- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Periods and Calendars

GL - Periods and Calendars

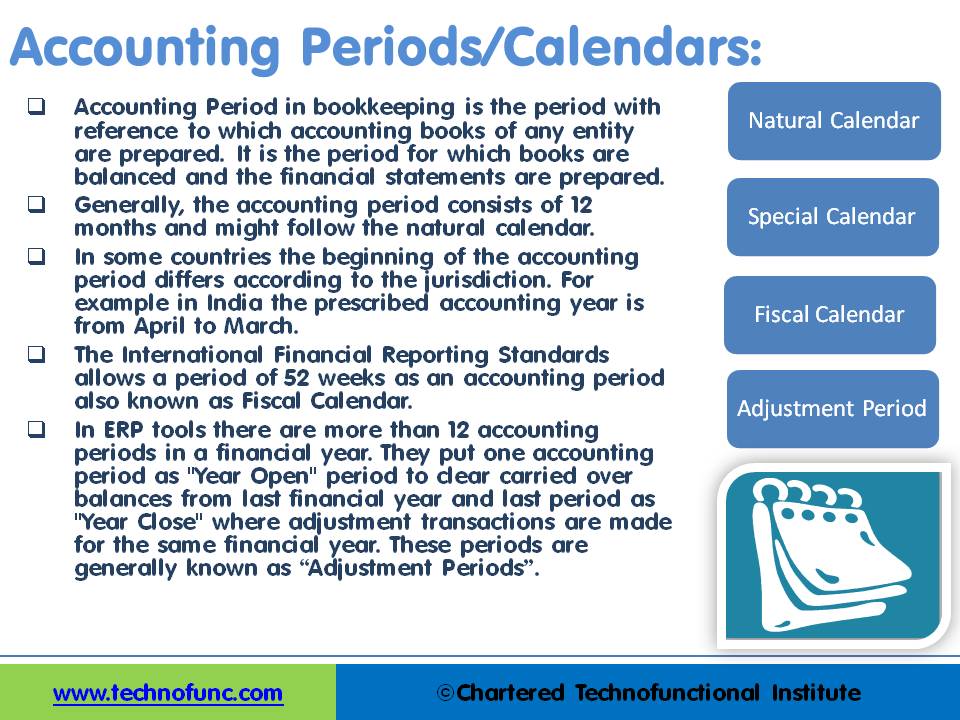

In some of the ERP tools, there are more than 12 accounting periods in a financial year. This article discusses the concept of accounting calendar and accounting periods. Learn why different companies have different accounting periods. Understand some of the commonly used periods across different organizations and the definition & use of an adjustment period.

What is an Accounting Period?

The accounting Period in bookkeeping is the period with reference to which accounting books of any entity are prepared. It is the period for which books are balanced and the financial statements are prepared. In accounting, financial results are measured by periods. Any period with a defined beginning and end can be used for an accounting period.

Why we need Accounting Periods?

The accounting entity is viewed as a going concern and is expected to have a fairly long life. To determine the exact profit or loss of a business enterprise one needs to find that realizable difference between the end value of equity at closure and the investment into the business by the owners. The real value can be determined only when the enterprise is liquidated.

But the owners need to know the profitability of the business on an ongoing basis to make informed business decisions. Hence, to overcome this problem, the accountants have developed the “Concept of Periodicity” for reporting the periodical progress of a business entity. This period for which the enterprise is determining and reporting its operating profit is the accounting period.

Why organizations use different Accounting Periods?

Generally, the accounting period consists of 12 months but we see differences in the way different organizations define their accounting period. There exist multiple reasons for the same.

1. Regulatory Reasons:

Some periods are set by outside authorities and in that case, the beginning of the accounting period differs according to the jurisdiction. For example, one entity may follow the regular calendar year, i.e. January to December as the accounting year, while another entity may follow April to March as the accounting period. The International Financial Reporting Standards even allows a period of 52 weeks as an accounting period instead of a proper year. Most of the time organizations choose to go with the statutory prescribed fiscal period like going with the periods they need to have for tax purposes. Many countries have prescribed accounting periods that do not follow the natural calendar and these periods are compulsory to be followed by all organizations conducting business in that country. In that case, multi-national companies also need to follow the same period for the operations conducted in that country. This also creates different accounting periods as compared to the global parent company.

2. Business Specific Reasons:

Sometimes business circumstances are very compelling to warrant different accounting periods and in that case accounting periods are set solely at the discretion of the company based on their specific business needs, and as explained above, organizations are allowed to define as many periods as they want as long as they meet legal requirements. For example, many restaurants, nearly all the larger chain operators, define their accounting period as consisting of four weeks. They have 13 four-week periods a year, instead of 12 monthly statements. The business reason being, most restaurants do 45% to 60% and even more of their weekly sales on two days of the week, normally Friday and Saturday. This makes it difficult to compare results using monthly periods as the number of week-ends differs from month to month.

What are some commonly used accounting calendars and periods?

1. Natural Calendar:

Generally, the accounting period consists of 12 months and might follow the natural calendar. Natural Calendar follows the natural sequence of months from January to December.

2. Special Calendar:

Any calendar not following the natural months is a “Special Calendar”, for example, a special calendar from “April to March”. In some countries, the beginning of the accounting period differs according to the jurisdiction. For example in India, the prescribed accounting year is from April to March. The Australian government's financial year begins on July 1 and concludes on June 30 of the following year. The Financial Year in Costa Rica spans from October 1 until September 30 of the following year.

3. Fiscal Calendar:

The International Financial Reporting Standards allow up-to a period of 52 weeks as an accounting period also known as “Fiscal Calendar”. A large number of companies use 52 weeks fiscal calendar for their reporting and financial tracking purposes. Many companies find that it is convenient for purposes of comparison and also for accurate stock taking to always end their fiscal year on the same day of the week, where local legislation permits. Thus some fiscal years will have 52 weeks and others 53. Fiscal years vary between businesses and countries. The fiscal year may also refer to the year used for financial reporting or for Income Tax Reporting.

4. The 4–4–5 Calendar:

It is another method of managing accounting periods. It is a common calendar structure for some industries, like the retail, manufacturing, and parking industry. 4–4–5 calendar divides a year into 4 quarters. Each quarter has 13 weeks which are grouped into two 4-week "months" and one 5-week "month". The grouping of 13 weeks may be set up as 5–4–4 weeks or 4–5–4 weeks, but the 4–4–5 is the most common arrangement. Its major advantage over a regular calendar is that the end date of the period is always the same day of the week, which is useful for shift or manufacturing planning, and in this calendar, every period is the same length. Each accounting period for one business year corresponds to the same accounting period in the previous year, and the next year. This helps in comparative analysis and provides a review and forecast tool for management.

5. The 52–53-Week Fiscal Calendar:

It is a variation of the 4–4–5 calendar. It is used by companies that want their fiscal year to end on the same day of the week. Any day of the week may be used as the ending day, and the use of Saturday and Sunday is common as this facilitates counting inventory and other year-end accounting activities due to business holiday. Some major drawbacks for non-calendar periods are:

- These calendars result in 364 days (13 periods X 4 weeks X 7 days per week) and there are 365 days in a year. This shortfall of 1 day each year needs adjustment.

- Bank statements are usually done on a monthly basis and can make the bank reconciliations process a little complicated.

- Some expenses are billed on a monthly basis. You might need to make adjustments for these types of expenses.

6. Transaction Calendar for Average Balancing:

Some industries like banking need to maintain their average daily balances. They need to define their transaction calendars specifying each valid business day for which the average balances need to be calculated and maintained in General Ledger.

What is the need for period end entries?

1. Transactions Spanning Multiple Periods:

The transactions have to be identified with a particular accounting period. However, in practice, many business transactions affect more than one accounting period like the assets held with the organization, insurance premium paid in advance, goods sold on credit, capital work in progress, etc.

2. Matching Concept:

The matching concept is an accounting principle that requires the identification and recording of expenses associated with revenue earned and recognized during the same accounting period. Under the matching principle accounting transactions needs to be related to specific accounting periods so that the corresponding revenues and expenses can be accounted for in the same accounting period. This necessitates the need to pass period-end accounting entries.

3. Calendar Adjustments:

Large corporations conduct their businesses across the globe-spanning multiple countries. In some jurisdictions or countries, the accounting books need to be maintained as per the rules prescribed by the local laws of that country. Parent company being the owner of the subsidiary units operating in different countries, need to consolidate its results for reporting in its base country of registration. As the units, that are part of the same group of businesses, are not maintaining the same fiscal year in their local books, consolidating companies need to adjust for transactions between units with different fiscal years.

What are Adjustment Periods?

Adjustment Entries and period end entries add complexity to consolidation processes and automated general ledgers help manage these complicated adjustments. ERP tools provide you with the flexibility to define more than 12 accounting periods in a financial year. As a best practice companies using automated general ledgers define adjustment periods in their accounting calendars. They put one accounting period as the "Year Open" period to clear carried over balances from last financial year and the last period as "Year Close" where adjustment transactions are made for the same financial year. These periods are generally known as “Adjustment Periods”.

Related Links

You May Also Like

-

Network Organizational Structures

The newest, and most divergent, team structure is commonly known as a Network Structure (also called "lean" structure) has central, core functions that operate the strategic business. It outsources or subcontracts non-core functions. When an organization needs to control other organizations or agencies whose participation is essential to the success, a network structure is organized.

-

GL - Accrued / Unbilled Revenue

Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. Understand what we mean by the terms accrued revenue, accrued assets, and unbilled revenue. Explore the business conditions that require recognition of accrued revenue in the books of accounts and some industries where this practice is prevalent.

-

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

-

What is Accounting & Book Keeping

Accounting is a process designed to capture the economic impact of everyday transactions. Each day, many events and activities occur in an entity, these events and activities are in the normal course of business; however, each of these events may or may not have an economic impact. Events or activities that have an effect on the accounting equation are accounting events.

-

Horizontal or Flat Organizational Structures

Flat organizational structure is an organizational model with relatively few or no levels of middle management between the executives and the frontline employees. Its goal is to have as little hierarchy as possible between management and staff level employees. In a flat organizational structure, employees have increased involvement in the decision-making process.

-

McKinsey 7S Framework is most often used as an organizational analysis tool to assess and monitor changes in the internal situation of an organization. The model is based on the theory that, for an organization to perform well, seven elements need to be aligned and mutually reinforcing.

-

Matrix Organizational Structures

In recent times the two types of organization structures which have evolved are the matrix organization and the network organization. Rigid departmentalization is being complemented by the use of teams that cross over traditional departmental lines.

-

An allocation is a process of shifting overhead costs to cost objects, using a rational basis of allotment. Understand what is the meaning of allocation in the accounting context and how defining mass allocations simplifies the process of allocating overheads to various accounting segments. Explore types of allocations and see some practical examples of mass allocations in real business situations.

-

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

-

Although technically a general ledger appears to be fairly simple compared to other processes, in large organizations, the general ledger has to provide many functionalities and it becomes considerably large and complex. Modern business organizations are complex, run multiple products and service lines, leveraging a large number of registered legal entities, and have varied reporting needs.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved