- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- Legal Structures for Multinational Companies

Legal Structures for Multinational Companies

A multinational company generally has offices and/or factories in different countries and a centralized head office where they coordinate global management. A multinational company (MNC)is a corporate organization that owns or controls the production of goods or services in at least one country other than its home country.

Due to advent of information age and globalization, the traditional hierarchy of the industrial age is rapidly disappearing and new large groups that are spread across the globe are fast emerging. A multinational corporation is a company with headquarters in one country but they operate in many countries. The post Second World War period saw the rapid growth of multinationals in Europe, America and Japan. As the world economy is opening up with a fall in regulatory barriers to foreign investment, better transport and communications, freer capital movements, etc., international companies are finding it easier to invest where they choose to cheaply, and with less risk. With the advent of globalization, companies started expanding to international markets and establishing marketing, manufacturing, or research and development facilities in several foreign countries.

What are multi-national companies?

A multinational company generally has offices and/or factories in different countries and a centralized head office where they coordinate global management. A multinational company (MNC)is a corporate organization that owns or controls the production of goods or services in at least one country other than its home country. One of the first multinational business organizations, the East India Company, was established in 1601. After the East India Company, came the Dutch East India Company in 1603, which would become the largest company in the world for nearly 200 years.

Some current examples are big multi national companies like Apple, Google, Amazon, Coca-Cola, Starbucks, IBM, FedEx, Accenture, Samsung or General Electric etc. Nestle and Shell Oil are two examples of European multinational. Most of the largest and most influential companies of the modern age are publicly traded multinational corporations, including Forbes Global 2000 companies.

What are Conglomerates?

A conglomerate is a combination of two or more corporations engaged in entirely different businesses that fall under one corporate group, usually involving a parent company and many subsidiaries. Often, a conglomerate is a multi-industry company. Conglomerates are often large and multinational.

Features of MNCs & Conglomerates

Some of the attributes associated with these large multi-national corporations are:

- These multinational groups operate across the boundaries of nations

- They employ and serve thousands of people with different cultures.

- Their annual sales turnover is in billions of dollars.

- They raise money in different stock markets.

- In spite of all these diversities they may be part of the same global group.

- These companies operate as individual entities in different countries/markets and consolidate with the group.

- Domestic corporations are taxed on their worldwide income at the federal (country) and state levels.

- Compliance (without overpaying) makes the products & services of these conglomerates more competitive, earnings more attractive to investors & company a more responsible corporate citizen.

Evolution of Legal Structures for MNCs/Conglomerates

They are dynamic organizations that are constantly changing and evolving, acquiring and merging many companies, opening their offices in all parts of world and operating under the ambit of ever-changing complex organizational structures.

Fundamentally a corporation must be legally domiciled in a particular country and engage in other countries through foreign direct investment and the creation of foreign branches or foreign subsidiaries.

All these large groups have smaller companies within them. The conglomerate may be constituted of different units which may represent separate legal entities constituted in different countries having multiple layers of ownership (which might be added to the group through mergers, acquisitions or could be joint ventures). Multinational corporations can select from a variety of jurisdictions for various subsidiaries, but the ultimate parent company can select a single legal domicile.

Global operations of these corporations are conducted with multiple subsidiaries, branch offices and joint venture partners working together, constantly evolving and changing their legal structures through mergers, acquisitions and takeovers. These subsidiaries and partners are responsible for their own P&L. They have their own Fixed Assets (such as assets held for the purpose of producing or providing goods/services) and their own markets where their own or their other group concern’s products are sold and eventually consolidate with the group.

Multinational corporations may be subject to the laws and regulations of both their domicile and the additional jurisdictions where they are engaged in business. In some cases, the jurisdiction can help to avoid burdensome laws. Corporations can legally engage in tax avoidance through their choice of jurisdiction, but must be careful to avoid illegal tax evasion. These MNCs should comply fully with all statutory and tax laws & regulations around the world and ensure payment of the correct amount of taxes in every country where it operates.

Aside from setting up a private limited company as subsidiary, foreign companies have two other options for entering the foreign market – a Branch Office or a Representative Office. Both are registered locally in the country of operations, follow local procedures, and need to pay official fees for registration.

Related Links

You May Also Like

-

GL - Accrued / Unbilled Revenue

Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. Understand what we mean by the terms accrued revenue, accrued assets, and unbilled revenue. Explore the business conditions that require recognition of accrued revenue in the books of accounts and some industries where this practice is prevalent.

-

Shared Services is the centralization of service offering at one part of an organization or group sharing funding and resourcing. The providing department effectively becomes an internal service provider. The key is the idea of 'sharing' within an organization or group.

-

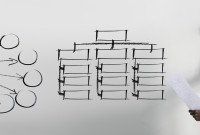

Hierarchical Organization Structures

Hierarchical structure is typical for larger businesses and organizations. It relies on having different levels of authority with a chain of command connecting multiple management levels within the organization. The decision-making process is typically formal and flows from the top down.

-

An account inquiry is a review of any type of financial account, whether it be a depository account or a credit account. In this tutorial, you learn what we mean by drill through functionality in the context of the general ledger system. We will explain the concept of drill-down and how it enables users to perform account and transaction inquiry at a granular level and the benefits of using this functionality.

-

Although technically a general ledger appears to be fairly simple compared to other processes, in large organizations, the general ledger has to provide many functionalities and it becomes considerably large and complex. Modern business organizations are complex, run multiple products and service lines, leveraging a large number of registered legal entities, and have varied reporting needs.

-

In this article we will discuss various types of "Management Entities". Various types of operational units, are created by management, to effectively run, manage and control their business. Different types of functional units, and divisional units, are widely used across industry.

-

Accrued expenses, sometimes referred to as accrued liabilities, are expenses that have been incurred but have not been recorded in the accounts. Discuss the need to record accrued liabilities and why they require an adjustment entry. Understand the treatment for these entries once the accounting period is closed and learn to differentiate when the commitments become liabilities.

-

GL - Unearned / Deferred Revenue

Unearned revenue is a liability to the entity until the revenue is earned. Learn the concept of unearned revenue, also known as deferred revenue. Gain an understanding of business scenarios in which organizations need to park their receipts as unearned. Look at some real-life examples and understand the accounting treatment for unearned revenue. Finally, look at how the concept is treated in the ERPs or automated systems.

-

The purpose of the general ledger is to sort transaction information into meaningful categories and charts of accounts. The general ledger sorts information from the general journal and converts them into account balances and this process converts data into information, necessary to prepare financial statements. This article explains what a general ledger is and some of its major functionalities.

-

There are two commonly used methods of accounting - Cash Basis and the Accruals Basis. Understand the difference between accruals and reversals. Recap the earlier discussion we had on accruals and reversals and see the comparison between these two different but related accounting concepts. Understand how the action of accruing results in reversals subsequently in the accounting cycle.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved