- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Errors & Reversals

GL - Errors & Reversals

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

Discovery of Errors in Accounting Books:

It is obvious that care should be used in recording transactions in the journal and in posting to the accounts. The need for accuracy in determining account balances and reporting them to the business stakeholders is also evident.

In the practical world, errors will sometimes occur in journalizing and posting transactions. In some cases, however, an error might not be significant enough to affect the decisions of management or others. In such cases, the materiality concept implies that the error may be treated in the easiest possible way. For example, an error of a few dollars in recording an asset as an expense for a business with millions of dollars in assets would be considered immaterial, and a correction would not be necessary. However, in case the error is significant and material then it needs to be corrected. In the case of automated systems and ERPs, the general practice is to correct all identified errors.

Causes of Errors:

Some of the most common errors in the recording and posting steps are described below:

- Failure to record a transaction or to post a transaction.

- Recording the same erroneous amount for both the debit and the credit parts of a transaction.

- Recording the same transaction more than once.

- Posting a part of a transaction correctly as a debit or credit but to the wrong account.

- Posting the transaction not in accordance with the accounting principles

- Source system errors creating wrong transactions in General Ledger

- Wrong period errors, prior period items getting posted in the current period

- Interface errors, sub-ledger feed is omitted or is posted twice

- Coding errors – erroneous data is automatically created and posted.

- Exchange Rate Errors- the system has picked up a wrong exchange rate that needs to be corrected

- Account balance errors

- The wrong amount posted to an account.

- Debit posted as credit, or vice versa.

- Debit or credit posting omitted.

- Posting errors

Correction of Errors by Reversals:

The procedures used to correct an error vary according to the nature of the error, when the error is discovered, and whether a manual or computerized accounting system is used. Oftentimes, an error is discovered as it is being journalized or posted. In such cases, the error is simply corrected. For example, computerized accounting systems automatically verify for each journal entry whether the total debits equal the total credits. If the totals are not equal, an error report is created and the computer program will not proceed until the journal entry is corrected.

Occasionally, however, an error is not discovered until after a journal entry has been recorded and posted to the accounts. Correcting this type of error is more complex. In the automated systems the journal cannot be edited or deleted once it has been posted. After the posting process has happened, the only way to correct the errors is to reverse the original transaction that nullifies the accounting impact of the wrong Journal and create a new journal with the correct accounting data.

In Automated Accounting Systems, it is not possible to delete transactions once the posting has been made. In such systems reversals is the recommended way to correct the erroneous entries. An example is that one interface feed has been posted by mistake twice. This has inflated many income expense accounts. A reversing entry with opposite debit and credit amounts to all the impacted accounts will nullify the impact of the mistake.

Reversal of Adjustment Entries:

At the beginning of each accounting period, there is an accounting practice to use reversing entries to cancel out the adjusting/accrual entries that were made to accrue revenues and expenses at the end of the previous accounting period. The use of Reversing Entries makes it easier to record subsequent transactions by eliminating the possibility of duplication.

- Reversing entries are made on the first day of an accounting period in order to offset adjusting accrual/provision entries made in the previous accounting period.

- Reversing entries are used to avoid the double booking of revenues or expenses when the accruals/provisions are settled in cash.

- A reversing entry is linked to the original adjusting entry and is written by reversing the position of debits with credits and vice versa.

- The net impact of Original Entry and Reversing Entry on the accounting books is always zero.

Automatic Reversals:

Large organizations need to routinely generate and post large numbers of journal reversals as part of their month-end closing and opening procedures. Automated journal reversals save time and reduce entry errors by automatically generating and posting journal reversals. Users generally need to define journal reversal criteria which are the reversal business rules for journal categories or classes along with the reversal method, period and date. The journal will be reversed based on the method, period, and date criteria defined for that journal category/class when a new accounting period is opened.

Related Links

You May Also Like

-

As the business grows, the company may want to transition to a branch structure as branches are allowed to conduct a much broader range of activity than representative offices. Branches can buy and sell goods, sign contracts, build things, render services, and generally everything that a regular business can do. A company expands its business by opening up its branch offices in various parts of the country as well as in other countries.

-

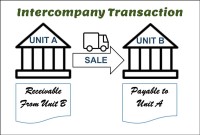

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

In this article we will discuss various types of "Management Entities". Various types of operational units, are created by management, to effectively run, manage and control their business. Different types of functional units, and divisional units, are widely used across industry.

-

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

-

Trial Balance in General Ledger

One of the greatest benefits of using a double-entry accounting system is the capability to generate a trial balance. What do we mean by trial balance? As the name suggests a trial balance is a report that must have its debits equals to credits. Understand the importance of trial balance and why it is balanced. Learn how it is prepared and in which format.

-

Internally, an organization can be structured in many different ways, depending on their objectives. The internal structure of an organization will determine the modes in which it operates and performs. Organizational structure allows the expressed allocation of responsibilities for different functions and processes to different entities such as the branch, department, workgroup and individual.

-

There are five types of core accounts to capture any accounting transaction. Apart from these fundamental accounts, some other special-purpose accounts are used to ensure the integrity of financial transactions. Some examples of such accounts are clearing accounts, suspense accounts, contra accounts, and intercompany accounts. Understand the importance and usage of these accounts.

-

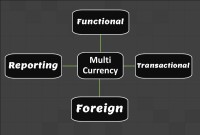

General Ledger - Advanced Features

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

-

Functional Organizational Structures

A functional organizational structure is a structure that consists of activities such as coordination, supervision and task allocation. The organizational structure determines how the organization performs or operates. The term organizational structure refers to how the people in an organization are grouped and to whom they report.

-

Operational Structures in Business

Large organizations grow through subsidiaries, joint ventures, multiple divisions and departments along with mergers and acquisitions. Leaders of these organizations typically want to analyze the business based on operational structures such as industries, functions, consumers, or product lines.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved