- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- The Subsidiary Ledgers

The Subsidiary Ledgers

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

What are Subsidiary Ledgers?

In the previous articles, we have learned that journals present a chronological listing of a company's daily transactions, which are then posted to General Ledger. The general ledger of a business is the place where all account information is posted and a balance is maintained for each account. Based on the order of the Chart of Accounts, the general ledger contains accounts organized by assets, liabilities, shareholders' equity, revenue, and expenses. For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger.

Subsidiary ledgers are often used in addition to a general ledger, to focus on particular areas of interest and capture additional and granular details pertaining to that particular area and reduce the need for excessive details in the general ledger. General ledger accounts with a large volume of repetitive transactions or multiple transaction sources often warrant subsidiary ledgers. All the day to day financial information for such accounts is first posted in Subsidiary Leaders and at a periodic interval, subsidiary ledger information is summarized in the corresponding control account of the general ledger. In each subsidiary ledger, subaccount balances are maintained for the various sources contributing transactions to the account, and each source has its own sub-account level balance.

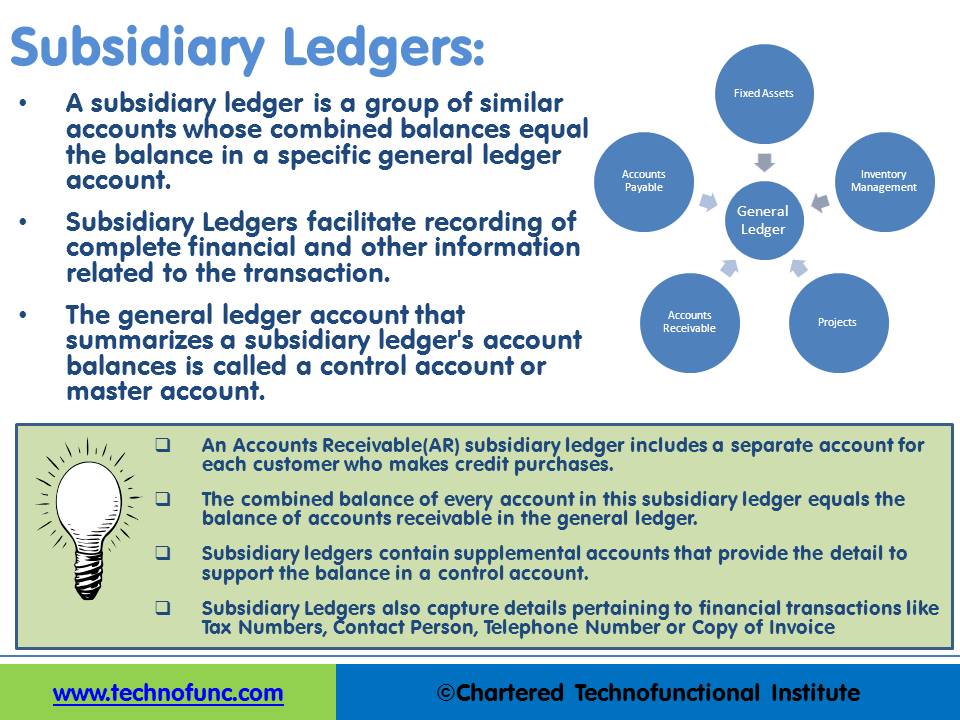

Balances in General Ledger are supported by various sub-ledgers. A subsidiary ledger is a group of similar accounts whose combined balances equal the balance in a specific general ledger account. Subsidiary Ledgers facilitate the recording of complete financial and other information related to the transaction.

What is the Need for Subsidiary Ledgers?

Consider any one account in a general ledger, such as Accounts Payable. Perhaps you want to know how much money you currently owe to each of your suppliers and this information is very critical for you to manage your relationship with that supplier and to ensure that you are paying only for what you purchased and received. If you only have one or two suppliers, it is easily possible to compile this information directly in the general ledger by opening two natural accounts in the name of the suppliers. But what if you have hundreds or even thousands of suppliers? In that case, you may want to create subsidiary ledgers for accounts payable that will capture the complete master and transactional level details for each of your suppliers. This way, you can record the details of transactions involving each supplier in the relevant subsidiary ledger and then subsequently transfer the totals into a control account in the general ledger.

Let’s also understand the concept of Subsidiary Ledger by having a look at the Accounts Receivable Process. We have an “Accounts Receivable” (AR) subsidiary ledger that includes a separate account for each customer who makes credit purchases. The combined balance of every account in this AR subsidiary ledger equals the balance of “Accounts Receivable Account” in the general ledger. “Accounts Receivable Account” is also known as “Customer Receivable Control Account”. Subsidiary ledgers contain supplemental accounts that provide the detail to support the summary balance in a control account. Subsidiary Ledgers also capture details pertaining to financial transactions like “Tax Numbers”, “Contact Person”, “Telephone Number” or “Copy of Invoice”. In IT; subsidiary ledgers are also called Modules in the accounting system.

To give you another example; In the Fixed Assets Subsidiary Ledger, you can find all the details pertaining to fixed assets owned by the company. Apart from the financial details like cost of the assets, other information like date of purchase, date when the asset was put to use in business, name of the supplier, storage and location of the asset etcetera are also captured in subsidiary ledgers.

What is Control Account in General Ledger?

Each subsidiary ledger has a corresponding control account in the general ledger. The general ledger account that summarizes a subsidiary ledger's account balances is called a Control Account or master account. Accounting transactions are captured in General Ledger at a summarized level and all relevant details for that transaction are available in the subsidiary ledgers.

For example, accounts receivable is the controlling account in the general ledger for the accounts receivable subsidiary ledger. While the subsidiary ledger displays the detailed data by the customer, the control account summarizes that data by the account that reflects the summation of balances for all customers captured in the respective subsidiary ledger. After entering the transactional information pertaining to customers and credit sales in the AR Subsidiary Ledger, totals are subsequently entered into the control account in the general ledger. The total balance information must be the same in both forms, so each general ledger control account balance is checked against the combined balances of the individual accounts in its subsidiary ledger at the end of the accounting period.

For any given business account, the level of detail needed varies. Therefore, some general ledger accounts will not need subsidiary ledgers. Those with no corresponding subsidiary ledgers are not referred to as control accounts.

What are the Advantages of Subsidiary Ledgers?

Subsidiary ledgers have a number of efficiency benefits. They show up-to-date information on individual account balances, freeing the general ledger of the need for excessive detail. And just as with special journals, subsidiary ledgers allow simultaneous processing of general ledgers.

It enables you to keep track of your due to and due from with each of your external parties or transaction sources, which helps you assess your financial situation with each of your customers and suppliers – for example, how much money you owe to them.

Apart from just capturing the financial information that has an economic impact you can easily capture additional information in your subsidiary leaders. For example, you can capture the credit rating, payment terms, contact information, birthday, etc. against each of your customers.

Using an accounts payable subsidiary ledger, organized alphabetically by the supplier, puts individual account balance information at your fingertips. The same holds true for accounts receivable and customers.

Some of the commonly used subsidiary ledgers are “Fixed Assets”, “Accounts Payable”, Accounts Receivable”, “Projects” and “Inventory” and they all send the financial data to General Ledger.

Related Links

You May Also Like

-

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

-

Matrix Organizational Structures

In recent times the two types of organization structures which have evolved are the matrix organization and the network organization. Rigid departmentalization is being complemented by the use of teams that cross over traditional departmental lines.

-

General Ledger - Advanced Features

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

-

GL - Accrued / Unbilled Revenue

Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. Understand what we mean by the terms accrued revenue, accrued assets, and unbilled revenue. Explore the business conditions that require recognition of accrued revenue in the books of accounts and some industries where this practice is prevalent.

-

Horizontal or Flat Organizational Structures

Flat organizational structure is an organizational model with relatively few or no levels of middle management between the executives and the frontline employees. Its goal is to have as little hierarchy as possible between management and staff level employees. In a flat organizational structure, employees have increased involvement in the decision-making process.

-

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

-

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

-

What is Accounting & Book Keeping

Accounting is a process designed to capture the economic impact of everyday transactions. Each day, many events and activities occur in an entity, these events and activities are in the normal course of business; however, each of these events may or may not have an economic impact. Events or activities that have an effect on the accounting equation are accounting events.

-

Prepayments and Prepaid Expenses

Prepayments are the payment of a bill, operating expense, or non-operating expense that settle an account before it becomes due. Learn the concept of prepaid expenses. Understand the accounting treatment for prepaid expenses. Understand the concept by looking at some practical examples and finally learn the adjusting entry for these expenses.

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved