- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Cash Management

- Clearing V/s Suspense Account

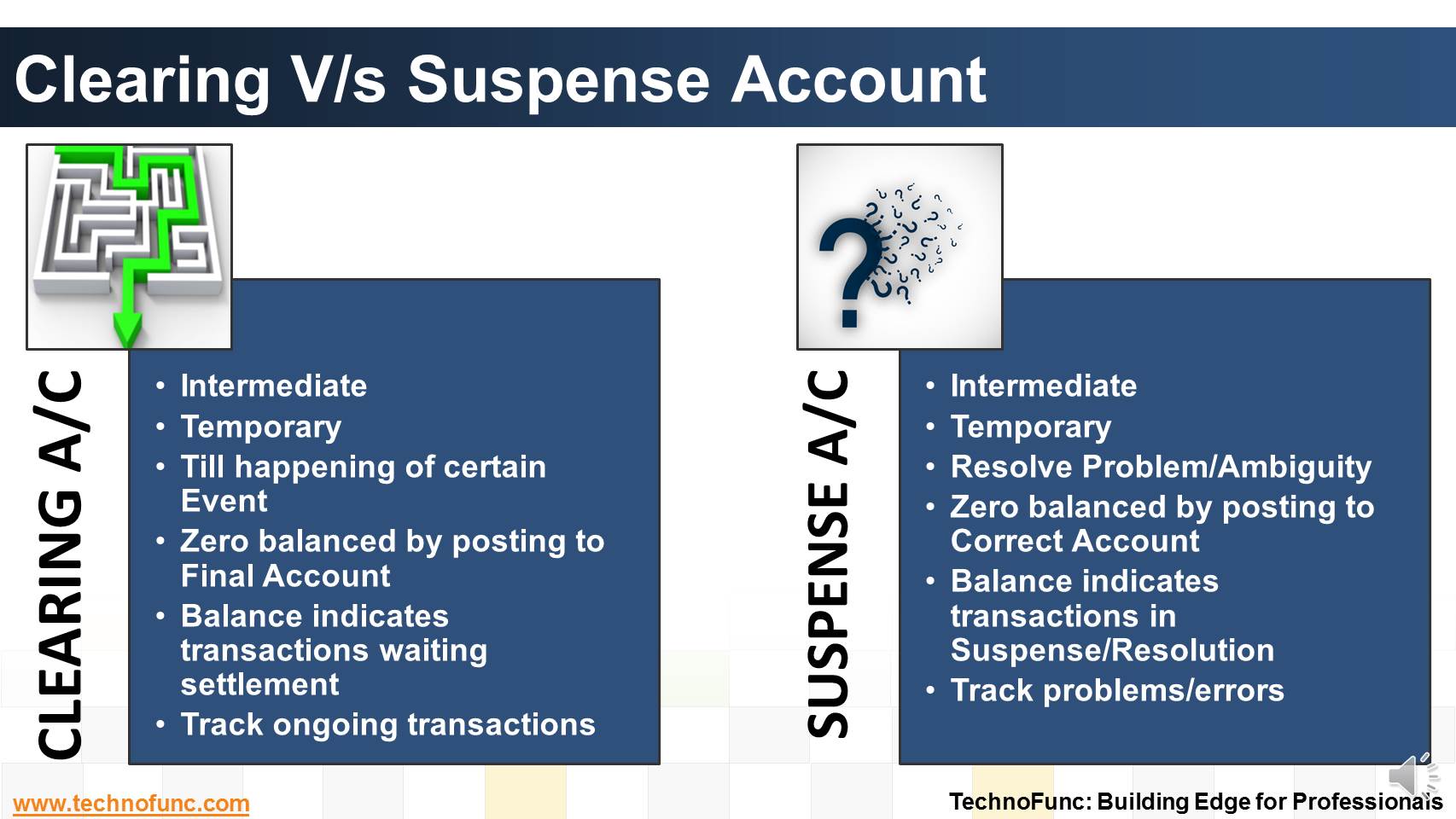

Clearing V/s Suspense Account

Suspense and clearing accounts resemble each other in many respects but there exists important fundamental difference between the two. Read more to explore these differences.

Suspense and clearing accounts resemble each other in many respects but there exists one important fundamental difference.

Both are temporary accounts. Transactions are entered and finally transferred to the appropriate account.

Suspense and clearing accounts have entirely different functions.

Clearing accounts are used to hold transactions for later posting and ensure information is recorded correctly and completely.

A suspense account is used when there appears to be a problem. It serves to record an amount until the problem is resolved.

Both suspense and clearing accounts are "zeroed out" periodically. This means everything in an account is moved to other accounts, leaving a zero balance.

Suspense A/c is used for tracking Uncertainties – to hold transactions when there is some ambiguity involved.

For example, customer has deposited payment in the bank account and you are unable to identify the customer from available information,

You can put the transaction in a suspense account until you determine where it belongs.

Whereas Clearing Accounts are used for tracking transactions on a temporary basis until it's time to post them to a more permanent account.

Taking the same example, now the customer has sent payment against many outstanding invoices and you know it belongs to a particular customer but not to which invoice.

This may be parked in a clearing account until the confirmation is received from customer and amount applied to correct invoice.

Just to keep track of correct outstanding past due invoices.

Related Links

You May Also Like

-

Many different accounts are used in finance. Understand the representation and nature of clearing account in context of accounting, finance and ERP Systems.

-

Treasury has increasingly become a strategic business partner across all areas of the business, adding value to the operating divisions of the company. Managing activities that were traditionally carried out within the general finance function. Learn about the drivers for this change.

-

Have you ever wondered what is actually a Bank Statement and why it is needed. What is the information that is available in a bank statement?

-

Suspense and clearing accounts resemble each other in many respects but there exists important fundamental difference between the two. Read more to explore these differences.

-

The objective of Financial risk management is to protect assets and cash flows from any risk. Treasury function works to accurately assess financial risks by identifying financial exposures including foreign exchange, interest rate, credit, commodity and other enterprise risks. Learn about the various risks that are managed by treasury.

-

Complete Bank Reconciliation Process

Bank Reconciliation Process is a eight step process starting from uploading the Bank Statement to finally posting the entries in General Ledger. Learn the Eight Steps in Detail!

-

Introduction to Cash Clearing Process

Unravel the mystery behind clearing accounts. Learn why clearing accounts are used in finance and accounting. Learn why so many clearing accounts are defined in ERPs and Automated Accounting Systems.

-

The terms Treasury Management and Cash Management are sometimes used interchangeably, while, in fact, the scope of treasury management is larger and includes funding and investment activities as well. Learn all about Treasury Management here!

-

Account Reconciliation – How? Learn the three key attributes to perfom account reconciliation.

-

Bank reconciliation process is targeted to validate the bank balance in the general ledger and explain the difference between the bank balance shown in an organization's bank statement. Learn the reasons for existence of differences between the two.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved