- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Intercompany Accounting

GL - Intercompany Accounting

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

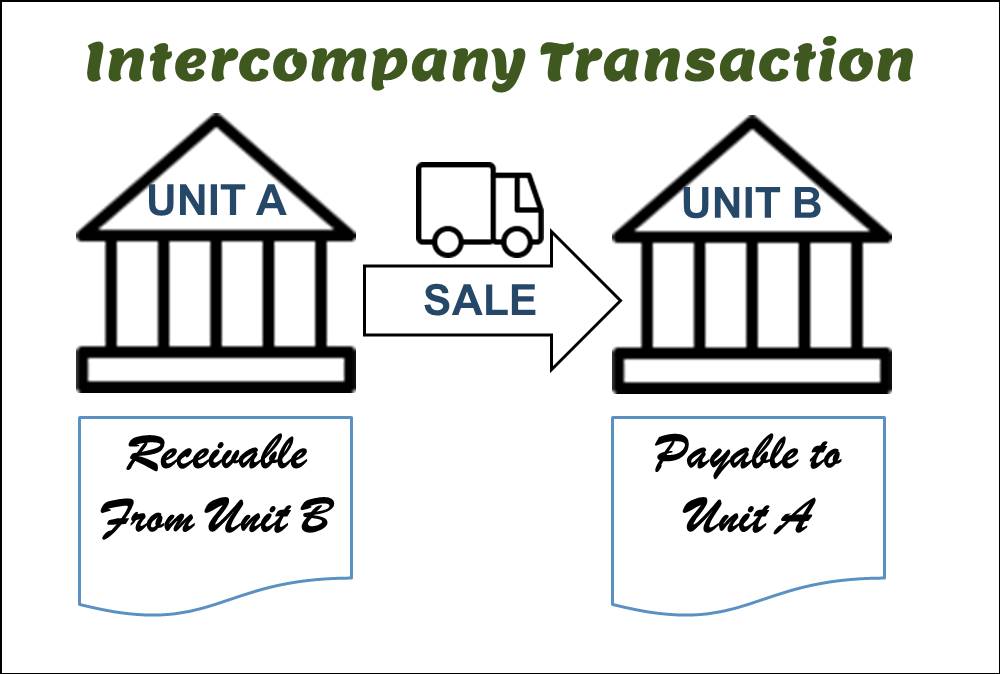

What are intercompany transactions?

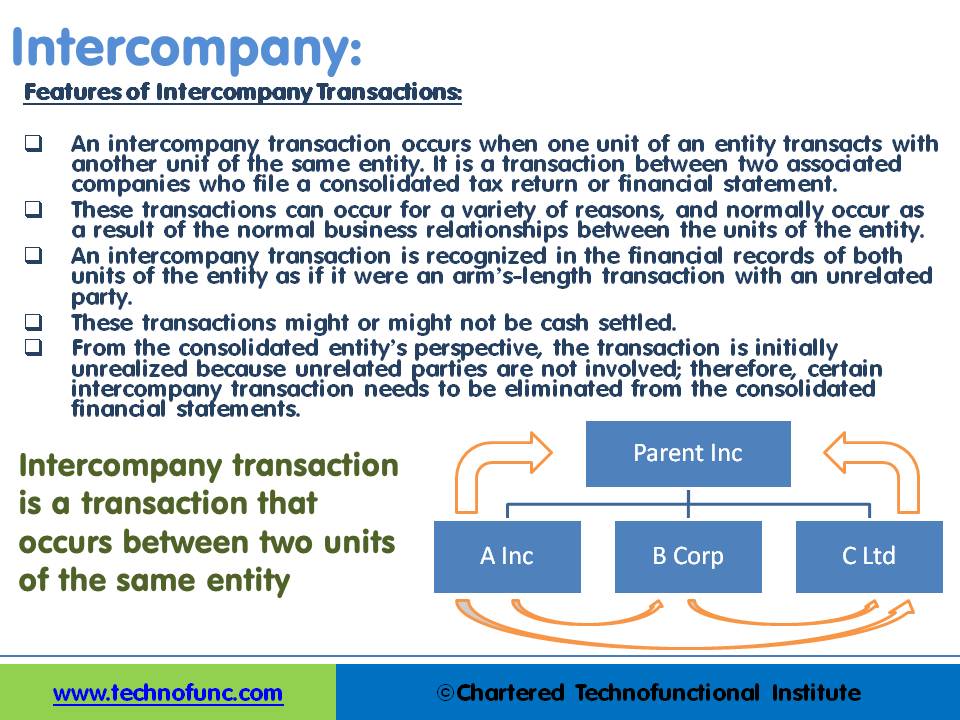

An intercompany transaction occurs when one unit of an entity is involved in a transaction with another unit of the same entity. Most economic transactions involve two unrelated entities, although transactions may occur between units of one entity (intercompany transactions). An intercompany transaction is a transaction that occurs between two units of the same entity. An intercompany transaction occurs when one unit of an entity transacts with another unit of the same entity. It is a transaction between two associated companies that file a consolidated tax return or financial statement.

Why intercompany transactions occur?

While these transactions can occur for a variety of reasons, they often occur as a result of the normal business relationships that exist between the units of the entity. These units may be the parent and a subsidiary, two subsidiaries, two divisions, or two departments of one entity.

It is common for vertically integrated organizations to transfer inventory among the units of the consolidated entity. On the other hand, a plant asset may be transferred between organizational units to take advantage of changes in demand across product lines. Intercompany transactions may involve such items as the declaration and payment of dividends, the purchase and sale of assets such as inventory or plant assets, and borrowing and lending.

Accounting Treatment for Intercompany Transactions:

An intercompany transaction is recognized in the financial records of both units of the entity as if it were an arms-length transaction with an unrelated party. From the consolidated entity’s perspective, the transaction is initially unrealized because unrelated parties are not involved; therefore, the intercompany transaction needs to be interpreted differently than it was by either of the participating units. The difference in interpretation generally results in the elimination of certain account balances from the consolidated financial statements.

The purpose of consolidated statements is to present, primarily for the benefit of the shareholders and creditors of the parent company, the results of operations and the financial position of a parent company and its subsidiaries essentially as if the group were a single company with one or more branches or divisions. Regardless of the type of transaction, the occurrence of an intercompany transaction, if not removed (eliminated) from the consolidated financial statements, will often result in a misrepresentation of the consolidated entity’s financial position.

- These transactions can occur for a variety of reasons and normally occur as a result of the normal business relationships between the units of the entity.

- An intercompany transaction is recognized in the financial records of both units of the entity as if it were an arms-length transaction with an unrelated party.

- These transactions might or might not be cash-settled.

- From the consolidated entity’s perspective, the transaction is initially unrealized because unrelated parties are not involved; therefore, the intercompany transaction needs to be eliminated from the consolidated financial statements.

Types of Intercompany Transactions:

Transactions between units of an entity can take several forms and can occur between any units of the entity. Transactions flowing from the parent to the subsidiary are commonly called downstream transactions, transactions from the subsidiary to the parent are commonly called upstream transactions, and transactions between subsidiaries are commonly called lateral transactions. Hence intercompany transactions can be classified as:

- Downstream Intercompany Transactions

- Upstream Intercompany Transactions

- Lateral Intercompany Transactions

Impact of Intercompany Transactions:

Interpreting the impact of intercompany transactions on the financial records of the units involved begins with understanding how the transactions are initially recognized on each unit’s financial records. Intercompany transactions need an effective system to manage them appropriately as it could be a complex affair for globalized companies. Some complexities are streamlining intercompany trading with unlimited trading partners, local statutory compliance with intercompany invoices for each of the trading partners, intercompany reconciliation, and transaction-level balancing for sub-ledger applications and intercompany eliminations at period close.

It is also important to understand how each intercompany transaction impacts the income statement and balance sheet of the units involved in the period of the intercompany transaction as well as in subsequent periods.

Intercompany V/s Intracompany Transactions:

Intercompany Transactions are between two or more related internal legal entities with common control, i.e. in the same enterprise. Intracompany transactions are between two or more entities within the same legal entity. Hence intercompany is cross legal entities and intracompany is across various units belonging to the same legal entity. Rules for intracompany processing can be determined by the organization based on internal procedures and guidelines, however, for intercompany transactions, companies need to follow the GAAP and the law.

Intercompany Reconciliations:

Intercompany reconciliations are required to ensure that balances owed to and from companies (legal entities) in the same group are in agreement so that when group accounts are prepared the intercompany balances all cancel out on consolidation. As organizations use multi-currency and different accounting systems, balances at business units or subsidiary companies may not match with each other and the yearend process can be delayed. Too many reconciling differences may require investigation or resolution before the balances are acceptable to management and/or auditors.

Some of the factors that give rise to intercompany differences are:

- Individual companies may book items to intercompany balances and not confirm with the other group company if they have recorded the other leg of the transaction.

- Wrong posting to/from intercompany accounts, may post balances due from other members of the group to sundry debtors or creditors

- Currency rate differences due to recording transactions on different dates may translate at different values when accounts are consolidated

- Summarization by aggregating amounts and posting them as a single journal when the counterparty posts amount individually

- Counterparties may be incorrectly identified by each other so that although the net positions are correctly stated overall the actual balance details do not eliminate

Related Links

You May Also Like

-

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

-

In every journal entry that is recorded, the debits and credits must be equal to ensure that the accounting equation is matched. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit. We will also focus on some efficient methods of recording and analyzing transactions.

-

In this article, we will describe how to determine if an account needs adjustment entries due to the application of the matching concept. Learners will get a thorough understanding of the adjustment process and the nature of the adjustment entries. We will discuss the four types of adjustments resulting from unearned revenue, prepaid expenses, accrued expenses, and accrued revenue.

-

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

-

Shared Services is the centralization of service offering at one part of an organization or group sharing funding and resourcing. The providing department effectively becomes an internal service provider. The key is the idea of 'sharing' within an organization or group.

-

Multi Currency - Functional & Foriegn

Currency is the generally accepted form of money that is issued by a government and circulated within an economy. Accountants use different terms in the context of currency such as functional currency, accounting currency, foreign currency, and transactional currency. Are they the same or different and why we have so many terms? Read this article to learn currency concepts.

-

A joint venture (JV) is a business agreement in which the parties agree to develop, for a finite time, a new entity and new assets by contributing equity. They exercise control over the enterprise and consequently share revenues, expenses and assets. A joint venture takes place when two or more parties come together to take on one project.

-

There are five types of core accounts to capture any accounting transaction. Apart from these fundamental accounts, some other special-purpose accounts are used to ensure the integrity of financial transactions. Some examples of such accounts are clearing accounts, suspense accounts, contra accounts, and intercompany accounts. Understand the importance and usage of these accounts.

-

The sole trader organization (also called proprietorship) is the oldest form of organization and the most common form of organization for small businesses even today. In a proprietorship the enterprise is owned and controlled only by one person. This form is one of the most popular forms because of the advantages it offers. It is the simplest and easiest to form.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved