- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- Defining Reporting Dimensions

Defining Reporting Dimensions

Multitude of these legal and operational structures clubbed with accounting and reporting needs give rise to many reporting dimensions at which the organization may want to track or report its operational metrics and financial results. This is where business dimensions play a vital role.

Multitude of these legal and operational structures clubbed with accounting and reporting needs give rise to many reporting dimensions at which the organization may want to track or report its operational metrics and financial results. This is where business dimensions play a vital role.

Business Dimensions:

A dimension reflects the attributes of a business, such as legal structure, management structure, departments and projects. Dimensions are used to help capture and analyze underlying data and when used with reporting provides an effective tool to break down key components of business to help make better business decisions. Business dimensions describe the business-specific objects within the model, such as products, customers, regions, employees, and so on.

Why we need business dimensions:

In any typical entity, accounting process starts with recording of a transaction that has a financial implication on a voucher and it culminates with the preparation of final books of accounts. However this simple process gains complexity when the size of the organization and diversity of its environment increases. For example: Global companies regularly distribute goods from a central site to customers located in different countries or regions. Before shipping lo a customer, goods may be processed through a separate operating unit or subsidiary in the country of sales origin. A complex sequence of coupled accounting records is needed because these transactions impact multiple organizations and legal entities, and most governments require a financial record for transactions conducted between legal entities. Management need to contemplate these business dimensions properly for decision-making and enhancing the achievement of the competitive advantage and control over the operations of the enterprise.

- There exist various types of entities or business units which are part of the same global group.

- These units may represent countries, locations, businesses, functions, projects, cost centers, segments etc.

- These units may have different reporting needs.

- These units may be responsible for their own profit and loss.

- They might be holding their own Fixed Assets.

- They might be concerned with their own markets where their products are sold.

- They might be constituted as separate legal entities over multiple layers of ownership with their peculiar independent local statutory reporting needs.

- Subsidiaries and branches operating as individual entities need to be consolidated with the group financials.

Examples of different dimensions are:

- Legal Entity: Financial results and trial balance at each legal entity level

- Division/Department: Financial results and trial balance at each division or department

- Product Line: Operating margins for each product line

- Geography: Annual Growth for each geography in which a company operates

- Project: Cost and profitability for each project undertaken by business

- Cost Center: Costs accumulated and allocated through each cost center

- Accounts: Total fixed assets owned by the legal entity, accounted under land and building, furniture and fixtures and other accounts

- Functional Area: Total cost attributable to each function like finance, marketing etc.

These dimensions further have parent child relationships within themselves and other corporate relationships (known as Business Hierarchies) with other dimensions. Corporate relationships are the links between various dimensions like parent companies, subsidiaries, headquarters, branches, functions, product lines, cost centers etc. A dimension may consists of one or more hierarchies that can contain several levels.

Related Links

You May Also Like

-

Defining Organizational Hierarchies

A hierarchy is an ordered series of related objects. You can relate hierarchy with “pyramid” - where each step of the pyramid is subordinate to the one above it. One can use drill up or down to perform multi-dimensional analysis with a hierarchy. Multi-dimensional analysis uses dimension objects organized in a meaningful order and allows users to observe data from various viewpoints.

-

A legal entity is an artificial person having separate legal standing in the eyes of law. A Legal entity represents a legal company for which you prepare fiscal or tax reports. A legal entity is any company or organization that has legal rights and responsibilities, including tax filings.

-

An organizational design is the process by which a company defines and manages elements of structure so that an organization can control the activities necessary to achieve its goals. Good organizational structure and design helps improve communication, increase productivity, and inspire innovation. Organizational structure is the formal system of task and activity relationships to clearly define how people coordinate their actions and use resources to achieve organizational goals.

-

Operational Structures in Business

Large organizations grow through subsidiaries, joint ventures, multiple divisions and departments along with mergers and acquisitions. Leaders of these organizations typically want to analyze the business based on operational structures such as industries, functions, consumers, or product lines.

-

In this article we will help you understand the double-entry accounting system and state the accounting equation and define each element of the equation. Then we will describe and illustrate how business transactions can be recorded in terms of the resulting change in the elements of the accounting equation.

-

The general ledger is the central repository of all accounting information in an automated accounting world. Summarized data from various sub-ledgers are posted to GL that eventually helps in the creation of financial reports. Read more to understand the role and benefits of an effective general ledger system in automated accounting systems and ERPs.

-

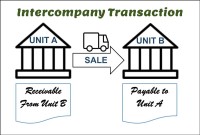

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

Horizontal or Flat Organizational Structures

Flat organizational structure is an organizational model with relatively few or no levels of middle management between the executives and the frontline employees. Its goal is to have as little hierarchy as possible between management and staff level employees. In a flat organizational structure, employees have increased involvement in the decision-making process.

-

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

-

Five Core General Ledger Accounts

Typically, the accounts of the general ledger are sorted into five categories within a chart of accounts. Double-entry accounting uses five and only five account types to record all the transactions that can possibly be recorded in any accounting system. These five accounts are the basis for any accounting system, whether it is a manual or an automated accounting system. These five categories are assets, liabilities, owner's equity, revenue, and expenses.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved