- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- Driving Business Efficiency through Divisions and Departments

Driving Business Efficiency through Divisions and Departments

In case of a multi-divisional organizational structure, there is one parent company, or head-office. And that parent owns smaller departments, under the same brand name. Dividing the firm, into several self-contained, autonomous units, provides the optimal level of centralization, in a company.

What do we mean by a department or a division, in context of organizational structures?

The divisions are nothing, but distinct parts, of the same business.

A division of a business or "business division" is one of the parts, into which a business, organization, or company is divided.

Divisions are self-contained units.

The divisional structure consists of self-contained divisions.

Divisions can be defined for different business areas, research units, or administrative offices.

They might have different appointed managers.

And, Divisions may have programmatic, operational, fiscal and budgetary responsibility, for a specific set of business activities, and projects

What is the Relationship between, legal entity and divisions?

A department or division can be viewed as the intersection between a legal entity and a business unit.

In a simplistic scenario, all divisions are part of the same company.

The company itself is legally responsible, for all of the obligations and debts of the divisions.

However, this relationship, may change, in case of large organizations.

In that case, a business division may include, one or many subsidiaries as well.

Initially, in such companies, business units which are part of the same legal entity, are setup to operate in divisions.

Later with growth, these divisions become subsidiaries, and also independent legal entities.

In such cases, various parts of the business may be run by different subsidiaries.

Each subsidiary in such a case is a separate legal entity, owned by the primary business, or by another subsidiary in the hierarchy.

Divisions are also used by management, as a tool for segregation and delegation of responsibilities, to various parts of the business.

Divisions also help the management, in operational control.

Let us understand how they help management in these objectives.

Department as a tool for, Segregation & Delegation.

In case of a multi-divisional organizational structure, there is one parent company, or head-office.

And that parent owns smaller departments, under the same brand name.

Dividing the firm, into several self-contained, autonomous units, provides the optimal level of centralization, in a company.

Although, the whole organization is controlled by central management.

But most decisions are left to autonomous divisions or departments.

Central management provides the overall direction of the firm.

While each division operates autonomously to cater to its own needs.

It is held accountable for its own profits, and can remain productive, even if the other divisions fail.

Divisions as a tool for operational control

A division is a collection of functions, which manage similar types of activities, like the one which produce a product.

They are generally used as cost accumulators and also for revenue recognition.

They may have profit and loss responsibility, and may consist of a group of cost centers.

Departments can also serve as profit centers, managing their own profitability.

In that case, they utilize a budget plan to compete, and operate, as a separate business profit center.

What are some of the basis for creating divisions?

Divisional structure could be based on, many external or internal parameters, based on the management needs.

Some commonly used parameters across industry are, product, customer segment, geographical locations etc.

For example, in case of differentiation by products, each division is responsible for certain product, and has its own resources, such as finance, marketing, warehouse, maintenance etc.

Let us look at some common methods of differentiation, for creating divisions.

First could be, By Product; For example separate divisions are created, to manage different product or service lines.

Another way is to differentiate By Geographical Location; Example is the regional offices created by companies, like Northern Division, Southern division etc.

One can also define divisions by the Type of Customer; For example in case of a bank, different divisions are created to take care of retail business, wealth management and corporate clients.

And divisions can also be created by different Processes; for example in case of a hospital, one can have a division managing admissions, another for surgery, and one for discharge processes, etc.

Related Links

You May Also Like

-

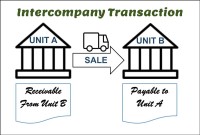

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

GL - Review & Approve Journals

Review and Approval mechanisms ensure that the accounting transaction is reasonable, necessary, and comply with applicable policies. Understand why we need review and approval processes, what are they, and how they are performed in automated general ledger systems. Learn the benefits of having journal approval mechanisms in place.

-

Generally Accepted Accounting Principles define the accounting procedures, and understanding them is essential to producing accurate and meaningful records. In this article we emphasize on accounting principles and concepts so that the learner can understand the “why” of accounting which will help you gain an understanding of the full significance of accounting.

-

A legal entity is an artificial person having separate legal standing in the eyes of law. A Legal entity represents a legal company for which you prepare fiscal or tax reports. A legal entity is any company or organization that has legal rights and responsibilities, including tax filings.

-

There are five types of core accounts to capture any accounting transaction. Apart from these fundamental accounts, some other special-purpose accounts are used to ensure the integrity of financial transactions. Some examples of such accounts are clearing accounts, suspense accounts, contra accounts, and intercompany accounts. Understand the importance and usage of these accounts.

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

-

GL - Unearned / Deferred Revenue

Unearned revenue is a liability to the entity until the revenue is earned. Learn the concept of unearned revenue, also known as deferred revenue. Gain an understanding of business scenarios in which organizations need to park their receipts as unearned. Look at some real-life examples and understand the accounting treatment for unearned revenue. Finally, look at how the concept is treated in the ERPs or automated systems.

-

Multi Currency - Functional & Foriegn

Currency is the generally accepted form of money that is issued by a government and circulated within an economy. Accountants use different terms in the context of currency such as functional currency, accounting currency, foreign currency, and transactional currency. Are they the same or different and why we have so many terms? Read this article to learn currency concepts.

-

In this article, we explain some commonly used subsidiary ledgers like accounts receivable subsidiary ledger, accounts payable subsidiary ledger or creditors' subsidiary ledger, inventory subsidiary ledger, fixed assets subsidiary ledger, projects subsidiary ledger, work in progress subsidiary ledger, and cash receipts or payments subsidiary ledger.

-

Team-Based Organizational Structure

Team-based structure is a relatively new structure that opposes the traditional hierarchical structure and it slowly gaining acceptance in the corporate world. In such a structure, employees come together as team in order to fulfill their tasks that serve a common goal.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved