- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Recurring Journal Entries

GL - Recurring Journal Entries

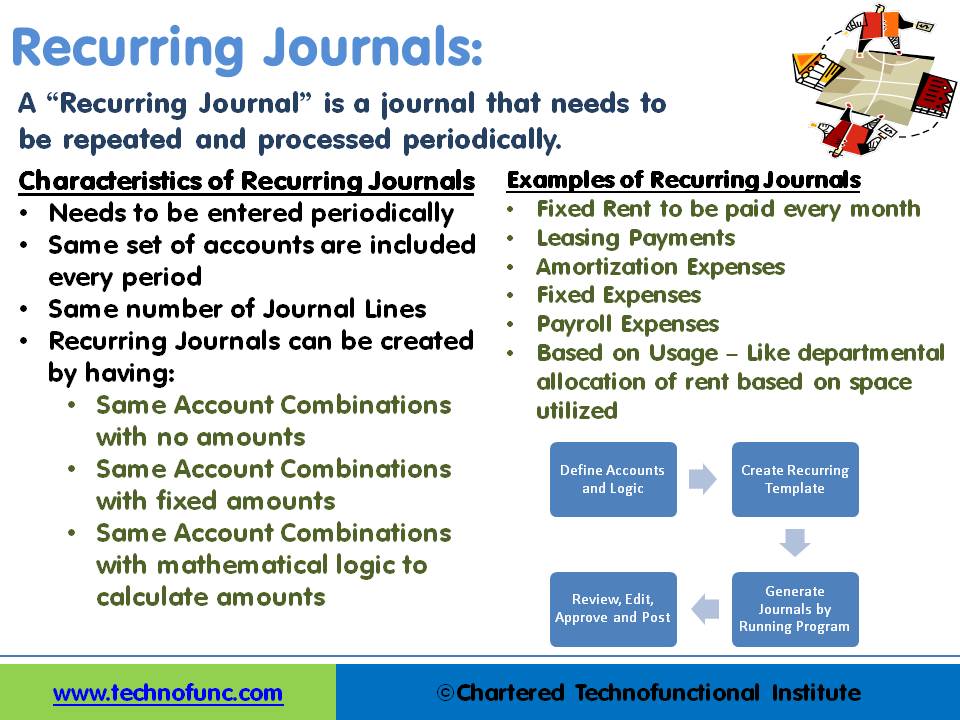

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

What is a Recurring Journal?

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Each accounting period the journal should have the same accounts but the amounts could be different. A recurring journal entry enables you to automate similar or repeating entries. For users who need to post certain transactions frequently with few or no changes, it is an advantage to use recurring journals.

Recurring entries allow for common repeatable transactions to be saved in a template and created in multiple accounting periods upon request, making it unnecessary to retype the entire transaction thereby improving productivity. The Auto-generation of recurring accounting entries minimizes the occurrence of errors and omissions. Systems allow the generation of recurring entries at weekly, monthly, or any other frequency.

Characteristics of Recurring Journals:

-

Needs to be entered periodically

-

The same set of accounts are included every period

-

The same number of Journal Lines

-

Logic exists to define the line selection criteria

-

Simplifies the process of recording repetitive journal entries

-

Creates same journal entries with varying or same amounts in different accounting periods

Methods to Create Recurring Journals:

1. Same Account Combinations with no amounts:

This is useful when the same accounts need to be used every period however the amounts get changed every time. In this scenario, the template is defined with no amounts, and amounts are entered manually every accounting period for which the entry needs to be generated.

2. Same Account Combinations with fixed amounts:

This is useful when both accounts and amounts can be pre-determined. A good example of this scenario is fixed rent payable each month on a specific date. In this case, the template is defined with actual amounts, and journals are created and posted for relevant accounting periods.

3. Same Account Combinations with mathematical logic to calculate amounts:

This is useful when accounts can be pre-determined and amounts will be based on some logic or pre-defined formula. A good example of this scenario could be defining salesmen accounts as the pre-determined accounts. The commission is to be paid to these salesmen as a fixed percentage of sales made by each salesman during the month and sales for each salesman are recorded in separate accounts. A recurring journal can be defined that can look for the balance in respective sales accounts at the end of the period and automatically calculate the commission and create the required accounting entry for commission payable.

Examples of Recurring Journals:

This method works best for repeatable transactions. For example annual expenses that can be charged through twelve equal monthly entries such as, rent or insurance expense allocation or annual lease rentals. Each month 1/12th of the total annual expense can be debited and credited to the appropriate accounts and appear as the current month’s actual transaction. Users can benefit by creating a recurring entry for some of the business scenarios listed below:

- Fixed Rent to be paid every month

- Fixed Insurance to be paid every month

- Leasing Payments

- Amortization Expenses

- Fixed Expenses

- Payroll Expenses

- Based on Usage – Like departmental allocation of rent based on space utilized

- Depreciation

- Allocations

Generic Process to Create Recurring Journals:

Users need to define recurring journal formulas for transactions that they want to repeat every accounting period, such as accruals, depreciation charges, and allocations. The formulas can be simple or complex but need to have some logic of ascertaining the amounts for each of the accounts that need to be repeated. Each formula can use fixed amounts and/or account balances and period-to-date or year-to-date balances from the current period, prior period, or same period last year. Given below is a generic process flow to define recurring journals:

- Define Accounts, Amounts or Formula or Logic

- Create Recurring Template

- Define the accounting periods for which the recurring journals need to be created

- Generate Journals by Running automated recurring journals creation program

- Enter missing data in case of Skelton journals – missing amounts

- Review, Edit, Approve and Post recurring journals

Allocations V/s Recurring Journals:

Recurring Journals are for transactions that repeat every accounting period as explained above and allocation Journals are for single journal entry using an accounting or mathematical formula to allocate revenues and expenses across a group of accounting dimensions like cost centers, departments, divisions, locations, or product lines depending upon usage factors.

Related Links

You May Also Like

-

Accrued expenses, sometimes referred to as accrued liabilities, are expenses that have been incurred but have not been recorded in the accounts. Discuss the need to record accrued liabilities and why they require an adjustment entry. Understand the treatment for these entries once the accounting period is closed and learn to differentiate when the commitments become liabilities.

-

An allocation is a process of shifting overhead costs to cost objects, using a rational basis of allotment. Understand what is the meaning of allocation in the accounting context and how defining mass allocations simplifies the process of allocating overheads to various accounting segments. Explore types of allocations and see some practical examples of mass allocations in real business situations.

-

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation.

-

GL - Unearned / Deferred Revenue

Unearned revenue is a liability to the entity until the revenue is earned. Learn the concept of unearned revenue, also known as deferred revenue. Gain an understanding of business scenarios in which organizations need to park their receipts as unearned. Look at some real-life examples and understand the accounting treatment for unearned revenue. Finally, look at how the concept is treated in the ERPs or automated systems.

-

Team-Based Organizational Structure

Team-based structure is a relatively new structure that opposes the traditional hierarchical structure and it slowly gaining acceptance in the corporate world. In such a structure, employees come together as team in order to fulfill their tasks that serve a common goal.

-

Legal Structures in Businesses

Businesses not only vary in size and industry but also in their ownership. Most businesses evolve from being owned by just one person to a small group of people and eventually being managed by a large numbers of shareholders. Different ownership structures overlap with different legal forms that a business can take. A business’s legal and ownership structure determines many of its legal responsibilities.

-

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

-

Multitude of these legal and operational structures clubbed with accounting and reporting needs give rise to many reporting dimensions at which the organization may want to track or report its operational metrics and financial results. This is where business dimensions play a vital role.

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

-

Prepayments and Prepaid Expenses

Prepayments are the payment of a bill, operating expense, or non-operating expense that settle an account before it becomes due. Learn the concept of prepaid expenses. Understand the accounting treatment for prepaid expenses. Understand the concept by looking at some practical examples and finally learn the adjusting entry for these expenses.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved