- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- The Subsidiary Ledgers

The Subsidiary Ledgers

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

What are Subsidiary Ledgers?

In the previous articles, we have learned that journals present a chronological listing of a company's daily transactions, which are then posted to General Ledger. The general ledger of a business is the place where all account information is posted and a balance is maintained for each account. Based on the order of the Chart of Accounts, the general ledger contains accounts organized by assets, liabilities, shareholders' equity, revenue, and expenses. For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger.

Subsidiary ledgers are often used in addition to a general ledger, to focus on particular areas of interest and capture additional and granular details pertaining to that particular area and reduce the need for excessive details in the general ledger. General ledger accounts with a large volume of repetitive transactions or multiple transaction sources often warrant subsidiary ledgers. All the day to day financial information for such accounts is first posted in Subsidiary Leaders and at a periodic interval, subsidiary ledger information is summarized in the corresponding control account of the general ledger. In each subsidiary ledger, subaccount balances are maintained for the various sources contributing transactions to the account, and each source has its own sub-account level balance.

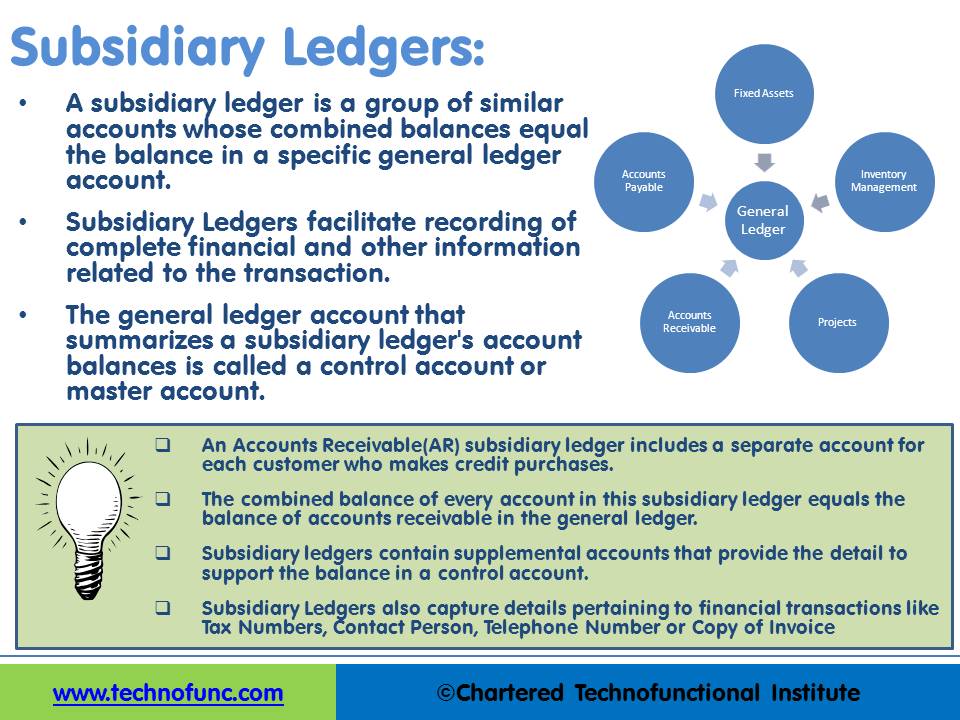

Balances in General Ledger are supported by various sub-ledgers. A subsidiary ledger is a group of similar accounts whose combined balances equal the balance in a specific general ledger account. Subsidiary Ledgers facilitate the recording of complete financial and other information related to the transaction.

What is the Need for Subsidiary Ledgers?

Consider any one account in a general ledger, such as Accounts Payable. Perhaps you want to know how much money you currently owe to each of your suppliers and this information is very critical for you to manage your relationship with that supplier and to ensure that you are paying only for what you purchased and received. If you only have one or two suppliers, it is easily possible to compile this information directly in the general ledger by opening two natural accounts in the name of the suppliers. But what if you have hundreds or even thousands of suppliers? In that case, you may want to create subsidiary ledgers for accounts payable that will capture the complete master and transactional level details for each of your suppliers. This way, you can record the details of transactions involving each supplier in the relevant subsidiary ledger and then subsequently transfer the totals into a control account in the general ledger.

Let’s also understand the concept of Subsidiary Ledger by having a look at the Accounts Receivable Process. We have an “Accounts Receivable” (AR) subsidiary ledger that includes a separate account for each customer who makes credit purchases. The combined balance of every account in this AR subsidiary ledger equals the balance of “Accounts Receivable Account” in the general ledger. “Accounts Receivable Account” is also known as “Customer Receivable Control Account”. Subsidiary ledgers contain supplemental accounts that provide the detail to support the summary balance in a control account. Subsidiary Ledgers also capture details pertaining to financial transactions like “Tax Numbers”, “Contact Person”, “Telephone Number” or “Copy of Invoice”. In IT; subsidiary ledgers are also called Modules in the accounting system.

To give you another example; In the Fixed Assets Subsidiary Ledger, you can find all the details pertaining to fixed assets owned by the company. Apart from the financial details like cost of the assets, other information like date of purchase, date when the asset was put to use in business, name of the supplier, storage and location of the asset etcetera are also captured in subsidiary ledgers.

What is Control Account in General Ledger?

Each subsidiary ledger has a corresponding control account in the general ledger. The general ledger account that summarizes a subsidiary ledger's account balances is called a Control Account or master account. Accounting transactions are captured in General Ledger at a summarized level and all relevant details for that transaction are available in the subsidiary ledgers.

For example, accounts receivable is the controlling account in the general ledger for the accounts receivable subsidiary ledger. While the subsidiary ledger displays the detailed data by the customer, the control account summarizes that data by the account that reflects the summation of balances for all customers captured in the respective subsidiary ledger. After entering the transactional information pertaining to customers and credit sales in the AR Subsidiary Ledger, totals are subsequently entered into the control account in the general ledger. The total balance information must be the same in both forms, so each general ledger control account balance is checked against the combined balances of the individual accounts in its subsidiary ledger at the end of the accounting period.

For any given business account, the level of detail needed varies. Therefore, some general ledger accounts will not need subsidiary ledgers. Those with no corresponding subsidiary ledgers are not referred to as control accounts.

What are the Advantages of Subsidiary Ledgers?

Subsidiary ledgers have a number of efficiency benefits. They show up-to-date information on individual account balances, freeing the general ledger of the need for excessive detail. And just as with special journals, subsidiary ledgers allow simultaneous processing of general ledgers.

It enables you to keep track of your due to and due from with each of your external parties or transaction sources, which helps you assess your financial situation with each of your customers and suppliers – for example, how much money you owe to them.

Apart from just capturing the financial information that has an economic impact you can easily capture additional information in your subsidiary leaders. For example, you can capture the credit rating, payment terms, contact information, birthday, etc. against each of your customers.

Using an accounts payable subsidiary ledger, organized alphabetically by the supplier, puts individual account balance information at your fingertips. The same holds true for accounts receivable and customers.

Some of the commonly used subsidiary ledgers are “Fixed Assets”, “Accounts Payable”, Accounts Receivable”, “Projects” and “Inventory” and they all send the financial data to General Ledger.

Related Links

You May Also Like

-

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

-

The purpose of the general ledger is to sort transaction information into meaningful categories and charts of accounts. The general ledger sorts information from the general journal and converts them into account balances and this process converts data into information, necessary to prepare financial statements. This article explains what a general ledger is and some of its major functionalities.

-

Learn the typical accounting cycle that takes place in an automated accounting system. We will understand the perquisites for commencing the accounting cycle and the series of steps required to record transactions and convert them into financial reports. This accounting cycle is the standard repetitive process that is undertaken to record and report accounting.

-

An allocation is a process of shifting overhead costs to cost objects, using a rational basis of allotment. Understand what is the meaning of allocation in the accounting context and how defining mass allocations simplifies the process of allocating overheads to various accounting segments. Explore types of allocations and see some practical examples of mass allocations in real business situations.

-

As the business grows, the company may want to transition to a branch structure as branches are allowed to conduct a much broader range of activity than representative offices. Branches can buy and sell goods, sign contracts, build things, render services, and generally everything that a regular business can do. A company expands its business by opening up its branch offices in various parts of the country as well as in other countries.

-

In every journal entry that is recorded, the debits and credits must be equal to ensure that the accounting equation is matched. In this article, we will focus on how to analyze and recorded transactional accounting information by applying the rule of credit and debit. We will also focus on some efficient methods of recording and analyzing transactions.

-

In some of the ERP tools, there are more than 12 accounting periods in a financial year. This article discusses the concept of accounting calendar and accounting periods. Learn why different companies have different accounting periods. Understand some of the commonly used periods across different organizations and the definition & use of an adjustment period.

-

Trial Balance in General Ledger

One of the greatest benefits of using a double-entry accounting system is the capability to generate a trial balance. What do we mean by trial balance? As the name suggests a trial balance is a report that must have its debits equals to credits. Understand the importance of trial balance and why it is balanced. Learn how it is prepared and in which format.

-

An organizational design is the process by which a company defines and manages elements of structure so that an organization can control the activities necessary to achieve its goals. Good organizational structure and design helps improve communication, increase productivity, and inspire innovation. Organizational structure is the formal system of task and activity relationships to clearly define how people coordinate their actions and use resources to achieve organizational goals.

-

When the quantum of business is expected to be moderate and the entrepreneur desires that the risk involved in the operation be shared, he or she may prefer a partnership. A partnership comes into existence when two or more persons agree to share the profits of a business, which they run together.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved