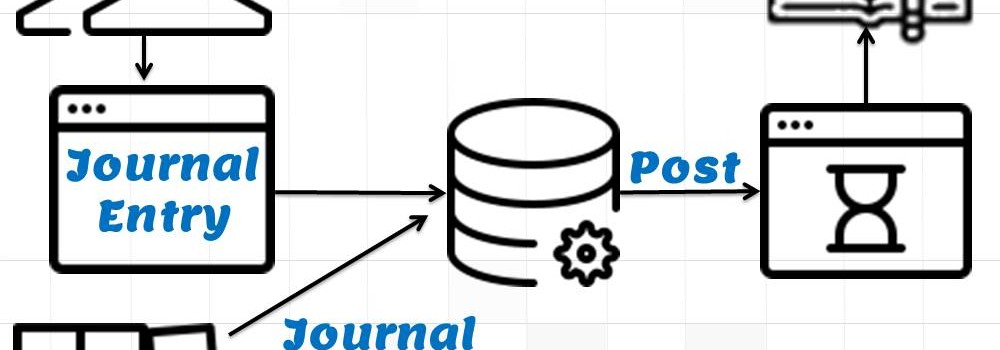

GL - Journal Entry & Import

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

GL - Journal Posting and Balances

In this tutorial, we will explain what we mean by the posting process and what are the major differences between the posting process in the manual accounting system compared to the automated accounting systems and ERPs. This article also explains how posting also happens in subsidiary ledgers and subsequently that information is again posted to the general ledger.

GL - Reversing Journal Entry

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

GL - Errors & Reversals

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

GL - Recurring Journal Entries

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

GL - Using Adjustment Period

In most of the automated financial systems, you can define more than 12 accounting periods in a financial year. This article will explain the concept of the adjustment period and the benefits of having adjustment periods. Adjustment periods have their inherent challenges for the users of financial statements and there is a workaround for those who don’t want to use adjustment periods.

GL - Unearned / Deferred Revenue

Unearned revenue is a liability to the entity until the revenue is earned. Learn the concept of unearned revenue, also known as deferred revenue. Gain an understanding of business scenarios in which organizations need to park their receipts as unearned. Look at some real-life examples and understand the accounting treatment for unearned revenue. Finally, look at how the concept is treated in the ERPs or automated systems.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved