- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- Concept of Representative Office

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature. As its name says, a representative office represents its foreign parent in the country of operations.

A representative office is an office established by a company to conduct marketing and other non-transactional operations, generally in a foreign country where a branch office or subsidiary is not warranted. A representative office cannot regularly buy and sell goods or offer services. Representative offices are generally easier to establish than a branch or subsidiary, as they are not used for actual "business" (e.g. sales) and therefore there is less incentive for them to be regulated.

A representative office is a more tentative step into the foreign market, often used by investors to test the waters or for promotional purposes when the business distributes its goods by other means. A representative office is most appropriate in the early stages of corporation’s business presence in a foreign country. They have been used extensively by foreign investors in emerging markets such as China, India and Vietnam although they do have restrictions through not being able to invoice locally for goods or services.

Main Features:

- Representative office to engage only in activities which do not amount to, or form part of, the carrying on of the relevant business in foreign country.

- Having a nominated person employed by a local affiliate to handle enquiries could fall into this category.

- The representative office can contact customers and enter into contracts on behalf of its foreign parent, but can’t sell the goods itself.

- Representative Offices tend to be utilized by foreign investors in fields such as sourcing of products, quality control, and general liaison activities between the Head Office and the Representative Offices overseas.

- Corporations should periodically review the suitability of the structure and its activities to make sure that the company is not triggering a taxable presence in the foreign land by exceeding the permissible activities.

ICICI Bank, India's second largest bank, opened representatives offices in three east-Asian countries Thailand, Indonesia and Malaysia". The branches are expected to enable the bank to increase its participation in India's trade transactions in the region. It also has a representative office in the US.

Related Links

You May Also Like

-

In this article we will focus on and understand the accounting process which enables the accounting system to provide the necessary information to business stakeholders. We will deep dive into each of the steps of accounting and will understand how to identify accounting transactions and the process for recording accounting information and transactions.

-

In most of the automated financial systems, you can define more than 12 accounting periods in a financial year. This article will explain the concept of the adjustment period and the benefits of having adjustment periods. Adjustment periods have their inherent challenges for the users of financial statements and there is a workaround for those who don’t want to use adjustment periods.

-

Prepayments and Prepaid Expenses

Prepayments are the payment of a bill, operating expense, or non-operating expense that settle an account before it becomes due. Learn the concept of prepaid expenses. Understand the accounting treatment for prepaid expenses. Understand the concept by looking at some practical examples and finally learn the adjusting entry for these expenses.

-

In this article, we explain some commonly used subsidiary ledgers like accounts receivable subsidiary ledger, accounts payable subsidiary ledger or creditors' subsidiary ledger, inventory subsidiary ledger, fixed assets subsidiary ledger, projects subsidiary ledger, work in progress subsidiary ledger, and cash receipts or payments subsidiary ledger.

-

Multitude of these legal and operational structures clubbed with accounting and reporting needs give rise to many reporting dimensions at which the organization may want to track or report its operational metrics and financial results. This is where business dimensions play a vital role.

-

McKinsey 7S Framework is most often used as an organizational analysis tool to assess and monitor changes in the internal situation of an organization. The model is based on the theory that, for an organization to perform well, seven elements need to be aligned and mutually reinforcing.

-

Business Metrics for Management Reporting

Business metric is a quantifiable measure of an organization's behavior, activities, and performance used to access the status of the targeted business process. Traditionally many metrics were finance based, inwardly focusing on the performance of the organization. Businesses can use various metrics available to monitor, evaluate, and improve their performance across any of the focus areas like sales, sourcing, IT or operations.

-

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation.

-

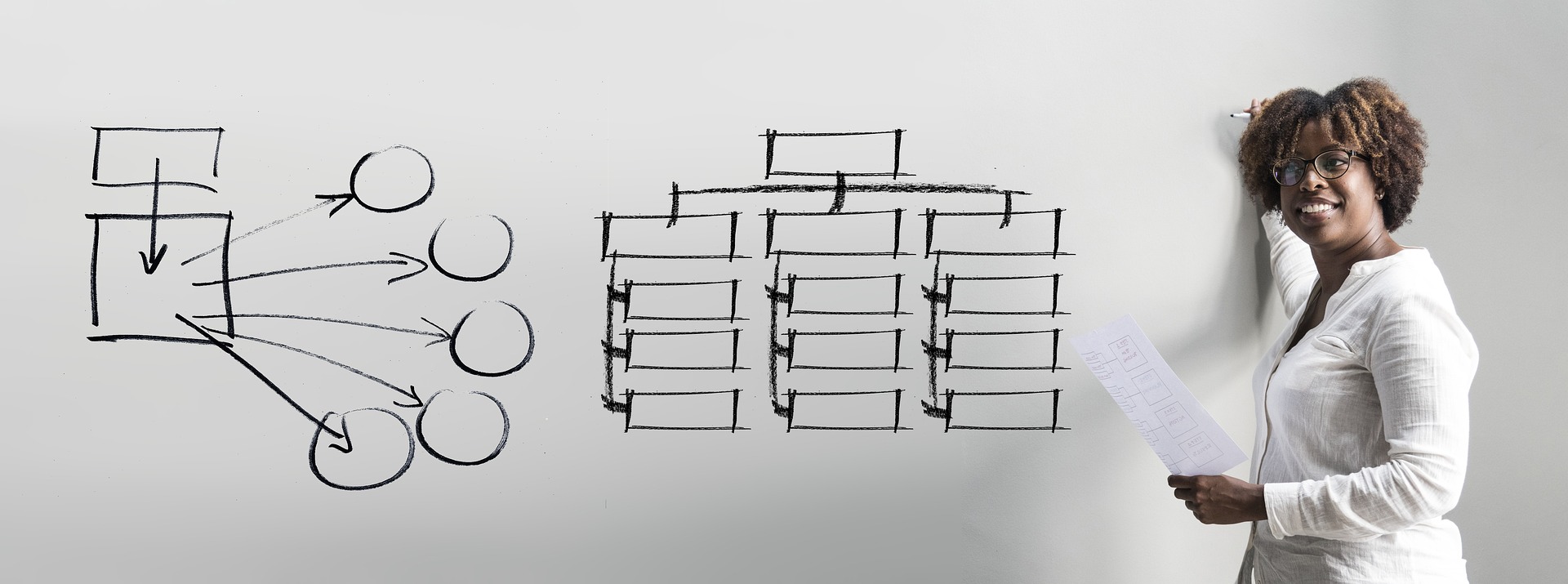

Internally, an organization can be structured in many different ways, depending on their objectives. The internal structure of an organization will determine the modes in which it operates and performs. Organizational structure allows the expressed allocation of responsibilities for different functions and processes to different entities such as the branch, department, workgroup and individual.

-

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved