- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Accrued / Unbilled Revenue

GL - Accrued / Unbilled Revenue

Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. Understand what we mean by the terms accrued revenue, accrued assets, and unbilled revenue. Explore the business conditions that require recognition of accrued revenue in the books of accounts and some industries where this practice is prevalent.

What is Accrued Revenue?

Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. Accrued revenue is treated as an asset on the balance sheet rather than a liability. Accrued revenue refers to revenue that has been incurred but not yet received. It is a temporary debt to the business that has provided the product or service. Examples of accrued revenue items might be services or products you have provided but that have not yet been billed or paid for. This outstanding amount is usually displayed under the label of current assets on the company balance sheet. Accrued revenue becomes unbilled revenue once recognized as unbilled revenue is the revenue that had been recognized but which had not been billed to the purchaser(s).

The amount of the accrued income will also result in a corresponding increase in the entity’s retained earnings account as the accrued revenue adjusting entry also includes a credit to the revenue account.

Which industries generally use Accrued Revenue?

The service industries account for a large number of accrued revenue transactions, since quite often services are provided over a week, month, or even year, but aren't billed until the job is complete.

In the financial services industry, payment is typically based on a particular action, such as creating an account, transferring funds, notarizing a document, or offering advice. It is very common for some fees to be billed to clients after the services have been completed, so there is a delay between the service and the payment that leads to accrued revenue.

In the case of software companies, they work under fixed-price contracts where the payments are based on different milestones. Where the work has been completed and the milestone has not been yet reached, accrued or unbilled revenue exists. Simply put, this pertains to work completed for which a bill has not yet been issued to clients for example the milestone is the Go Live Date of the system, the code has been developed and work of the software company is over but the client has not yet moved the code to the production system.

Accrued revenue is also significant for the construction industry where ~90% of the work is done on credit and payments which come over a period of time. The Percentage-of-completion method is the preferred method for the construction industry whenever the estimates of costs to complete the work can be reasonably made and are dependable. Besides the construction industry, accrued revenue also plays a big role in the rental industry, where unclaimed bills are grouped under accrued revenue.

Utility revenues, derived primarily by providing utility services to consumers like telephone, electricity, gas pipelines, are recognized when the service is delivered to and received by the customer. Revenues include accruals services delivered but not yet billed to customers based on estimates of deliveries (accrued unbilled revenues).

Examples of Accrued Revenues:

- An example of accrued revenue is fees for services that an attorney has provided but hasn’t billed to the client at the end of the period. Other examples include unbilled commissions by a travel agent, accrued interest on notes receivable, and accrued rent on property rented to others.

- Another example of an accrued revenue would be for a custom ordered machine that has been shipped FOB shipping point but the approval to bill the customer has not been received by the billing clerk. An adjusting entry would be recorded to recognize the revenue in the correct period. This entry will reverse when the customer is appropriately invoiced.

- In the case of a landscaping company that has performed work on a lawn for half a month; the company may delay the billing to the customer, accruing it until the client can be billed for a full month of work instead. This gives rise to accrued revenue for the unbilled period.

What are some of the benefits of tracking accrued revenue?

Keeping track of accrued revenue is most important in service-industry businesses that often supply products or services before payment is received. Allowing customers to receive products or services and pay for them later can help increase sales by enticing customers who want to get a product or service but may not have the cash on hand. It can also help businesses that deal with large service contracts by allowing the customer to pay for the service gradually. One disadvantage to allowing this type of arrangement is that the business has incurred the cost of the service before it receives money for the service, which can increase the risk of non-payment until the debt is paid.

Accrued revenue figures are most useful when trying to get a fair valuation of the business, as it can help raise the value of a business that has made sales that have not been paid for. This reporting is very important to the valuation of a company, where billing typically occurs after the work or service is complete. Without this asset class on financial reports, the service companies could appear to have much lower revenues, and may not have a fair method to balance expenses associated with the accrued revenue. Accrued revenues are assets that unless properly accounted for, will not provide an accurate picture of the balance sheet for a business in the case of these industries.

What is the accounting treatment for accrued revenue? Is it an established practice?

From an accounting perspective, the practice of accounting for unbilled revenue is an accepted practice, where the nature of the industry demands recording income that is not billed, on an accruals basis.

For example, the software company would carry out work under a contract that specifies payments based on milestone billing dates that fall shortly after accounting periods. In such instances, the firm would include the revenues in the profit & loss account while declaring accounting results, with a corresponding debit to unbilled revenues in the balance sheet, even though the invoice on the client can be raised only at a later date. The unbilled revenue disclosed as a separate line item in the balance sheet by software companies is a monetary asset similar to accounts receivable, except that the right to receive cash may not have been established through billing as on the balance sheet date.

What is the difference between accrued revenue and accounts receivable?

Accrued revenue and debtors are similar as both of them are current assets but they are different financial terms signifying an important business reality. In both cases, a journal entry is closely related, the revenue is earned before the actual cash has been received, and they represent a resource owned by the entity, which will bring a future economic benefit in the near foreseeable future. They are also different in a subtle but significant way

In case of accounts receivable, the customer has already been delivered goods or services and also the invoice specifying the amount due from the customer, hence a credit sale has occurred, there is a contractual obligation on the customer to pay on the due date and a debtor should be recognized in the books as per the accrual concept. However, in the case of accrued unbilled revenue, the customer has been delivered goods or services, either in full or part; however, the invoice for the same, obligating payment from the customer has not been raised yet. On the day of closing the books, there is no obligation on the customer to pay that amount, however, there exists a reasonable certainty that the customer will be billed and such future invoices will be paid in the due course of time under the normal business cycle.

Recognition of this accrued unbilled income adds to the revenue reported in the income statement, and also results in a corresponding asset on the balance sheet. Future cash collection reduces this asset created in the balance sheet but doesn’t affect accrued revenue recognized in the income statement.

Related Links

You May Also Like

-

The general ledger is the central repository of all accounting information in an automated accounting world. Summarized data from various sub-ledgers are posted to GL that eventually helps in the creation of financial reports. Read more to understand the role and benefits of an effective general ledger system in automated accounting systems and ERPs.

-

What Is a General Ledger? General Ledger (also known in accounting as the GL or the Nominal Ledger) is at the heart of any accounting system. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. Ledger is the skillful grouping and presentation of the Journal entries. Learn the accounting fundamentals, general ledger process, and general ledger flow.

-

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

-

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

-

Global Business Services (GBS) Model

Global business services (GBS) is an integrated, scalable, and mature version of the shared services model. Global Business Services Model is a result of shared services maturing and evolving on a global scale. It is represented by the growth and maturity of the Shared services to better service the global corporations they support.

-

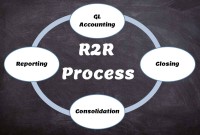

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

-

GL - Recurring Journal Entries

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

-

In this article, we will describe how to determine if an account needs adjustment entries due to the application of the matching concept. Learners will get a thorough understanding of the adjustment process and the nature of the adjustment entries. We will discuss the four types of adjustments resulting from unearned revenue, prepaid expenses, accrued expenses, and accrued revenue.

-

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

-

An organizational design is the process by which a company defines and manages elements of structure so that an organization can control the activities necessary to achieve its goals. Good organizational structure and design helps improve communication, increase productivity, and inspire innovation. Organizational structure is the formal system of task and activity relationships to clearly define how people coordinate their actions and use resources to achieve organizational goals.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved