- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- Concept of Legal Entity

Concept of Legal Entity

A legal entity is an artificial person having separate legal standing in the eyes of law. A Legal entity represents a legal company for which you prepare fiscal or tax reports. A legal entity is any company or organization that has legal rights and responsibilities, including tax filings.

One of the most frequently used terms in the world of compliance and governance is that of the legal entity. But what is the meaning of a legal entity, and why is it so important for finance, compliance, legal and operational professional?

As explained before, A business is entitled enter into commercial transactions due to its charter in the legal system. Commercial groups exist through corporate law. Units in the legal structure of a group are individual companies that share common ownership and control. In a public group, a company is owned by the public through shares sold on a stock market. In a private group, they are held by a privately held holding company. In other organizations, the legal entities are partnerships, funds, or government agencies. A legally recognized entity can own and trade assets and employ people; while an entity without legal recognition cannot. When granted these privileges, legal entities are also assigned responsibilities to account for themselves to the public (statutory reporting and external reporting), comply with legislation and regulations, and pay income or transaction taxes.

What Is a Legal Entity?

A legal entity is an artificial person having separate legal standing in the eyes of law. A Legal entity represents a legal company for which you prepare fiscal or tax reports. A legal entity is any company or organization that has legal rights and responsibilities, including tax filings. It is a business that can enter into contracts either as a vendor or a supplier and can sue or be sued in a court of law. A legal entity can enter into contracts and assume the obligations of those contracts, can borrow and pay debts, can file suits and be named by other parties in suits, and can be held to account for the results of those lawsuits.

Features of Legal Entities

- Legal Entity is also known as GRE - Government Reporting Entity. Some of the attributes associated with legal entity are:

Structure

- A Legal entity is identified through the registration with Legal Authority.

- You assign tax identifiers and other Legal entity information to legal entity

- Legal Entity possesses separate existence for tax purposes. Legal Entities pay the taxes and therefore need tax registrations.

- Legal entities such as parent companies own or control subsidiaries. A large corporation can own many legal entities as its subsidiaries.

Rights & Obligations

- A legal entity has legal capacity to enter into agreements or contracts, assume obligations, incur and pay debts, sue and be sued in its own right, and to be held responsible for its actions.

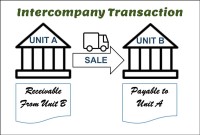

- Trade between Legal Entities belonging to same corporate is intercompany and must be supported by adequate legal documentation.

- Legal Entities own the money and bank accounts

Compliance & Accounting

- Legal Entities comply with whatever needs compliance – The “Legal” in word “Legal Entity”. This includes recording of all relevant transactions and generating all supporting documents required for financial statements.

- Legal Entities file the accounts and take care of accounting. Legal Entity is the organizational unit for Financial Accounting for which a complete self-contained set of accounts needs to be drawn up for purposes of external reporting.

- Accounting Books must balance at Legal Entity level. This is an entity for which you prepare a trial balance.

Summary

Legal entities are structured in a way that allows for a greater degree of protection for strictly personal assets from lawsuits and regulatory penalties. Each type of entity provides a different set of protections and tax burdens. Legal entity codes are not standardized, despite the globalized economic world in which we live, due to the laws and regulations that govern legal entities fluctuate drastically across jurisdictions.

Related Links

You May Also Like

-

Legal Structures for Multinational Companies

A multinational company generally has offices and/or factories in different countries and a centralized head office where they coordinate global management. A multinational company (MNC)is a corporate organization that owns or controls the production of goods or services in at least one country other than its home country.

-

Functional Organizational Structures

A functional organizational structure is a structure that consists of activities such as coordination, supervision and task allocation. The organizational structure determines how the organization performs or operates. The term organizational structure refers to how the people in an organization are grouped and to whom they report.

-

There are five types of core accounts to capture any accounting transaction. Apart from these fundamental accounts, some other special-purpose accounts are used to ensure the integrity of financial transactions. Some examples of such accounts are clearing accounts, suspense accounts, contra accounts, and intercompany accounts. Understand the importance and usage of these accounts.

-

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

Different Types of Organizational Structures

Modern business organizations run multiple product and service lines, operate globally, leverage large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders.

-

There are two commonly used methods of accounting - Cash Basis and the Accruals Basis. Understand the difference between accruals and reversals. Recap the earlier discussion we had on accruals and reversals and see the comparison between these two different but related accounting concepts. Understand how the action of accruing results in reversals subsequently in the accounting cycle.

-

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

-

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

-

When the quantum of business is expected to be moderate and the entrepreneur desires that the risk involved in the operation be shared, he or she may prefer a partnership. A partnership comes into existence when two or more persons agree to share the profits of a business, which they run together.

-

In some of the ERP tools, there are more than 12 accounting periods in a financial year. This article discusses the concept of accounting calendar and accounting periods. Learn why different companies have different accounting periods. Understand some of the commonly used periods across different organizations and the definition & use of an adjustment period.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved