- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- Benefits of Automated GLs

Benefits of Automated GLs

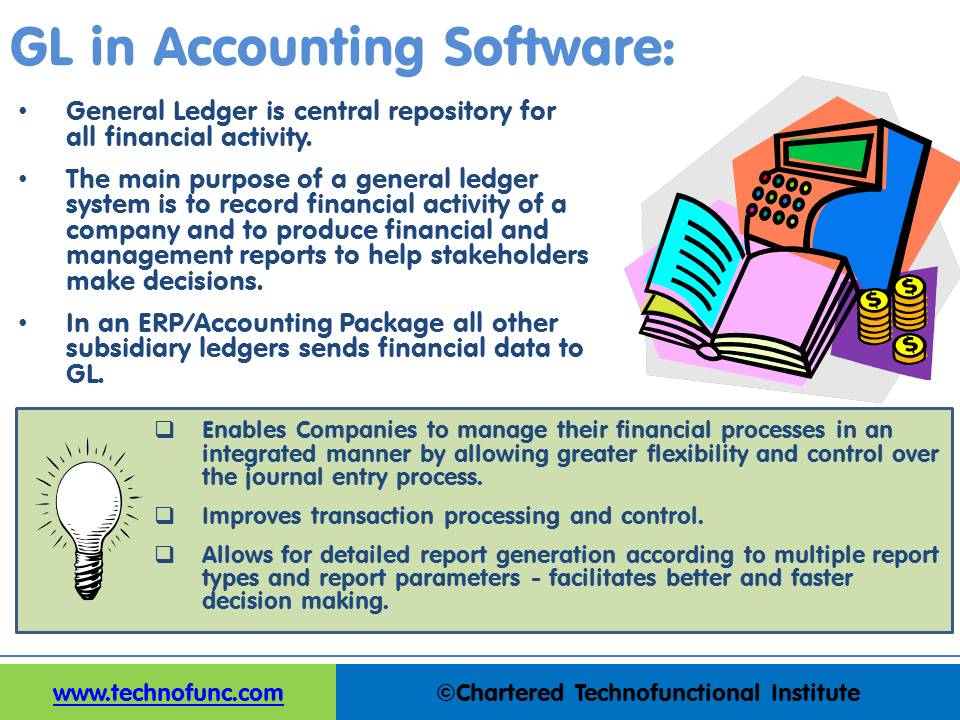

The general ledger is the central repository of all accounting information in an automated accounting world. Summarized data from various sub-ledgers are posted to GL that eventually helps in the creation of financial reports. Read more to understand the role and benefits of an effective general ledger system in automated accounting systems and ERPs.

Automated General Ledgers

In order for people inside and outside an organization to use financial data, transaction information is organized by the account in ledgers. A general ledger is the main accounting record of a business. Originally a paper document, a ledger is now more likely to be an electronic document containing summarized financial data and balances for all the accounts of an organization.

In automated systems like ERPs, General Ledger is the central repository for all transactions that get recorded in various supplemental books, which are known as modules or sub-ledgers. Examples of supplemental books in traditional accounting are sales books for sales, purchase books for purchases, cash and bank book for cash related transactions and general journals book to capture adjustment entries. In “Automated Accounting Packages” these supplemental transactions are recorded in modules like Accounts Payables, Accounts Receivables, Purchase, or Inventory.

The respective journals may contain additional information other than the accounting information and all activities or transactions get recorded in various Sub‐Ledgers(Especially in ERPs) irrespective of whether they have a financial impact or not. An example is the creation of PO’s in the purchasing modules irrespective of them having no financial impact. However, the same PO can later be converted into a Payables Invoice automatically, which has an accounting impact.

These subsidiary ledgers (also known as modules), send financial data to General Ledger. Data from different modules can be imported automatically using integrations with Sub Ledgers. General Ledger validates the financial data and updates the balances to the respective accounts.

Benefits of Automated General Ledger:

In Accounting Packages or in ERP’s like Oracle and SAP, “General Ledger” is the central repository of all accounting information. Automated General Ledgers can be a comprehensive financial management solution that can provide highly automated financial processing, effective management control, and real-time visibility to financial results. It can provide internal controls that an organization needs to meet financial compliance. Some major benefits of an automated general ledger system are explained below:

Flexible Accounting Model:

In today’s complex, global, and regulated environment, finance organizations face challenges in trying to comply with local regulations and multiple reporting requirements. The Automated General Ledger system allows companies to meet these challenges in a streamlined and automated way. You can define multiple ledgers based on your needs and they can be used to cater to statutory, corporate, regulatory, and management reporting needs with the same underlying financial data. With a single entry source, multiple accounting representations can be simultaneously maintained for a single transaction. For example, a single journal entered in the main, record-keeping ledger can be automatically represented in multiple ledgers (local and global consolidated) even if each ledger uses a different chart of accounts, calendar, currency, and accounting principles.

Multi-Currency Functionality:

Automated General Ledgers provides multi-currency functionalities that can help satisfy complicated global financial requirements. These features can perform currency conversion, revaluation, re-measurement, and translation in accordance with local and international accounting standards for a large number of currencies.

Transaction Processing & Control:

The general ledger is the foundation of any accounting system; it improves transaction processing and control. It collects transaction details from other applications allowing the preparation of key financial reports. Control on Journal Entries creates an auditable record of a business's complete financial history. Automated General Ledger can provide a variety of journal processing options to help organizations to capture transactions with efficiency and control. The entry of journals can be automated using journal templates or can be uploaded using a spreadsheet.

Accuracy and Real-Time:

A good general ledger software application will provide management with accurate, up-to-date information in order to make short and long term business decisions. It also has inbuilt controls and processes necessary, to ensure that the correct information is reported. Income statements, balance sheets, and statements of cash flow are standard reports needed by management to judge business progress and these reports can be built using the trial balance created in General Ledger.

Common Chart of Accounts (COA):

Organizations can enforce a common Chart of Accounts structure across different processes, modules, and entities, enabling them to manage their financial processes in an integrated manner by allowing greater flexibility and control over the journal entry process. Accounts in the chart of accounts can be secured to prevent unauthorized access and viewing of sensitive financial data. They also support account hierarchies to group accounting data.

Accuracy of Financial Statements:

The main purpose of a general ledger system is to record the financial activity of a company and to produce financial and management reports to help stakeholders make decisions. Every corporation needs to prepare financial statements like Balance Sheet and Profit and Loss Account. General Ledger provides detailed account balances for the formation of this financial reporting. Stakeholders can make effective decisions only when the underlying financial data is available timely on-demand and correct.

Reporting Flexibility:

Using General Ledger Software allows for detailed report generation according to multiple report types and report parameters - facilitates better and faster decision making. The ability to access financial records by departments, cost centers, or other accounting divisions, provides visibility to understand business performance across the organization. It enables tracking critical information on the company's financial position and supplements it with various statutory and management reporting options.

Related Links

You May Also Like

-

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

-

The sole trader organization (also called proprietorship) is the oldest form of organization and the most common form of organization for small businesses even today. In a proprietorship the enterprise is owned and controlled only by one person. This form is one of the most popular forms because of the advantages it offers. It is the simplest and easiest to form.

-

Team-Based Organizational Structure

Team-based structure is a relatively new structure that opposes the traditional hierarchical structure and it slowly gaining acceptance in the corporate world. In such a structure, employees come together as team in order to fulfill their tasks that serve a common goal.

-

GL - Recurring Journal Entries

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

-

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

-

There are two commonly used methods of accounting - Cash Basis and the Accruals Basis. Understand the difference between accruals and reversals. Recap the earlier discussion we had on accruals and reversals and see the comparison between these two different but related accounting concepts. Understand how the action of accruing results in reversals subsequently in the accounting cycle.

-

In this article, we will describe how to determine if an account needs adjustment entries due to the application of the matching concept. Learners will get a thorough understanding of the adjustment process and the nature of the adjustment entries. We will discuss the four types of adjustments resulting from unearned revenue, prepaid expenses, accrued expenses, and accrued revenue.

-

Learn the typical accounting cycle that takes place in an automated accounting system. We will understand the perquisites for commencing the accounting cycle and the series of steps required to record transactions and convert them into financial reports. This accounting cycle is the standard repetitive process that is undertaken to record and report accounting.

-

A legal entity is an artificial person having separate legal standing in the eyes of law. A Legal entity represents a legal company for which you prepare fiscal or tax reports. A legal entity is any company or organization that has legal rights and responsibilities, including tax filings.

-

GL - Different Type of Journals

Two basic types of journals exist: general and special. In this article, the learner will understand the meaning of journalizing and the steps required to create a journal entry. This article will also discuss the types of journals and will help you understand general journals & special journals. In the end, we will explain the impact of automated ERPs on the Journalizing Process.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved