- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- General Ledger Overview

General Ledger Overview

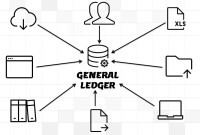

What Is a General Ledger? General Ledger (also known in accounting as the GL or the Nominal Ledger) is at the heart of any accounting system. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. Ledger is the skillful grouping and presentation of the Journal entries. Learn the accounting fundamentals, general ledger process, and general ledger flow.

What is accounting?

Accounting is a process designed to capture the economic impact of everyday transactions. Each day, many events and activities occur in an entity, these events and activities are in the normal course of business; however, each of these events may or may not have an economic impact. Events or activities that have an effect on the accounting equation are accounting events. The accounting equation is the basis for all accounting systems. Nowadays most of the accounting is automated using sub-ledger and general ledger systems.

The Accounting Process:

The accounting process enables the accounting system to capture accounting data and provide the necessary information to business stakeholders. Given below are the five steps in the accounting process:

- Step1: Identifying Business Stakeholders

- Step2: Understanding Accounting Needs

- Step3: Identifying Accounting Transactions

- Step4: Recording Transactions

- Step5: Preparing Accounting Reports

Generally Accepted Accounting Principles (GAAP):

Generally Accepted Accounting Principles define the accounting procedures, and understanding them is essential to producing accurate and meaningful records. Given below are the fundamental accounting principles:

- GAAP1: The Business Entity Principle

- GAAP2: The Cost Principle

- GAAP3: The Objectivity Principle

- GAAP4: The Unit of Measure Principle

- GAAP5: The Going-Concern Principle

Accounting Systems: Single Entry and Double Entry:

There are two common systems of bookkeeping single entry and double-entry accounting systems. The first – single entry – is simplistic, recording each transaction only once, either as revenue or as an expense. Double-entry bookkeeping has become the standard, and is the preferred way of accounting, as it allows businesses to track both the sources and application of money.

Accounting Methods: Cash V/s Accrual:

Two types of accounting methods are commonly used to record business transactions know as cash accounting and accrual accounting. Under the cash accounting method, revenue is recognized and recorded when the cash is received and expenses are recognized and recorded when the cash payments are made. Under the accrual method of accounting, revenue and expenses are recognized and recorded, when the product or service is actually sold to customers or received from suppliers, generally before they're paid for.

The Accounting Equation:

The following equation shows the relationship among assets, liabilities, and owner’s equity:

- Assets = Liabilities + Owner’s Equity

- Assets = Liabilities + Owner’s Equity + Revenues - Expenses

What do we mean by Journalizing?

Using the rules of debit and credit, transactions are initially entered in a record called a journal. In this way, the journal serves as a record of when transactions occurred and were recorded. The process of recording a transaction in the journal is called journalizing. The entry in the journal is called a journal entry.

What is General Ledger?

Transactions are first recorded in the general journal and then transferred, or posted, to the ledger, which stores all the charts of accounts of a business. An account is defined as an accounting record that reflects the increases and decreases in a single asset, liability, or owner's equity item (The Accounting Equation!!). In addition, the ledger shows the balance of each account that helps the user understand the final effects of the transactions.

While journals present a chronological listing of a company's daily transactions, ledgers are organized by account. As a result, financial statements such as Balance Sheets and Income Statements can only be generated from the general ledger not directly from the journals.

Automated General Ledgers

In order for people inside and outside an organization to use financial data, transaction information is organized by the account in ledgers. A general ledger is the main accounting record of a business. Originally a paper document, a ledger is now more likely to be an electronic document containing summarized financial data and balances for all the accounts of an organization.

In automated systems like ERPs, General Ledger is the central repository for all transactions that get recorded in various supplemental books, which are known as modules or sub-ledgers. Examples of supplemental books in traditional accounting are sales books for sales, purchase books for purchases, cash and bank book for cash related transactions and general journals book to capture adjustment entries. In “Automated Accounting Packages” these supplemental transactions are recorded in modules like Accounts Payables, Accounts Receivables, Purchase, or Inventory.

Accounting Cycle:

Accounting Cycle is the collective and repetitive process of recording and processing the accounting events of a company in different accounting periods. The series of steps begin when a business transaction occurs and end with the period closure where the cycle is again repeated. The steps in the accounting cycle are:

- Step1: Identifying Business Stakeholders

- Step2: Understanding Accounting Needs

- Step3: Identifying Accounting Transactions

- Step4: Recording Transactions

- Step5: Preparing Accounting Reports

General Ledger Process Flow:

GL process flow is a five-step process from recording the transactions in the system to finally running the reports containing financial data out of the system. The input for GL Process Flow is the raw accounting data and the output is the accounting reports that can be used to provide various levels of financial information. The steps in the general ledger process flow are:

- Step1. Create Journal or Import Journal from Sub‐Ledger

- Step2: Review Journals

- Step3: Approve Journals

- Step4: Journals Posting

- Step5: Run Financial Reports

Drilldown from General Ledger to Upstream Systems:

In the advances general ledger systems, users can drill down to sub-ledgers details from General Ledger and can get all of the transaction details that comprise an account balance, regardless of which sub-ledger originated the transaction. This functionality helps in analyzing any account balance by understanding the source of the transaction and viewing additional information that has been captured in the source system and not imported into the general ledger system.

Related Links

You May Also Like

-

Introduction to Organizational Structures

Organizations are systems of some interacting components. Levitt (1965) sets out a basic framework for understanding organizations. This framework emphasizes four major internal components such as: task, people, technology, and structure. The task of the organization is its mission, purpose or goal for existence. The people are the human resources of the organization.

-

Understand what we mean by GAAP to STAT adjustments. This article discusses the different standards that are used for multiple representations of the financial results for global organizations. Understand the meaning of US GAAP, Local GAAP, STAT, IFRS, and STAT. Finally, understand why accounting differences arise and how they are adjusted for different financial representations.

-

Operational Structures in Business

Large organizations grow through subsidiaries, joint ventures, multiple divisions and departments along with mergers and acquisitions. Leaders of these organizations typically want to analyze the business based on operational structures such as industries, functions, consumers, or product lines.

-

Network Organizational Structures

The newest, and most divergent, team structure is commonly known as a Network Structure (also called "lean" structure) has central, core functions that operate the strategic business. It outsources or subcontracts non-core functions. When an organization needs to control other organizations or agencies whose participation is essential to the success, a network structure is organized.

-

Shared Services is the centralization of service offering at one part of an organization or group sharing funding and resourcing. The providing department effectively becomes an internal service provider. The key is the idea of 'sharing' within an organization or group.

-

Functional Organizational Structures

A functional organizational structure is a structure that consists of activities such as coordination, supervision and task allocation. The organizational structure determines how the organization performs or operates. The term organizational structure refers to how the people in an organization are grouped and to whom they report.

-

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

-

Hierarchical Organization Structures

Hierarchical structure is typical for larger businesses and organizations. It relies on having different levels of authority with a chain of command connecting multiple management levels within the organization. The decision-making process is typically formal and flows from the top down.

-

Learn the typical accounting cycle that takes place in an automated accounting system. We will understand the perquisites for commencing the accounting cycle and the series of steps required to record transactions and convert them into financial reports. This accounting cycle is the standard repetitive process that is undertaken to record and report accounting.

-

GL - Understanding Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved