- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- What is Accounting & Book Keeping

What is Accounting & Book Keeping

Accounting is a process designed to capture the economic impact of everyday transactions. Each day, many events and activities occur in an entity, these events and activities are in the normal course of business; however, each of these events may or may not have an economic impact. Events or activities that have an effect on the accounting equation are accounting events.

What is accounting?

Accounting is the process of transforming the financial information associated with economic activity into usable financial information. Accounting is the art of recording, summarizing, reporting, and analyzing financial transactions. An accounting system can be a simple, utilitarian check register, or, as with modern automated enterprise resource planning systems, it can be a complete record of all the activities of a business, providing details of every aspect of the business, allowing the analysis of business trends, and providing insight into future prospects.

The American Institute of Certified Public Accountants (AICPA)

Accountancy is "the art of recording, classifying, and summarizing in a significant manner and in terms of money, transactions, and events which are, in part at least, of financial character, and interpreting the results thereof."

The outcome of the accounting process is a group of financial statements that reflect an organization's financial position, liquidity, and profitability. Periodically, financial statements are prepared to reveal the financial position and the results of operations. These financial statements are the output of the accounting process and become an input into the analysis and decision-making activities of business owners, investors, managers, creditors, and government regulators.

These financial statements or reports are shared with the stakeholders (interested parties) who analyze, interpret, and use this accounting information for their own purposes. This information helps the users with their analysis and decision making for various objectives like investment or understanding and improving the current business. Automated accounting is an information system that provides reports to stakeholders about the economic activities and conditions of a business.

The etymology of Word Accountant:

The word "Accountant" is derived from the French word Compter, which took its origin from the Latin word Computer. The word was formerly written in English as "Accomptant", but in process of time the word, which was always pronounced by dropping the "p", became gradually changed both in pronunciation and in orthography to its present form as “Accountant”

What is the role of accounting in business?

As discussed earlier, accounting provides information for managers to use in operating the business effectively and efficiently. In addition, accounting provides information to other stakeholders to use in assessing the economic performance and condition of the business. Accounting is generally referred to as the “language of business.” This is because accounting is the means by which business information is communicated to the stakeholders.

For example, accounting reports summarizing the profitability of a new product help management decide whether to continue selling the product. Likewise, financial analysts use accounting reports in deciding whether to recommend the purchase of the Company’s stock. Banks use accounting reports in determining the amount of credit to extend to the company and suppliers on the other hand use accounting reports in deciding whether to offer credit to the company for purchases of supplies and raw materials. Governments and other statutory bodies use accounting reports to calculate and assess taxes appropriately.

Role of Accounting Department:

The accounting job is typically done by the Accounting Department, led by an accounting manager, controller, comptroller, or similar title. These folks record all the transactions that occur as the company does its business and then prepare reports that help the company management, and outside constituencies understand the financial impact of those transactions.

The accountants maintain the accounting software, process all the documentation pertaining to transactions that have occurred and record them into the company's general ledger. From all these transaction records the accountants are able to prepare a variety of reports. Some are for people outside the company, like the government, bankers, investors, and stockholders and others are the reports that are important for running the company efficiently. Accountants prepare financial reports that managers use to understand their company’s financial past and make decisions about its financial future. Automated accounting programs typically produce a variety of reports and we'll discuss these reports in-depth in later sub-sections that pertain to the general ledger.

What is bookkeeping?

Bookkeeping is the practice of recording transactions. Bookkeepers tend to focus on the details, recording transactions in an efficient and organized manner, and they may or may not see the overall picture. Accountants use the work done by bookkeepers to produce and analyze financial reports. Although accounting follows the same principles and rules as bookkeeping, accounting converts them into meaningful financial information that captures all of the details necessary to satisfy the needs of the business — managerial, financial reporting, projection, analysis, and tax reporting. Effective accounting practices across a company will create a system of financial reporting that gives a complete picture of the business.

Related Links

You May Also Like

-

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

-

Business Metrics for Management Reporting

Business metric is a quantifiable measure of an organization's behavior, activities, and performance used to access the status of the targeted business process. Traditionally many metrics were finance based, inwardly focusing on the performance of the organization. Businesses can use various metrics available to monitor, evaluate, and improve their performance across any of the focus areas like sales, sourcing, IT or operations.

-

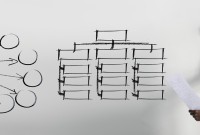

Hierarchical Organization Structures

Hierarchical structure is typical for larger businesses and organizations. It relies on having different levels of authority with a chain of command connecting multiple management levels within the organization. The decision-making process is typically formal and flows from the top down.

-

The general ledger is the central repository of all accounting information in an automated accounting world. Summarized data from various sub-ledgers are posted to GL that eventually helps in the creation of financial reports. Read more to understand the role and benefits of an effective general ledger system in automated accounting systems and ERPs.

-

In every journal entry that is recorded, the debits and credits must be equal to ensure that the accounting equation is matched. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit. We will also focus on some efficient methods of recording and analyzing transactions.

-

GL - Recurring Journal Entries

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

-

In this article we will help you understand the double-entry accounting system and state the accounting equation and define each element of the equation. Then we will describe and illustrate how business transactions can be recorded in terms of the resulting change in the elements of the accounting equation.

-

Internally, an organization can be structured in many different ways, depending on their objectives. The internal structure of an organization will determine the modes in which it operates and performs. Organizational structure allows the expressed allocation of responsibilities for different functions and processes to different entities such as the branch, department, workgroup and individual.

-

GL - Unearned / Deferred Revenue

Unearned revenue is a liability to the entity until the revenue is earned. Learn the concept of unearned revenue, also known as deferred revenue. Gain an understanding of business scenarios in which organizations need to park their receipts as unearned. Look at some real-life examples and understand the accounting treatment for unearned revenue. Finally, look at how the concept is treated in the ERPs or automated systems.

-

As the business grows, the company may want to transition to a branch structure as branches are allowed to conduct a much broader range of activity than representative offices. Branches can buy and sell goods, sign contracts, build things, render services, and generally everything that a regular business can do. A company expands its business by opening up its branch offices in various parts of the country as well as in other countries.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved