- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Domain Knowledge

- General Ledger

- General Ledger Process Flow

General Ledger Process Flow

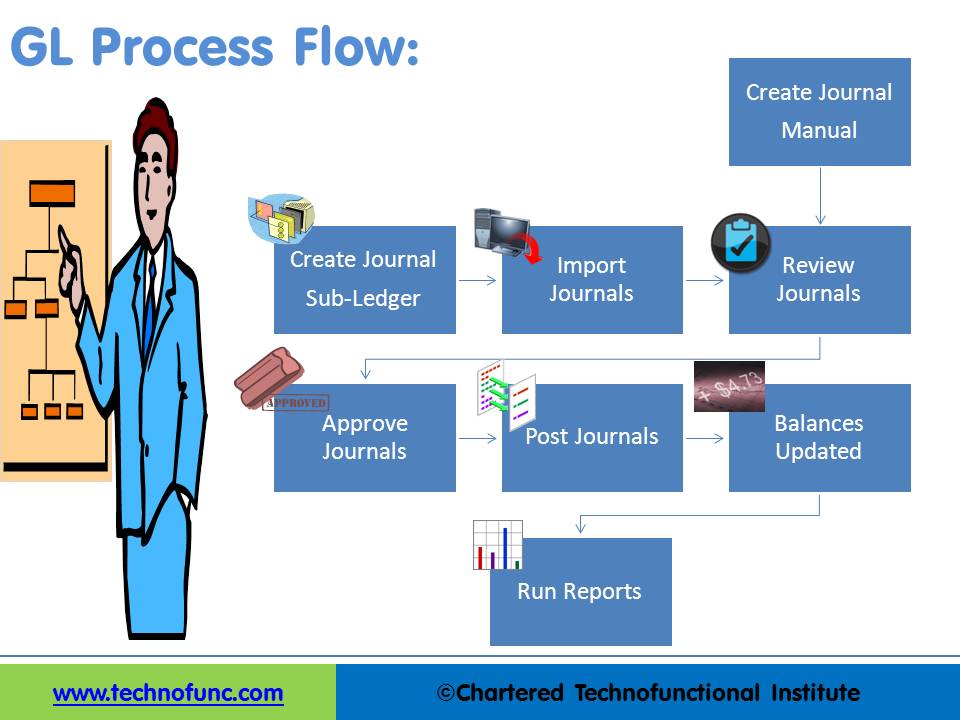

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

GL process flow is a five-step process from recording the transactions in the system to finally running the reports containing financial data out of the system. The input for GL Process Flow is the raw accounting data and the output is the accounting reports that can be used to provide various levels of financial information.

The steps in the general ledger process flow are:

- Step1. Create Journal or Import Journal from Sub‐Ledger

- Step2: Review Journals

- Step3: Approve Journals

- Step4: Journals Posting

- Step5: Run Financial Reports

Step 1: Create Journal or Import Journal from Sub‐Ledger:

Accounting Journals can be created directly in General Ledger. They can also be created in subsidiary ledgers and can then be imported to General Ledger. In the previous lesson, we saw some examples of commonly used subsidiary ledgers. Companies extensively use modules like accounts receivable, accounts payable, inventory, assets, projects, and cash management subsidiary ledgers. Data created in these sub-systems need to be imported to the general ledger for further processing, The accounting lines from sub-ledgers can be imported in summarized form or detailed form.

General Ledger also allows users to directly add transactions in the GL. In that case, you need to follow the accounting principles and the steps explained in the accounting process. At this stage, the journals are entered into the system and available for further processing, but they have not impacted the general ledger account balances yet.

Step 2: Review Journals:

Once the Journal is available in the General Ledger System you can query the journals that have been created. While reviewing the journal, you can make edits/corrections if required.

You might need to make some adjustments to the journals coming from other sources if you want to change the accounts or amounts that are coming from the sub-systems. Review functionality gives the capability to query the journals based on different parameters and also make edits if required.

Step 3: Approve Journals:

Accounting prudence requires that all financial transactions should be reviewed by someone other than the person creating the transaction. Approval ensures the validity and correctness of the transaction. The segregation of the Duties concept requires that the responsibility for related operations should be divided among two or more persons. This decreases the possibility of errors and fraud.

In this step, the system will validate the journal batch, determine if approval is required, and submit the batch to approvers (if required), then notifies appropriate individuals of the approval results. Email notifications can be sent to the approvers using the system and they can review and approve the journals. This step is generally optional and many organizations skip this step by putting additional controls in the process. If this feature is enabled then the journal cannot be posted unless it has been approved.

Step 4: Journals Posting:

An important feature of the general ledger is the "Balance" column, which keeps a running balance for each of the accounts pertaining to which transactions are happening. The transactional data captured through journals in the previous steps is transferred periodically to the columns in the general ledger. Journals posting is a process of updating the database with the amounts.

The volume of transactions carried out by a business will indicate how often to post. A busier company may post daily, while other companies may post weekly or monthly. Periodic postings is required to ensure balances for accounts are current, so the business has the up-to-date financial information it needs to make quick decisions. All transactions must be posted to the ledger at the end of an accounting period. Once the Journals are posted users can query for updated account balances using the account inquiry functions.

Journals Balances Updated: The posting process updates the journal balances. You can inquiry about the account balances in General Ledger for all posted transactions.

Step 5: Run Financial Reports:

One way to determine the financial progress of any organization is to look at the profit gained by a business. Once you have the account balances and transactional data available in the system they need to be formatted to meaningful information that can help users understand the financial history as well as equip them to make informed decisions. To enable these business users to need many types of financial reports.

The next step in the general ledger process is to generate these useful reports and the most common reports run from General Ledger are Transactions Register and Trial Balance Report. ERPs come with a large number of seeded reports as well as with tools to define user-specified reports.

Given above is the generic general ledger process. Some systems may have slight variations to the above process, but the underlying concepts remain more or less the same!

Related Links

You May Also Like

-

Understand what we mean by GAAP to STAT adjustments. This article discusses the different standards that are used for multiple representations of the financial results for global organizations. Understand the meaning of US GAAP, Local GAAP, STAT, IFRS, and STAT. Finally, understand why accounting differences arise and how they are adjusted for different financial representations.

-

Hierarchical Organization Structures

Hierarchical structure is typical for larger businesses and organizations. It relies on having different levels of authority with a chain of command connecting multiple management levels within the organization. The decision-making process is typically formal and flows from the top down.

-

In this article we will discuss various types of "Management Entities". Various types of operational units, are created by management, to effectively run, manage and control their business. Different types of functional units, and divisional units, are widely used across industry.

-

Generally Accepted Accounting Principles define the accounting procedures, and understanding them is essential to producing accurate and meaningful records. In this article we emphasize on accounting principles and concepts so that the learner can understand the “why” of accounting which will help you gain an understanding of the full significance of accounting.

-

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

-

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

-

Prepayments and Prepaid Expenses

Prepayments are the payment of a bill, operating expense, or non-operating expense that settle an account before it becomes due. Learn the concept of prepaid expenses. Understand the accounting treatment for prepaid expenses. Understand the concept by looking at some practical examples and finally learn the adjusting entry for these expenses.

-

Although technically a general ledger appears to be fairly simple compared to other processes, in large organizations, the general ledger has to provide many functionalities and it becomes considerably large and complex. Modern business organizations are complex, run multiple products and service lines, leveraging a large number of registered legal entities, and have varied reporting needs.

-

In some of the ERP tools, there are more than 12 accounting periods in a financial year. This article discusses the concept of accounting calendar and accounting periods. Learn why different companies have different accounting periods. Understand some of the commonly used periods across different organizations and the definition & use of an adjustment period.

-

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved