- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- Concept of Representative Office

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature. As its name says, a representative office represents its foreign parent in the country of operations.

A representative office is an office established by a company to conduct marketing and other non-transactional operations, generally in a foreign country where a branch office or subsidiary is not warranted. A representative office cannot regularly buy and sell goods or offer services. Representative offices are generally easier to establish than a branch or subsidiary, as they are not used for actual "business" (e.g. sales) and therefore there is less incentive for them to be regulated.

A representative office is a more tentative step into the foreign market, often used by investors to test the waters or for promotional purposes when the business distributes its goods by other means. A representative office is most appropriate in the early stages of corporation’s business presence in a foreign country. They have been used extensively by foreign investors in emerging markets such as China, India and Vietnam although they do have restrictions through not being able to invoice locally for goods or services.

Main Features:

- Representative office to engage only in activities which do not amount to, or form part of, the carrying on of the relevant business in foreign country.

- Having a nominated person employed by a local affiliate to handle enquiries could fall into this category.

- The representative office can contact customers and enter into contracts on behalf of its foreign parent, but can’t sell the goods itself.

- Representative Offices tend to be utilized by foreign investors in fields such as sourcing of products, quality control, and general liaison activities between the Head Office and the Representative Offices overseas.

- Corporations should periodically review the suitability of the structure and its activities to make sure that the company is not triggering a taxable presence in the foreign land by exceeding the permissible activities.

ICICI Bank, India's second largest bank, opened representatives offices in three east-Asian countries Thailand, Indonesia and Malaysia". The branches are expected to enable the bank to increase its participation in India's trade transactions in the region. It also has a representative office in the US.

Related Links

You May Also Like

-

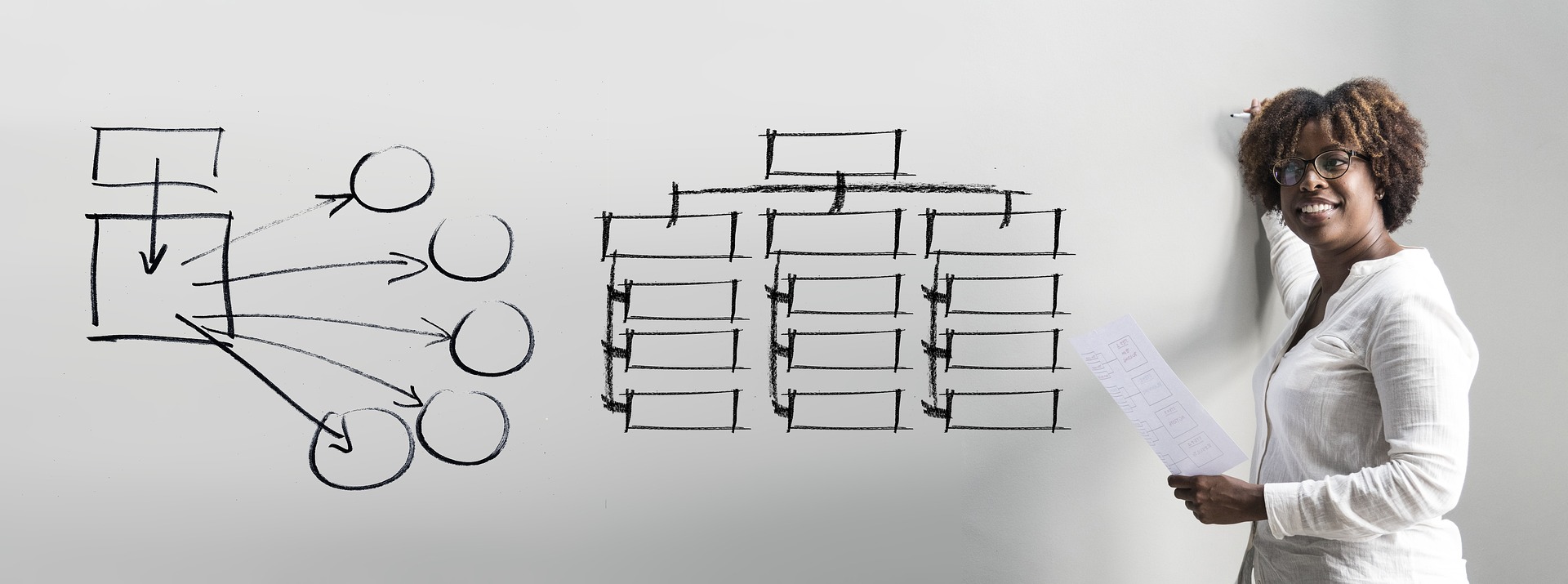

In this article we will discuss various types of "Management Entities". Various types of operational units, are created by management, to effectively run, manage and control their business. Different types of functional units, and divisional units, are widely used across industry.

-

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

-

Global Business Services (GBS) Model

Global business services (GBS) is an integrated, scalable, and mature version of the shared services model. Global Business Services Model is a result of shared services maturing and evolving on a global scale. It is represented by the growth and maturity of the Shared services to better service the global corporations they support.

-

A legal entity is an artificial person having separate legal standing in the eyes of law. A Legal entity represents a legal company for which you prepare fiscal or tax reports. A legal entity is any company or organization that has legal rights and responsibilities, including tax filings.

-

The sole trader organization (also called proprietorship) is the oldest form of organization and the most common form of organization for small businesses even today. In a proprietorship the enterprise is owned and controlled only by one person. This form is one of the most popular forms because of the advantages it offers. It is the simplest and easiest to form.

-

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

-

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

-

Trial Balance in General Ledger

One of the greatest benefits of using a double-entry accounting system is the capability to generate a trial balance. What do we mean by trial balance? As the name suggests a trial balance is a report that must have its debits equals to credits. Understand the importance of trial balance and why it is balanced. Learn how it is prepared and in which format.

-

There are two commonly used methods of accounting - Cash Basis and the Accruals Basis. Understand the difference between accruals and reversals. Recap the earlier discussion we had on accruals and reversals and see the comparison between these two different but related accounting concepts. Understand how the action of accruing results in reversals subsequently in the accounting cycle.

-

Internally, an organization can be structured in many different ways, depending on their objectives. The internal structure of an organization will determine the modes in which it operates and performs. Organizational structure allows the expressed allocation of responsibilities for different functions and processes to different entities such as the branch, department, workgroup and individual.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved