- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Reversing Journal Entry

GL - Reversing Journal Entry

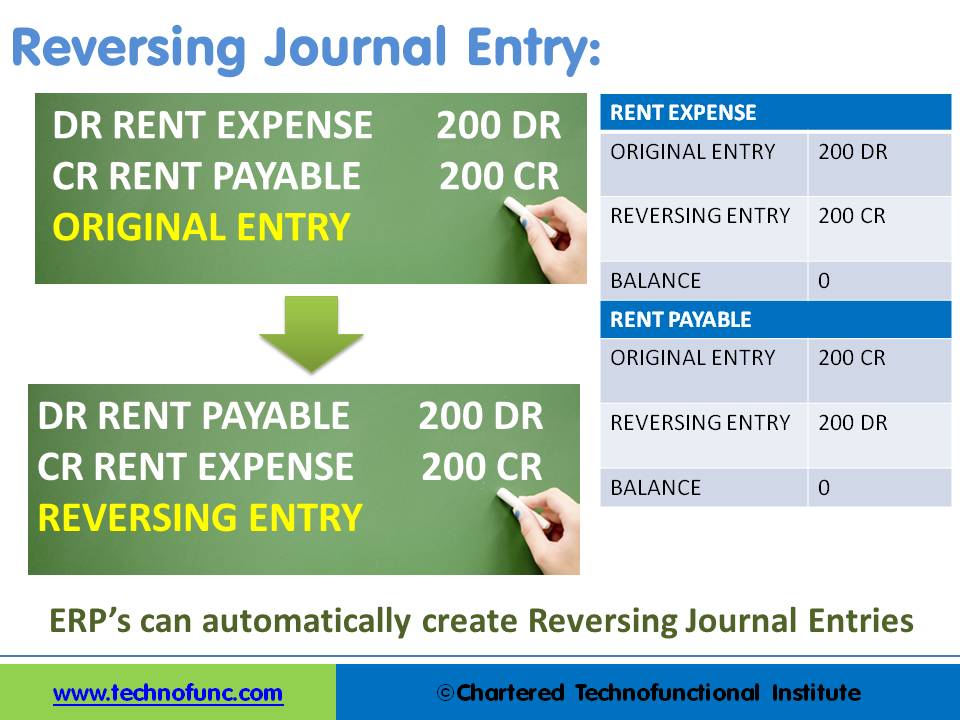

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

What is a Reversing Journal Entry?

A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries.

Reversing entry can be created in two ways. The first method is to use the same set of accounts with contra debits and credits, meaning that the accounts and amounts that were debited in the original entry will be credited with the same amount in the reversing journal “nullifying” the accounting impact. The second method is to create a journal with the same accounts but with negative amounts that will also nullify the accounting impact of the original transaction.

Automated Process Requirements:

- The accounts have been set up in the chart of accounts.

- The reversal criteria have been specified in the original adjustment or accrual journal, otherwise, the user generally needs to submit the journal manually for reversal.

- The date of the reversing journal has already been specified and the accounting period for that date is available for creating and posting transactions.

Process Flow Steps

- Enter a journal that reverses in the next month.

- Select the appropriate reversal option.

- At the beginning of the next period system creates a reversing entry dated the first day of the next accounting period.

Example of a reversing entry:

The business has taken premises on rent. The rent payable for each month is $200 and the invoice is raised by the landlord on the 15th of the subsequent month. The accounting department takes 5 days to process the payment and deposit the amount in the Landlord’s account. December is the close of the accounting year and the invoice for rent for the month of December will be received by the company on the 15th of January and payment will be made by the 20th of January.

Closing Books: On the 31st of December, the accounting department passes the rent accrual accounting entry, debiting the “Rent Expense” and crediting the “Rent Payable Account”. This entry records the rent for the month of Dec and creates a liability for “Rent Payable” to the landlord next month. At the beginning of the next accounting year, on day one this entry is reversed by debiting the “Rent Payable” and crediting the “Rent Account”.

Making Payment: Once the payment for Rent is made on 20th January (Again by Debiting “Rent Expense” and Crediting “Bank Account”) this reversal will ensure that the rent for last year is not impacting the current year financials as the net impact on the “Rent Expense” account will be zero.

Related Links

You May Also Like

-

GL - Understanding Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

-

Trial Balance in General Ledger

One of the greatest benefits of using a double-entry accounting system is the capability to generate a trial balance. What do we mean by trial balance? As the name suggests a trial balance is a report that must have its debits equals to credits. Understand the importance of trial balance and why it is balanced. Learn how it is prepared and in which format.

-

Funds contributed by owners in any business are different from all other types of funds. Equity is the residual value of the business enterprise that belongs to the owners or shareholders. The funds contributed by outsiders other than owners that are payable to them in the future. Liabilities are generally classified as Short Term (Current) and Long Term Liabilities. Current liabilities are debts payable within one year.

-

Driving Business Efficiency through Divisions and Departments

In case of a multi-divisional organizational structure, there is one parent company, or head-office. And that parent owns smaller departments, under the same brand name. Dividing the firm, into several self-contained, autonomous units, provides the optimal level of centralization, in a company.

-

Multitude of these legal and operational structures clubbed with accounting and reporting needs give rise to many reporting dimensions at which the organization may want to track or report its operational metrics and financial results. This is where business dimensions play a vital role.

-

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

-

What Is a General Ledger? General Ledger (also known in accounting as the GL or the Nominal Ledger) is at the heart of any accounting system. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. Ledger is the skillful grouping and presentation of the Journal entries. Learn the accounting fundamentals, general ledger process, and general ledger flow.

-

Matrix Organizational Structures

In recent times the two types of organization structures which have evolved are the matrix organization and the network organization. Rigid departmentalization is being complemented by the use of teams that cross over traditional departmental lines.

-

Legal Structures for Multinational Companies

A multinational company generally has offices and/or factories in different countries and a centralized head office where they coordinate global management. A multinational company (MNC)is a corporate organization that owns or controls the production of goods or services in at least one country other than its home country.

-

In some of the ERP tools, there are more than 12 accounting periods in a financial year. This article discusses the concept of accounting calendar and accounting periods. Learn why different companies have different accounting periods. Understand some of the commonly used periods across different organizations and the definition & use of an adjustment period.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved