- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- Complexities in GL System

Complexities in GL System

Although technically a general ledger appears to be fairly simple compared to other processes, in large organizations, the general ledger has to provide many functionalities and it becomes considerably large and complex. Modern business organizations are complex, run multiple products and service lines, leveraging a large number of registered legal entities, and have varied reporting needs.

These complexities create a need for advanced general ledger systems providing new functionalities. Let us understand some drivers for this complexity.

1. Specialized Software

For large organizations, the general ledger is hosted on a computerized system, integrated with multiple sub-ledgers and the legacy general ledgers. For the most part the journal entry is automated and fed into the general ledger through a complex import process. GL is the backbone of any enterprise resource planning (ERP) software and the general ledger stores the transactions into a database that is shared with other processes being managed through the ERP. In such cases a GL provides the following information:

- General ledger chart of accounts

- Administration of general ledger database reporting/consolidation structure

- Preparation and recording of journal entries

- Monitoring of the close process at unit and company levels

- Review and analysis of account and unit-level trial balances

- Preparation of consolidated company trial balance

- Generation and distribution of monthly system financial reports

- Reconciliation of balance sheet accounts and related bank statements

- Preparation of eliminating entries

- Finalization of monthly consolidated statements

- Calculation and consolidation of expense type (selling, general and administrative/cost of sales) information

- Maintenance of corporate/group overhead allocation pools and related rates

- Manual record retention/archiving and audit support specific to general accounting.

2. Multitude of Subsidiary Ledgers

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Consider any one account in a general ledger, such as Accounts Payable. Perhaps you want to know how much money you currently owe to each of your suppliers and this information is very critical for you to manage your relationship with that supplier and to ensure that you are paying only for what you purchased and received. If you only have one or two suppliers, it is easily possible to compile this information directly in the general ledger by opening two natural accounts in the name of the suppliers. But what if you have hundreds or even thousands of suppliers? In that case, you may want to create subsidiary ledgers for accounts payable that will capture the complete master and transactional level details for each of your suppliers. This way, you can record the details of transactions involving each supplier in the relevant subsidiary ledger and then subsequently transfer the totals into a control account in the general ledger.

3. Complex Organizational Structure

Modern business organizations run multiple products and service lines, operate globally, leverage a large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders. These complexities create a need for advanced operational and supporting business processes to drive organization-wide effectiveness, efficiency, and achieve business objectives. This forces companies to create a diverse array of subsidiaries, legal entities, organizations, and accounting processes to ensure a smooth and profitable business flow. Tax considerations also impact how businesses construct these complex legal structures. General Ledger has to be structured in a fashion that it can cater to the reporting needs of every unit, department, and regulatory bodies in this complex structure.

It needs to collect and process data from these multiple units and provide a consolidated view of the enterprise for shareholders and management.

4. Legacy Systems

Mergers & Acquisitions (M&A) is the new normal for large companies, driving innovation and growth. The capability to successfully integrate or divest businesses is a major source of competitive advantage. There is a lack of flexibility to integrate mergers and acquisitions. All these corporate actions bring added complexity from a general ledger standpoint. Legacy data need to be transferred to the organizational chart of accounts system and accounting policies. Systems need to be established to collect and transform such data on an ongoing basis until the migration to the enterprise general ledger is done.

5. Multiple Charts of Accounts

In these large corporations, different business units within the company have different COAs and different reporting priorities and the standard reports don’t produce the information the organization needs to properly run the business or meet tax and/or regulatory needs. Complexity arises also because of accounts that are not used consistently across the organization, reducing the effectiveness of reporting and consolidation.

6. FX and Complex Currency Requirements

For international businesses with significant volumes of cross-border transactions, the management of currency risk is an essential task for the treasury department. There are businesses with varied and very complex FX management needs, either because they have higher transaction volumes or because they work with a larger number of currencies. In these cases, their General Ledger becomes very complex as it needs to manage various processes like multi-currency recording, translation, conversion, and revaluation. Some businesses also do FX leveling and sweep to manage the hedging risks.

7. Changing Regulatory Landscape

The global regulatory landscape is undergoing a fundamental change. In the years since the 2007/08 financial crisis, regulators across the globe have focused on a program of more robust supervision of financial services firms. The increasing weight of new regulatory legislation from regulators, coupled with the increasingly diverse risks to which firms are exposed, means that firms need to ensure that their general ledgers are updated and flexible enough to provide the data needed for these changing participants are required to adapt and evolve to address the regulatory and technological changes.

Related Links

You May Also Like

-

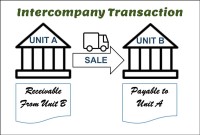

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

Team-Based Organizational Structure

Team-based structure is a relatively new structure that opposes the traditional hierarchical structure and it slowly gaining acceptance in the corporate world. In such a structure, employees come together as team in order to fulfill their tasks that serve a common goal.

-

There are five types of core accounts to capture any accounting transaction. Apart from these fundamental accounts, some other special-purpose accounts are used to ensure the integrity of financial transactions. Some examples of such accounts are clearing accounts, suspense accounts, contra accounts, and intercompany accounts. Understand the importance and usage of these accounts.

-

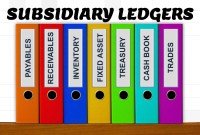

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

-

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

-

In this article, we explain some commonly used subsidiary ledgers like accounts receivable subsidiary ledger, accounts payable subsidiary ledger or creditors' subsidiary ledger, inventory subsidiary ledger, fixed assets subsidiary ledger, projects subsidiary ledger, work in progress subsidiary ledger, and cash receipts or payments subsidiary ledger.

-

What is a Business Eco System?

The goal of a business is to generate capital appreciation and profits for its owners or stakeholders by engaging in provision of goods and services to customers within the eco system/framework governed by respective laws(local/international). The eco system involves various entities that the business works with for delivery of a product or service.

-

An allocation is a process of shifting overhead costs to cost objects, using a rational basis of allotment. Understand what is the meaning of allocation in the accounting context and how defining mass allocations simplifies the process of allocating overheads to various accounting segments. Explore types of allocations and see some practical examples of mass allocations in real business situations.

-

McKinsey 7S Framework is most often used as an organizational analysis tool to assess and monitor changes in the internal situation of an organization. The model is based on the theory that, for an organization to perform well, seven elements need to be aligned and mutually reinforcing.

-

Different Types of Organizational Structures

Modern business organizations run multiple product and service lines, operate globally, leverage large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved