- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Using Adjustment Period

GL - Using Adjustment Period

In most of the automated financial systems, you can define more than 12 accounting periods in a financial year. This article will explain the concept of the adjustment period and the benefits of having adjustment periods. Adjustment periods have their inherent challenges for the users of financial statements and there is a workaround for those who don’t want to use adjustment periods.

What is the Adjustment Period?

Any accounting period created specifically for entering adjustment and closing entries is known as adjustment period. The dates in the adjustment period overlap with the normal accounting periods in automated systems. Organizations create one accounting period as "Year Open Period” which is the first period in the accounting calendar to clear “carried over balances” from last financial year. Similarly accountants may define the last period of the accounting calendar as "Year Close Period" where adjustment transactions and closing entries are posted for the current accounting calendar. These periods are generally known as “Adjustment Periods”, sometimes are also referred to as “Zero Periods”. Most ERP’s and automated general ledger systems provide the functionality to define adjustment periods.

Benefits of Adjustment Periods:

Opening Adjustment Period: Adjustment period at the beginning of the year helps tracks opening balances and transactions. At the beginning of the year user can create journals to transfer their opening balances for the current accounting year. Generally there is an time overlap between the opening of the new financial year and finalization of audit of the previous year. This results in creation of many adjustment entries in the previous year that has an impact on the opening balances of the current year. Users are able to capture those adjustments in a separate “opening adjustment period” to keep a complete track of their normal and adjustment entries. The starting period “Zero” is used to store the starting balance for each balance sheet account.

Closing Adjustment Period:

Similarly, defining an adjustment period at the close of the year helps track closing balances and adjustment transactions. Multiple closing periods allow generation of financial statements reflecting various stages of closing and are helpful in providing complete audit trail. This also helps controlling any back dated entries in the main accounting periods.

Tracking of Errors & Omissions:

Errors and Omissions discovered after the year close can be corrected by passing relevant entries in the Adjustment Period. This will not impact your reported balances; however will create an audit trail for the transactions that need to be take care of next year.

Stat to Management Reconciliation:

Adjustment Period can also be used to track reconciliation entries. Large corporations need to pass many reconciliation entries to tally their Statutory and Main Consolidation Books. Adjustment period is useful in tracking the entries made to reconcile the consolidation books with the Local Country Books.

Exclusion for Management Reporting:

After the close of the books, a large number of entries like accounting entries for accrual or provisions need to be made in the accounting books to comply with the accounting standards and legal regulations. Management however is generally interested in operational data to do their planning and forecasting activities. By limiting adjustment and statutory entries to adjustment period management reports can be driven from same accounting books by excluding adjustment periods from the reports.

Challenges of using Adjustment Periods:

Adjustment periods have some inherent challenges which have been discussed below:

- Automated Accounting Packages comes with many standard reports. You might need to evaluate the impact of adjustment periods on these reports.

- While reversing journal entries; users need to take precaution to select the period in which they want the reversals to happen. ERPs by default might select the adjustment period.

- You may need to decide whether adjustment period should be included or excluded in your comparative reports.

- Similarly you may need to decide whether adjustment period need to be included in any management reports, especially the ones that can be compared with your statutory published results.

How to track adjustment entries without adjustment period?

Defining adjustment periods is totally optional and decision must be based on company’s requirement on the factors discussed above. Alternate solution to defining adjustment periods could be to define a separate cost center (department, division, profit center etc.). All year-end adjustment entries are made using this cost center and this unit is included for statutory consolidation but excluded for management reporting.

Diagram: Figure given at bottom gives a pictorial representation of a calendar with 13 effective periods having one adjustment period at the year end. While reporting your financial results you need to include your beginning of the year adjustment period with the first calendar period and your last adjustment period with the last reporting period.

Related Links

You May Also Like

-

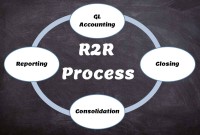

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

-

In this article we will discuss various types of "Management Entities". Various types of operational units, are created by management, to effectively run, manage and control their business. Different types of functional units, and divisional units, are widely used across industry.

-

Legal Structures for Multinational Companies

A multinational company generally has offices and/or factories in different countries and a centralized head office where they coordinate global management. A multinational company (MNC)is a corporate organization that owns or controls the production of goods or services in at least one country other than its home country.

-

Driving Business Efficiency through Divisions and Departments

In case of a multi-divisional organizational structure, there is one parent company, or head-office. And that parent owns smaller departments, under the same brand name. Dividing the firm, into several self-contained, autonomous units, provides the optimal level of centralization, in a company.

-

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

-

Legal Structures in Businesses

Businesses not only vary in size and industry but also in their ownership. Most businesses evolve from being owned by just one person to a small group of people and eventually being managed by a large numbers of shareholders. Different ownership structures overlap with different legal forms that a business can take. A business’s legal and ownership structure determines many of its legal responsibilities.

-

Period End Accruals, Receipt Accruals, Paid Time-Off Accruals, AP Accruals, Revenue Based Cost Accruals, Perpetual Accruals, Inventory Accruals, Accruals Write Off, PO Receipt Accrual, Cost Accrual, etc. are some of the most complex and generally misconstrued terms in the context of general ledger accounting. In this article, we will explore what is the concept of accrual and how it impacts general ledger accounting.

-

Accrued expenses, sometimes referred to as accrued liabilities, are expenses that have been incurred but have not been recorded in the accounts. Discuss the need to record accrued liabilities and why they require an adjustment entry. Understand the treatment for these entries once the accounting period is closed and learn to differentiate when the commitments become liabilities.

-

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved