- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Periods and Calendars

GL - Periods and Calendars

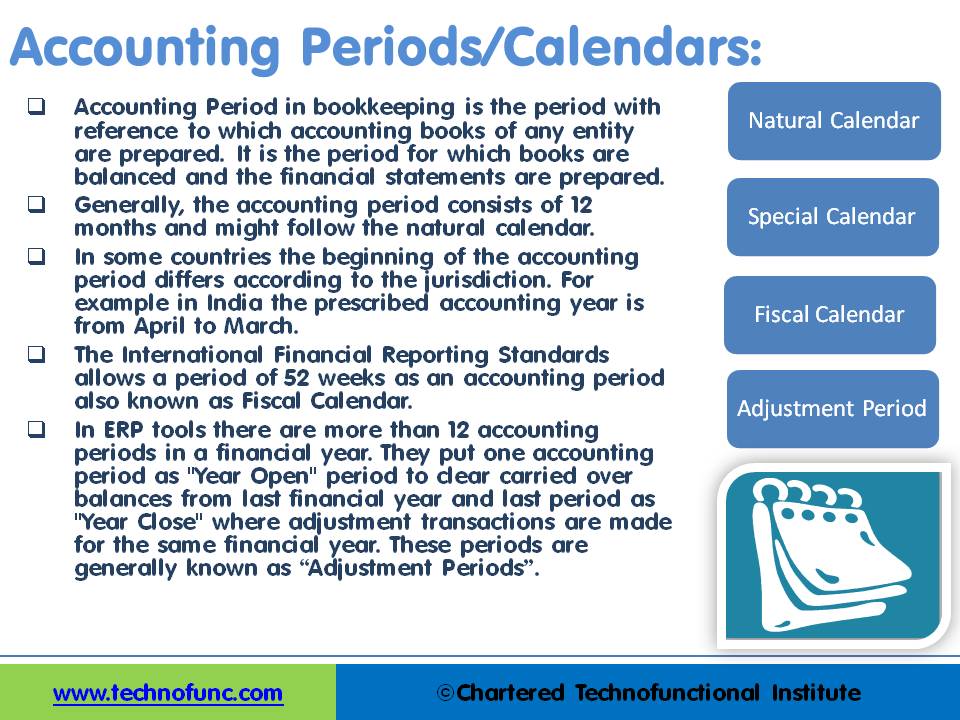

In some of the ERP tools, there are more than 12 accounting periods in a financial year. This article discusses the concept of accounting calendar and accounting periods. Learn why different companies have different accounting periods. Understand some of the commonly used periods across different organizations and the definition & use of an adjustment period.

What is an Accounting Period?

The accounting Period in bookkeeping is the period with reference to which accounting books of any entity are prepared. It is the period for which books are balanced and the financial statements are prepared. In accounting, financial results are measured by periods. Any period with a defined beginning and end can be used for an accounting period.

Why we need Accounting Periods?

The accounting entity is viewed as a going concern and is expected to have a fairly long life. To determine the exact profit or loss of a business enterprise one needs to find that realizable difference between the end value of equity at closure and the investment into the business by the owners. The real value can be determined only when the enterprise is liquidated.

But the owners need to know the profitability of the business on an ongoing basis to make informed business decisions. Hence, to overcome this problem, the accountants have developed the “Concept of Periodicity” for reporting the periodical progress of a business entity. This period for which the enterprise is determining and reporting its operating profit is the accounting period.

Why organizations use different Accounting Periods?

Generally, the accounting period consists of 12 months but we see differences in the way different organizations define their accounting period. There exist multiple reasons for the same.

1. Regulatory Reasons:

Some periods are set by outside authorities and in that case, the beginning of the accounting period differs according to the jurisdiction. For example, one entity may follow the regular calendar year, i.e. January to December as the accounting year, while another entity may follow April to March as the accounting period. The International Financial Reporting Standards even allows a period of 52 weeks as an accounting period instead of a proper year. Most of the time organizations choose to go with the statutory prescribed fiscal period like going with the periods they need to have for tax purposes. Many countries have prescribed accounting periods that do not follow the natural calendar and these periods are compulsory to be followed by all organizations conducting business in that country. In that case, multi-national companies also need to follow the same period for the operations conducted in that country. This also creates different accounting periods as compared to the global parent company.

2. Business Specific Reasons:

Sometimes business circumstances are very compelling to warrant different accounting periods and in that case accounting periods are set solely at the discretion of the company based on their specific business needs, and as explained above, organizations are allowed to define as many periods as they want as long as they meet legal requirements. For example, many restaurants, nearly all the larger chain operators, define their accounting period as consisting of four weeks. They have 13 four-week periods a year, instead of 12 monthly statements. The business reason being, most restaurants do 45% to 60% and even more of their weekly sales on two days of the week, normally Friday and Saturday. This makes it difficult to compare results using monthly periods as the number of week-ends differs from month to month.

What are some commonly used accounting calendars and periods?

1. Natural Calendar:

Generally, the accounting period consists of 12 months and might follow the natural calendar. Natural Calendar follows the natural sequence of months from January to December.

2. Special Calendar:

Any calendar not following the natural months is a “Special Calendar”, for example, a special calendar from “April to March”. In some countries, the beginning of the accounting period differs according to the jurisdiction. For example in India, the prescribed accounting year is from April to March. The Australian government's financial year begins on July 1 and concludes on June 30 of the following year. The Financial Year in Costa Rica spans from October 1 until September 30 of the following year.

3. Fiscal Calendar:

The International Financial Reporting Standards allow up-to a period of 52 weeks as an accounting period also known as “Fiscal Calendar”. A large number of companies use 52 weeks fiscal calendar for their reporting and financial tracking purposes. Many companies find that it is convenient for purposes of comparison and also for accurate stock taking to always end their fiscal year on the same day of the week, where local legislation permits. Thus some fiscal years will have 52 weeks and others 53. Fiscal years vary between businesses and countries. The fiscal year may also refer to the year used for financial reporting or for Income Tax Reporting.

4. The 4–4–5 Calendar:

It is another method of managing accounting periods. It is a common calendar structure for some industries, like the retail, manufacturing, and parking industry. 4–4–5 calendar divides a year into 4 quarters. Each quarter has 13 weeks which are grouped into two 4-week "months" and one 5-week "month". The grouping of 13 weeks may be set up as 5–4–4 weeks or 4–5–4 weeks, but the 4–4–5 is the most common arrangement. Its major advantage over a regular calendar is that the end date of the period is always the same day of the week, which is useful for shift or manufacturing planning, and in this calendar, every period is the same length. Each accounting period for one business year corresponds to the same accounting period in the previous year, and the next year. This helps in comparative analysis and provides a review and forecast tool for management.

5. The 52–53-Week Fiscal Calendar:

It is a variation of the 4–4–5 calendar. It is used by companies that want their fiscal year to end on the same day of the week. Any day of the week may be used as the ending day, and the use of Saturday and Sunday is common as this facilitates counting inventory and other year-end accounting activities due to business holiday. Some major drawbacks for non-calendar periods are:

- These calendars result in 364 days (13 periods X 4 weeks X 7 days per week) and there are 365 days in a year. This shortfall of 1 day each year needs adjustment.

- Bank statements are usually done on a monthly basis and can make the bank reconciliations process a little complicated.

- Some expenses are billed on a monthly basis. You might need to make adjustments for these types of expenses.

6. Transaction Calendar for Average Balancing:

Some industries like banking need to maintain their average daily balances. They need to define their transaction calendars specifying each valid business day for which the average balances need to be calculated and maintained in General Ledger.

What is the need for period end entries?

1. Transactions Spanning Multiple Periods:

The transactions have to be identified with a particular accounting period. However, in practice, many business transactions affect more than one accounting period like the assets held with the organization, insurance premium paid in advance, goods sold on credit, capital work in progress, etc.

2. Matching Concept:

The matching concept is an accounting principle that requires the identification and recording of expenses associated with revenue earned and recognized during the same accounting period. Under the matching principle accounting transactions needs to be related to specific accounting periods so that the corresponding revenues and expenses can be accounted for in the same accounting period. This necessitates the need to pass period-end accounting entries.

3. Calendar Adjustments:

Large corporations conduct their businesses across the globe-spanning multiple countries. In some jurisdictions or countries, the accounting books need to be maintained as per the rules prescribed by the local laws of that country. Parent company being the owner of the subsidiary units operating in different countries, need to consolidate its results for reporting in its base country of registration. As the units, that are part of the same group of businesses, are not maintaining the same fiscal year in their local books, consolidating companies need to adjust for transactions between units with different fiscal years.

What are Adjustment Periods?

Adjustment Entries and period end entries add complexity to consolidation processes and automated general ledgers help manage these complicated adjustments. ERP tools provide you with the flexibility to define more than 12 accounting periods in a financial year. As a best practice companies using automated general ledgers define adjustment periods in their accounting calendars. They put one accounting period as the "Year Open" period to clear carried over balances from last financial year and the last period as "Year Close" where adjustment transactions are made for the same financial year. These periods are generally known as “Adjustment Periods”.

Related Links

You May Also Like

-

In this article we will focus on and understand the accounting process which enables the accounting system to provide the necessary information to business stakeholders. We will deep dive into each of the steps of accounting and will understand how to identify accounting transactions and the process for recording accounting information and transactions.

-

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

-

Period End Accruals, Receipt Accruals, Paid Time-Off Accruals, AP Accruals, Revenue Based Cost Accruals, Perpetual Accruals, Inventory Accruals, Accruals Write Off, PO Receipt Accrual, Cost Accrual, etc. are some of the most complex and generally misconstrued terms in the context of general ledger accounting. In this article, we will explore what is the concept of accrual and how it impacts general ledger accounting.

-

Multi Currency - Functional & Foriegn

Currency is the generally accepted form of money that is issued by a government and circulated within an economy. Accountants use different terms in the context of currency such as functional currency, accounting currency, foreign currency, and transactional currency. Are they the same or different and why we have so many terms? Read this article to learn currency concepts.

-

A joint venture (JV) is a business agreement in which the parties agree to develop, for a finite time, a new entity and new assets by contributing equity. They exercise control over the enterprise and consequently share revenues, expenses and assets. A joint venture takes place when two or more parties come together to take on one project.

-

GL - Review & Approve Journals

Review and Approval mechanisms ensure that the accounting transaction is reasonable, necessary, and comply with applicable policies. Understand why we need review and approval processes, what are they, and how they are performed in automated general ledger systems. Learn the benefits of having journal approval mechanisms in place.

-

Matrix Organizational Structures

In recent times the two types of organization structures which have evolved are the matrix organization and the network organization. Rigid departmentalization is being complemented by the use of teams that cross over traditional departmental lines.

-

The general ledger is the central repository of all accounting information in an automated accounting world. Summarized data from various sub-ledgers are posted to GL that eventually helps in the creation of financial reports. Read more to understand the role and benefits of an effective general ledger system in automated accounting systems and ERPs.

-

Functional Organizational Structures

A functional organizational structure is a structure that consists of activities such as coordination, supervision and task allocation. The organizational structure determines how the organization performs or operates. The term organizational structure refers to how the people in an organization are grouped and to whom they report.

-

Internally, an organization can be structured in many different ways, depending on their objectives. The internal structure of an organization will determine the modes in which it operates and performs. Organizational structure allows the expressed allocation of responsibilities for different functions and processes to different entities such as the branch, department, workgroup and individual.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved