- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

Float

To understand cash management, one must understand FLOAT. Float is the most critical component in Cash Management. Learn about cash float in this article.

Float is the most critical component in Cash Management

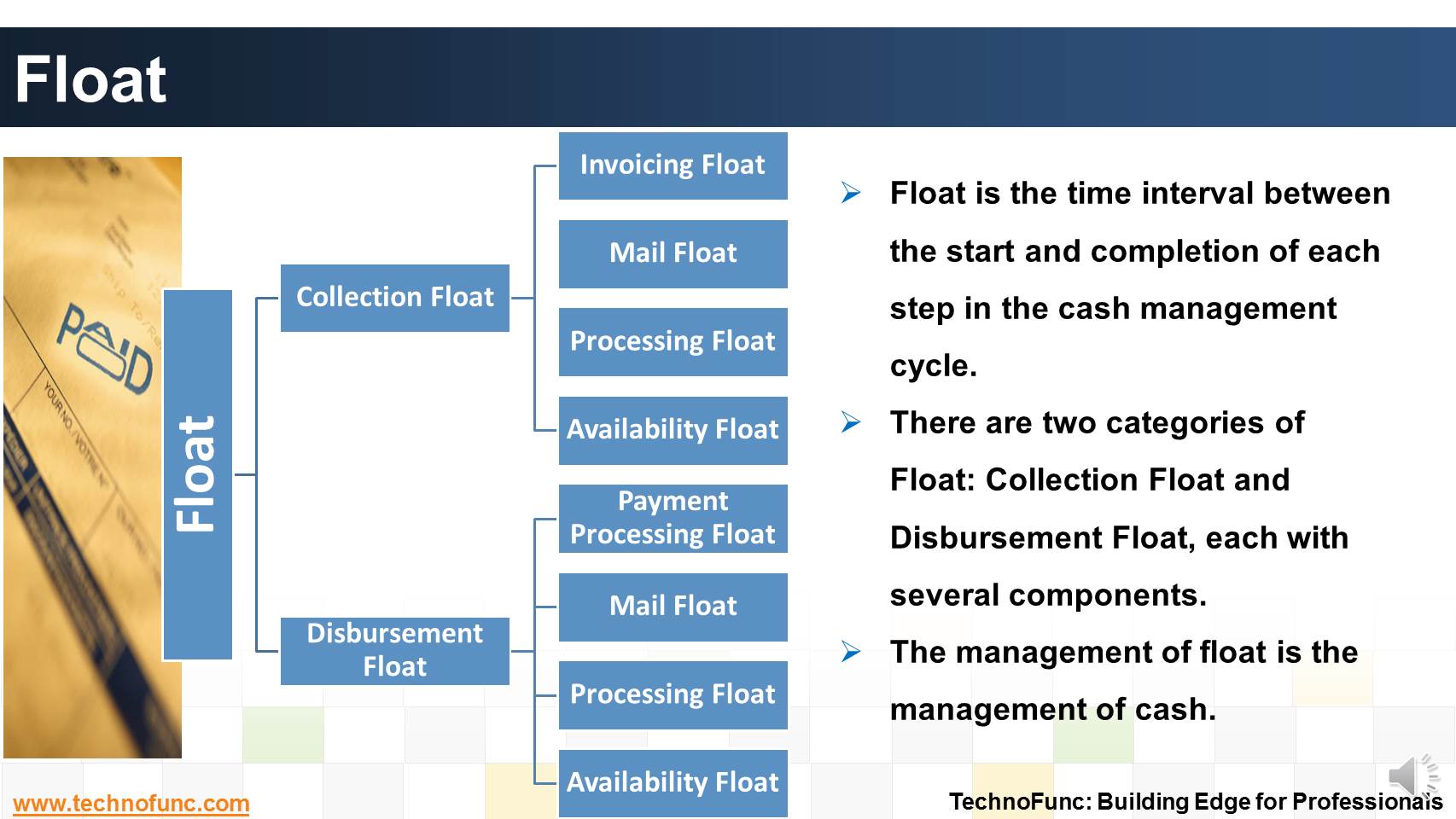

Float is the time interval between the start and completion of each step in the cash management cycle.

The management of float is the management of cash.

Each cash management system is designed to improve the flow of cash by accelerating the collection of funds and extending the disbursement float.

There are two categories of Float:

- Collection Float

- Disbursement Float, each with several components.

Related Links

You May Also Like

-

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Till reconciliation happens the amounts are parked in 'Cash Clearing Account'.

-

Have you ever wondered what is actually a Bank Statement and why it is needed. What is the information that is available in a bank statement?

-

Many different accounts are used in finance. Understand the representation and nature of clearing account in context of accounting, finance and ERP Systems.

-

Effectively using cash management with trade finance products brings tangible benefits to both corporates and financial institutions.Learn the various benefits of cash management process.

-

Treasury Management - Benefits

Effectively using treasury management with cash management and trade finance products brings tangible benefits to both corporates and financial institutions. Let us discuss some tangible benefits of treasury function.

-

Account Reconciliation – How? Learn the three key attributes to perfom account reconciliation.

-

What are the various sources of cash in an organization. Which sources increase the cash available with the enterprise and which sources results in outflow of the cash? Let us explore!

-

Bank reconciliation process is targeted to validate the bank balance in the general ledger and explain the difference between the bank balance shown in an organization's bank statement. Learn the reasons for existence of differences between the two.

-

Unravel the mystery behind clearing. Why we use clearing accounts. Find the relevance of word "Clearing" in business context.

-

Bank Reconciliation is a PROCESS to Validate the bank balance in the general ledger With Bank Statement. Learn the bank recon process.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved