- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Understanding Chart of Accounts

GL - Understanding Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

What is a Chart of Accounts?

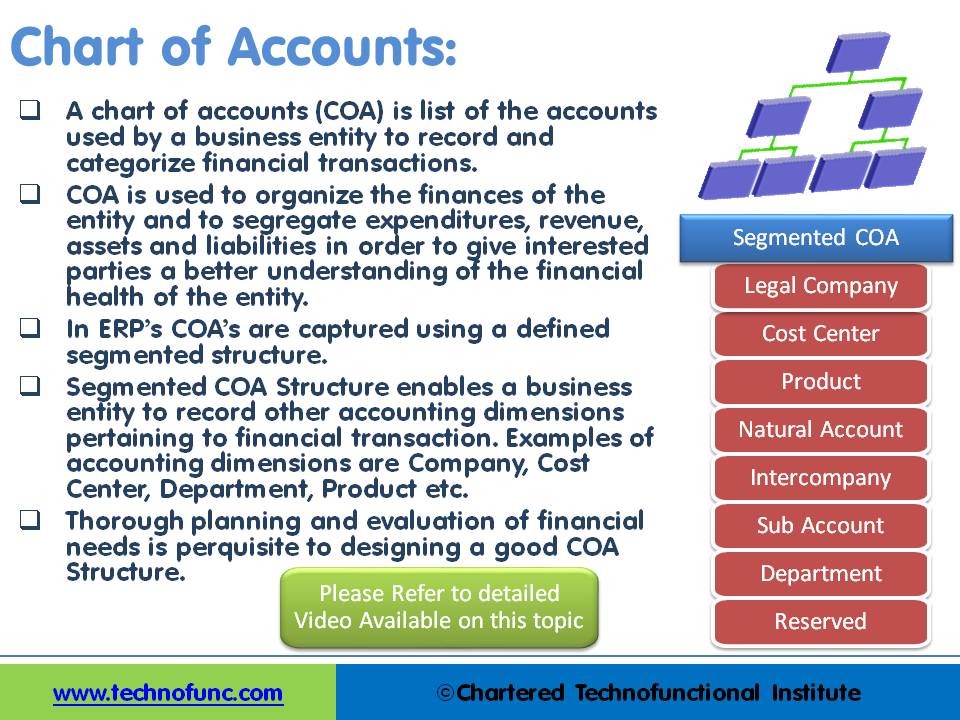

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA is used to organize the finances of the entity and to segregate expenditures, revenue, assets, and liabilities in order to give interested parties a better understanding of the financial health of the entity.

The chart of accounts is a list of all the accounts and their numbers contained in the general ledger. The accounts are listed in the order of assets, liabilities, owner's equity, revenue, and expenses. Transactions can be posted to each defined account in COA and it can capture balances in the general ledger chart of accounts is a way to outline the accounting system of a business, the chart of accounts establishes how the business will operate, what information will be captured, and what information will subsequently be readily retrievable by the system for reporting and other needs.

Is Chart of Accounts worth discussing? Does it really matter?

Have you ever wondered after hearing such phrases from accountants like "It's not in the chart of accounts. We don't know how to enter your transaction" or "We can't process your invoice without an account number." In the case of new general ledger implementations, nothing moves forward unless the chart of account has been finalized.

While to many non-financial managers and also to new IT implementers increased focus on the chart of accounts seems unwarranted and it appears that the client is unnecessarily slowing down the project by discussing chart of accounts too much. That's not really their purpose—and everyone who has worked in an IT project involving general ledger knows that this structure needs to be finalized first before other discussions can start and that too because it has a serious impact on the entire general ledger design.

Why we need a Chart of Accounts?

The entire recording process of any accounting system requires a basic organization of data so that the accounting data can be clubbed into meaningful accounts and represented in a way useful for the users and stakeholders. For example – purchases on credit from vendors through invoices can be later summarized and reported with some clarity as to what was purchased, why it was purchased, what organization(s) benefited from those expenditures, and what is the unpaid liability on account of all those purchases. That basic organization is called a chart of accounts.

You might think of the organizing system for your company's accounting data as a collection of buckets, or accounts, each with a particular kind of data inside. There might be a bucket for each ledger account names and associated numbers used by a company, arranged in the order in which they normally appear in financial statements—Assets, Liabilities, Owners' Equity or Stockholders' Equity, Revenue, and Expenses.

For management analysis, there will also be a bucket for each product or service the company sells and one for each type of department or cost center where those expenses might incur as it sells its products or services. The chart of accounts is an organized, comprehensive list of all those buckets. The buckets, in turn, are labeled with their appropriate account number and arranged by the kind of data they hold, so that accountants can quickly find the right bucket in which to store the latest piece of data about a particular accounting transaction. These buckets are then arranged and rearranged during the accounting process and their contents are counted and checked to produce reports that summarize the data they contain.

Purpose of Chart of Accounts:

General Ledger is used to recording and store each individual account and their transactions. The Chart of Accounts is the basis of any accounting system. The purpose of the Chart of Accounts is to classify each financial transaction and record it with reference to appropriate business dimensions enabling the users to select or extract the financial data through account inquiry screens or reports. Finally enabling reporting on (or enquire about) the sum total of financial transactions at various levels on the chart.

Adding more dimensions to the Chart of Accounts:

In ERP’s COA’s are captured using a defined segmented structure. Segmented COA Structure enables a business entity to record other accounting dimensions pertaining to financial transactions.

Modern organizations are complex generally consisting of many different lines of business; operating in different geographies, dealing in multiple products and services, running different projects, and moving resources and employees across these functions. The "chart of accounts” must reflect these complexities to enable effective management and external reporting. An effective chart of accounts structure can track revenue and expenses appropriately for different business dimensions like departments, geographies, product lines, etc. and can provide accurate analysis for decision making, and for reporting to government agencies, sponsors, and stakeholders.

What is Chart of Accounts Segment?

In automated accounting systems and ERPs, the chart of accounts is made up of and represented as a string of numeric and alphanumeric fields that act as identifiers. The companies define different segments to capture relevant business dimensions along with the natural account associated with the transaction. Companies may define anywhere from one to dozen segments to make up their Chart of Accounts and capture granular level business information associated with the transaction.

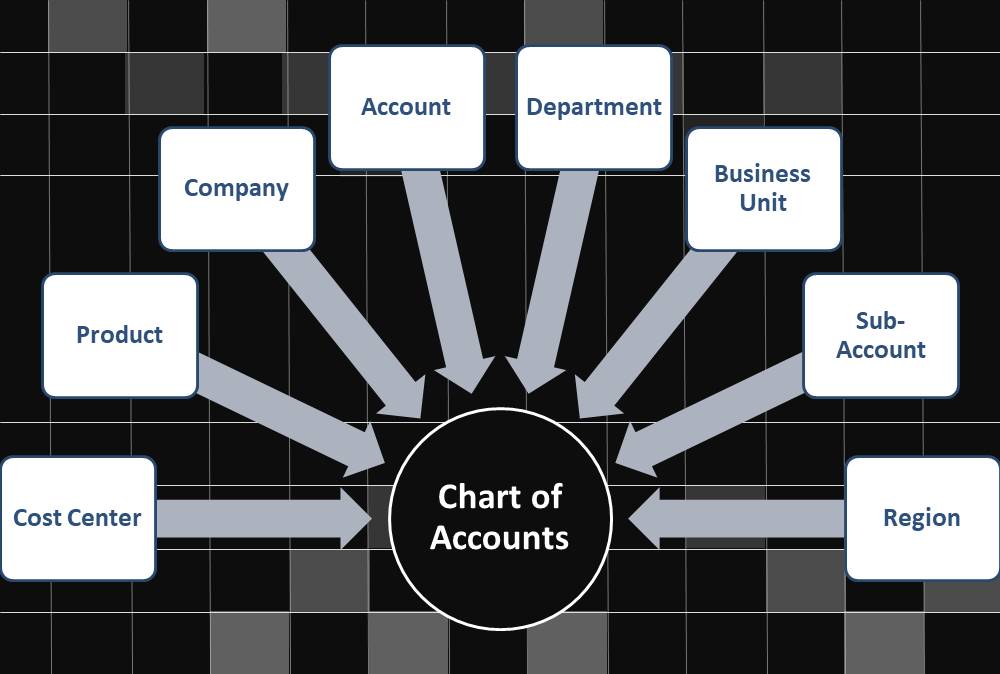

Examples of accounting dimensions are Company, Cost Center, Department, Product, etc. The figure below shows an example of the Segmented Chart of Accounts Structure using some of the commonly used business dimensions.

Thorough planning and evaluation of financial needs is a prerequisite to designing a good COA Structure. We have created a separate tutorial on GL Accounts that helps you understand the concept of Natural Accounts and some key GL Accounts. There is a full tutorial on the understanding of COA in detail and best practices to define an effective COA Structure.

Related Links

You May Also Like

-

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

-

Learn the typical accounting cycle that takes place in an automated accounting system. We will understand the perquisites for commencing the accounting cycle and the series of steps required to record transactions and convert them into financial reports. This accounting cycle is the standard repetitive process that is undertaken to record and report accounting.

-

Matrix Organizational Structures

In recent times the two types of organization structures which have evolved are the matrix organization and the network organization. Rigid departmentalization is being complemented by the use of teams that cross over traditional departmental lines.

-

Although technically a general ledger appears to be fairly simple compared to other processes, in large organizations, the general ledger has to provide many functionalities and it becomes considerably large and complex. Modern business organizations are complex, run multiple products and service lines, leveraging a large number of registered legal entities, and have varied reporting needs.

-

Network Organizational Structures

The newest, and most divergent, team structure is commonly known as a Network Structure (also called "lean" structure) has central, core functions that operate the strategic business. It outsources or subcontracts non-core functions. When an organization needs to control other organizations or agencies whose participation is essential to the success, a network structure is organized.

-

Prepayments and Prepaid Expenses

Prepayments are the payment of a bill, operating expense, or non-operating expense that settle an account before it becomes due. Learn the concept of prepaid expenses. Understand the accounting treatment for prepaid expenses. Understand the concept by looking at some practical examples and finally learn the adjusting entry for these expenses.

-

Shared Services is the centralization of service offering at one part of an organization or group sharing funding and resourcing. The providing department effectively becomes an internal service provider. The key is the idea of 'sharing' within an organization or group.

-

GL - Understanding Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

-

Business Metrics for Management Reporting

Business metric is a quantifiable measure of an organization's behavior, activities, and performance used to access the status of the targeted business process. Traditionally many metrics were finance based, inwardly focusing on the performance of the organization. Businesses can use various metrics available to monitor, evaluate, and improve their performance across any of the focus areas like sales, sourcing, IT or operations.

-

Introduction to Legal Entities Concept

Modern business organizations operate globally and leverage a large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders. Learn more about Legal Entities and their importance for businesses.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved