- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- What is Accounting & Book Keeping

What is Accounting & Book Keeping

Accounting is a process designed to capture the economic impact of everyday transactions. Each day, many events and activities occur in an entity, these events and activities are in the normal course of business; however, each of these events may or may not have an economic impact. Events or activities that have an effect on the accounting equation are accounting events.

What is accounting?

Accounting is the process of transforming the financial information associated with economic activity into usable financial information. Accounting is the art of recording, summarizing, reporting, and analyzing financial transactions. An accounting system can be a simple, utilitarian check register, or, as with modern automated enterprise resource planning systems, it can be a complete record of all the activities of a business, providing details of every aspect of the business, allowing the analysis of business trends, and providing insight into future prospects.

The American Institute of Certified Public Accountants (AICPA)

Accountancy is "the art of recording, classifying, and summarizing in a significant manner and in terms of money, transactions, and events which are, in part at least, of financial character, and interpreting the results thereof."

The outcome of the accounting process is a group of financial statements that reflect an organization's financial position, liquidity, and profitability. Periodically, financial statements are prepared to reveal the financial position and the results of operations. These financial statements are the output of the accounting process and become an input into the analysis and decision-making activities of business owners, investors, managers, creditors, and government regulators.

These financial statements or reports are shared with the stakeholders (interested parties) who analyze, interpret, and use this accounting information for their own purposes. This information helps the users with their analysis and decision making for various objectives like investment or understanding and improving the current business. Automated accounting is an information system that provides reports to stakeholders about the economic activities and conditions of a business.

The etymology of Word Accountant:

The word "Accountant" is derived from the French word Compter, which took its origin from the Latin word Computer. The word was formerly written in English as "Accomptant", but in process of time the word, which was always pronounced by dropping the "p", became gradually changed both in pronunciation and in orthography to its present form as “Accountant”

What is the role of accounting in business?

As discussed earlier, accounting provides information for managers to use in operating the business effectively and efficiently. In addition, accounting provides information to other stakeholders to use in assessing the economic performance and condition of the business. Accounting is generally referred to as the “language of business.” This is because accounting is the means by which business information is communicated to the stakeholders.

For example, accounting reports summarizing the profitability of a new product help management decide whether to continue selling the product. Likewise, financial analysts use accounting reports in deciding whether to recommend the purchase of the Company’s stock. Banks use accounting reports in determining the amount of credit to extend to the company and suppliers on the other hand use accounting reports in deciding whether to offer credit to the company for purchases of supplies and raw materials. Governments and other statutory bodies use accounting reports to calculate and assess taxes appropriately.

Role of Accounting Department:

The accounting job is typically done by the Accounting Department, led by an accounting manager, controller, comptroller, or similar title. These folks record all the transactions that occur as the company does its business and then prepare reports that help the company management, and outside constituencies understand the financial impact of those transactions.

The accountants maintain the accounting software, process all the documentation pertaining to transactions that have occurred and record them into the company's general ledger. From all these transaction records the accountants are able to prepare a variety of reports. Some are for people outside the company, like the government, bankers, investors, and stockholders and others are the reports that are important for running the company efficiently. Accountants prepare financial reports that managers use to understand their company’s financial past and make decisions about its financial future. Automated accounting programs typically produce a variety of reports and we'll discuss these reports in-depth in later sub-sections that pertain to the general ledger.

What is bookkeeping?

Bookkeeping is the practice of recording transactions. Bookkeepers tend to focus on the details, recording transactions in an efficient and organized manner, and they may or may not see the overall picture. Accountants use the work done by bookkeepers to produce and analyze financial reports. Although accounting follows the same principles and rules as bookkeeping, accounting converts them into meaningful financial information that captures all of the details necessary to satisfy the needs of the business — managerial, financial reporting, projection, analysis, and tax reporting. Effective accounting practices across a company will create a system of financial reporting that gives a complete picture of the business.

Related Links

You May Also Like

-

GL - Journal Posting and Balances

In this tutorial, we will explain what we mean by the posting process and what are the major differences between the posting process in the manual accounting system compared to the automated accounting systems and ERPs. This article also explains how posting also happens in subsidiary ledgers and subsequently that information is again posted to the general ledger.

-

Different Types of Organizational Structures

Modern business organizations run multiple product and service lines, operate globally, leverage large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders.

-

Defining Organizational Hierarchies

A hierarchy is an ordered series of related objects. You can relate hierarchy with “pyramid” - where each step of the pyramid is subordinate to the one above it. One can use drill up or down to perform multi-dimensional analysis with a hierarchy. Multi-dimensional analysis uses dimension objects organized in a meaningful order and allows users to observe data from various viewpoints.

-

GL - Different Type of Journals

Two basic types of journals exist: general and special. In this article, the learner will understand the meaning of journalizing and the steps required to create a journal entry. This article will also discuss the types of journals and will help you understand general journals & special journals. In the end, we will explain the impact of automated ERPs on the Journalizing Process.

-

Network Organizational Structures

The newest, and most divergent, team structure is commonly known as a Network Structure (also called "lean" structure) has central, core functions that operate the strategic business. It outsources or subcontracts non-core functions. When an organization needs to control other organizations or agencies whose participation is essential to the success, a network structure is organized.

-

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

-

McKinsey 7S Framework is most often used as an organizational analysis tool to assess and monitor changes in the internal situation of an organization. The model is based on the theory that, for an organization to perform well, seven elements need to be aligned and mutually reinforcing.

-

In this article we will focus on and understand the accounting process which enables the accounting system to provide the necessary information to business stakeholders. We will deep dive into each of the steps of accounting and will understand how to identify accounting transactions and the process for recording accounting information and transactions.

-

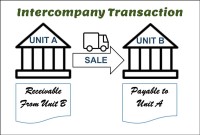

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

General Ledger - Advanced Features

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved