- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Procure to Pay

- Accounts Payable Journal Entry

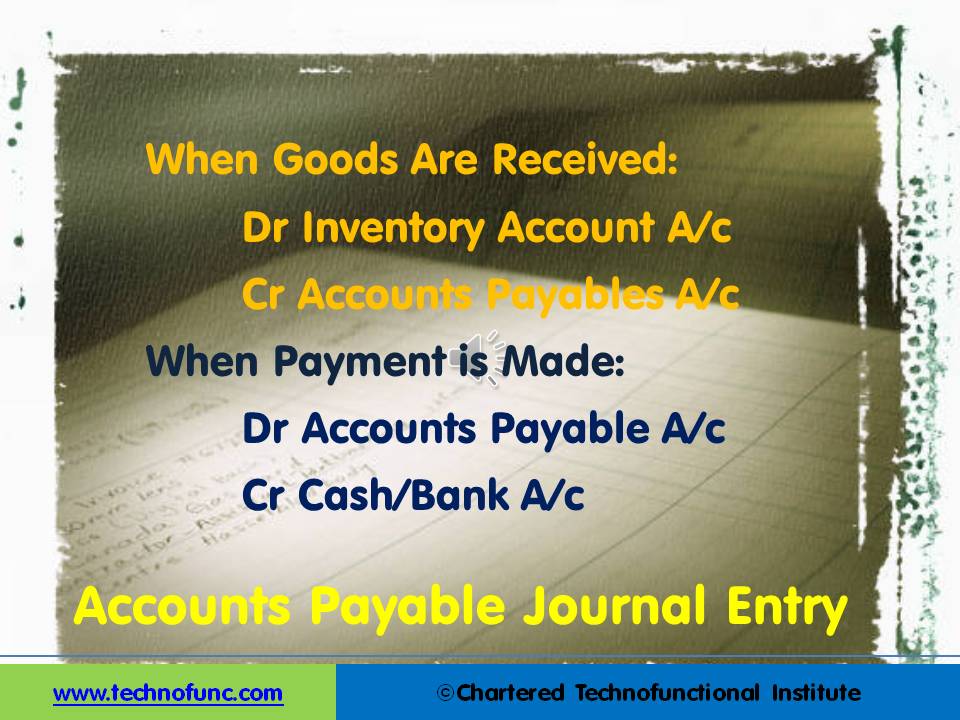

Accounts Payable Journal Entry

Although in the large organizations the Procure to Pay Accounting process starts when the purchase order for supply of goods is released to the supplier. To keep things simple in the beginning we will discuss the core accounting entries related to the Accounts Payables process.

Accounts Payable Journal Entry

As discussed earlier “Accounts Payable” refers to the accounting entry that indicates a short term liability payable to the supplier of goods and services for the goods supplied or services rendered.

Although in the large organizations the Procure to Pay Accounting process starts when the purchase order for supply of goods is released to the supplier. To keep things simple in the beginning we will discuss the core accounting entries related to the Accounts Payables process.

Receipt of Goods:

You issue purchase order to the supplier and he supplies you with the goods. Once the ownership of the goods gets transferred from the supplier to us, we account for the goods as our inventory and based on the invoice received from the supplier need to create a liability for the payment due to him. At this stage the accounting entry is:

Debit Inventory Account

Credit Accounts Payable Account

Making Payment to the Supplier:

Once the payment for the invoice is released then funds gets released from the bank or cash and the amount due to the supplier gets knocked off. For this part the accounting entry is:

Debit Accounts Payable Account

Credit Cash/Bank Account

Related Links

You May Also Like

-

Inventory is money, and hence businesses need to perform physical inventory counts periodically to make sure that their inventory records are accurate. The traditional approach to conducting inventory counts is to shut down a facility during a slow time of year to count everything, one item at a time. This process is slow, expensive, and (unfortunately) not very accurate.

-

Understand what we mean by accounts payable. Why the process is called accounts payable and what are the other names by which this process is known as. Download a ready recokner to keep with you.

-

Accounts Payable Journal Entry

Although in the large organizations the Procure to Pay Accounting process starts when the purchase order for supply of goods is released to the supplier. To keep things simple in the beginning we will discuss the core accounting entries related to the Accounts Payables process.

-

Warehouses may seem like a simple, straightforward concept, but they actually include a variety of different types of warehouses that all have their own niche. The type of warehousing that’s right for you depends on your specific industry, location, and needs. From private warehousing, distribution centers, and climate-controlled warehouses, there’s an option to suit every business.

-

Before shipping, businesses need to make sure that the items will arrive in good condition. Packaging is a form of protection against environmental threats that the product will face from the time it leaves warehouse facility until the time it reached the customer. The packaging is intended to provide protection for the item as it is being handled in the warehouse or when the item is being shipped.

-

Types of Inventory Count Processes

While dealing with lots of inventory in a warehouse, lots of things can go wrong. Shipments may not have the right number of units in them, or they could get damaged somewhere along the supply chain. Discrepancies in the stock may arise as part of every inventory control, and need to be corrected immediately after the inventory control procedure has been finished.

-

Resource Planning is the process of planning for expected workload and determining the number of resources required to complete each activity in the warehouse. There are many types of warehouse positions, and they also vary by the employer, the scale of operations and location. Discussed here are generic positions applicable to warehouse management processes.

-

One of the most important decisions when running a warehouse is its layout. Warehouse layout defines the physical arrangement of storage racks, loading and unloading areas, equipment and other facility areas in the warehouse. A good layout aligned with the business needs could have a significant effect on the efficiency.

-

At a high level, the essential elements in a warehouse are an arrival bay, a storage area, a departure bay, a material handling system and an information management system. As part of the process for enabling a warehouse layout, you must define warehouse zone groups, and zones, location types, and locations.

-

Understand the Accounts Payable process. Understand the AP cycle and the various tasks that need to be completed during AP transaction processing. Learn the key activities and setups that are done in any typical system during the AP processing.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved