- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- The Accounting Cycle

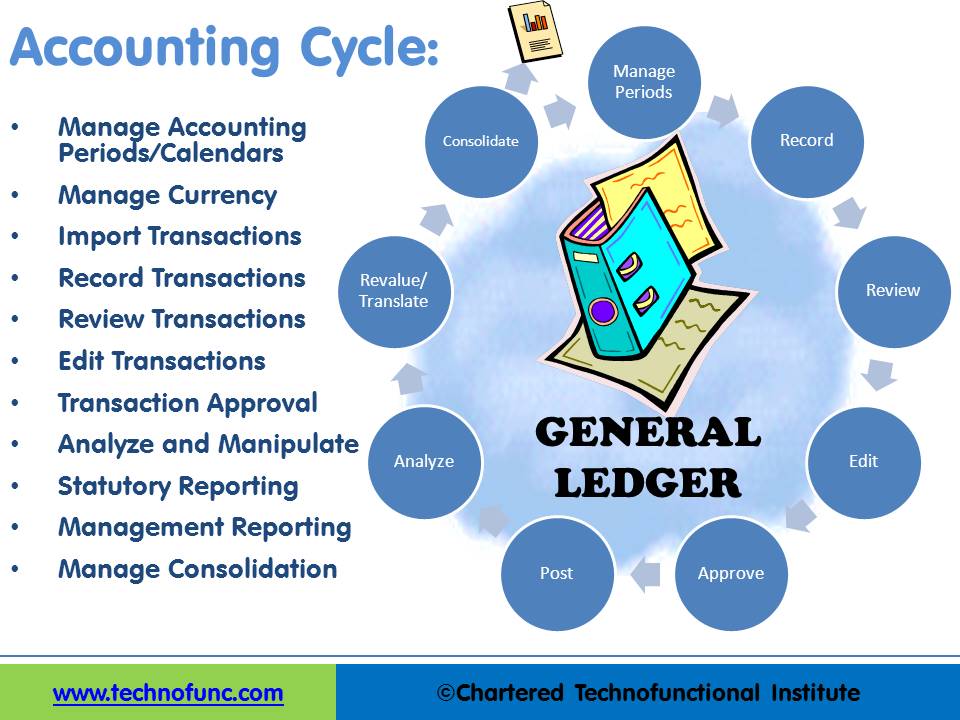

The Accounting Cycle

Learn the typical accounting cycle that takes place in an automated accounting system. We will understand the perquisites for commencing the accounting cycle and the series of steps required to record transactions and convert them into financial reports. This accounting cycle is the standard repetitive process that is undertaken to record and report accounting.

Accounting Cycle is the collective and repetitive process of recording and processing the accounting events of a company in different accounting periods. The series of steps begin when a business transaction occurs and end with the period closure where the cycle is again repeated.

Steps of Accounting Process

We have discussed the five steps of the accounting process in the article “The Accounting Process”.

Those five steps were:

- Step1: Identifying Business Stakeholders

- Step2: Understanding Accounting Needs

- Step3: Identifying Accounting Transactions

- Step4: Recording Transactions

- Step5: Preparing Accounting Reports

The Accounting Cycle

The prerequisite for the accounting cycle to begin in automated systems is that you have already identified your stakeholders and have designed an automated accounting system to cater to their reporting and recording needs. You have established a system in place to identify accounting transactions. Once you have identified your accounting transactions, the next step is to record them into your accounting system. Before you can start recording financial transactions in any books you need to have some basic information available. The minimum required information is:

- Nature of parties entering into the transaction (This leads to having a chart of accounts).

- Date when the transaction took place (This leads to having accounting periods and calendars).

- The money involved in the financial transaction (This leads to having currencies).

Once you have all the three above, the typical accounting cycle has eight recurring steps that are explained below:

1. Manage Accounting Periods/Calendars:

The accounting Period in bookkeeping is the period with reference to which accounting books of any entity are prepared. It is the period for which books are balanced and the financial statements are prepared. As a general practice the accounting period consists of 12 months and might follow the natural calendar, however, many companies define different lengths of dates as their accounting periods as explained in Accounting Periods and Calendars article.

The accounting period groups the transactions pertaining to a specified date range and facilitates the reporting of financial activity for that period. You define accounting periods in automated accounting systems to generate financial reports at the end of the period. Periods needs to be opened before any transaction can be entered for any accounting period. The first step in the accounting cycle is to make available the “Accounting Period” in which the transaction will be recorded.

2. Manage Currency:

Currency is the generally accepted form of money that is issued by a government and circulated within an economy. Currency is used as a medium of exchange for goods and services. Every nation has its own currency and global trade results in the exchange of currencies of different countries.

Accounting Currency is the monetary unit used while recording transactions in the company's financial books. “Accounting Currency” is also known as “Functional Currency” and is the main currency used by a business entity. The accounting currency may not necessarily be the same as the transacting currency. Transacting currency is the currency that customers deal with when conducting a transaction. Companies are likely to use their home country's currency (Accounting Currency) when recording transactions, even if the sale was denominated in some other currency (Foreign Currency). You can explore currency concepts in the article on “Currency”.

However, the automated systems provide you with the flexibility to enter a transaction in the transacting foreign currency and have the capability to convert that entered amount into functional or accounting currency using the appropriate exchange rate. For this to happen, relevant currencies must be defined in the system and need to be available for recording the transaction.

3. Import Transactions/Record Transactions:

In the previous lesson, we saw some examples of commonly used subsidiary ledgers. Companies extensively use modules like accounts receivable subsidiary ledger, accounts payable subsidiary ledger or creditors' subsidiary ledger, inventory subsidiary ledger, fixed assets or property or plant & equipment subsidiary ledger, projects subsidiary ledger, work in progress subsidiary ledger and cash receipts or payments subsidiary ledger, to capture their source transactional data.

If you are recording transactions in your subsidiary ledgers, you need to import the financial and economic impact, that is, Debit and Credit of transaction amounts and accounts to the general ledger. Importing transactions in automated accounting systems is an automated process.

General Ledger also allows users to directly add transactions in the GL. In that case, you need to follow the accounting principles and the steps explained in the accounting process. This step completes the recording transactions process.

4. Review Transactions/Edit Transactions:

The transactions can be reviewed for accuracy and completeness once they have been entered into the automated accounting system. If a review is done by another person who is not responsible or involved in recording the transaction it can help to ensure that financial information in the journals accurately reflects actual activity.

A review of transactions is done to ensure that the transaction is within the guidelines of the purpose of the accounts used and is appropriately charged to the account following the concepts defined in the accounting equation. In the case of manual journals, one must ensure that the transaction is consistent with available supporting documents. If any errors are found in the transaction, they can be edited and corrected at this stage.

5. Journal Approval:

The segregation of the Duties concept requires that the responsibility for related operations should be divided among two or more persons. This decreases the possibility of errors and fraud. In the case of journal recording the journal entered by one person needs to be approved by another person in this step. This ensures having more than one person to complete the “Journal Creation Task”. In GL the separation by getting the financial transaction approved by more than one individual prevents fraud and error.

Automated accounting systems provide you with the functionality of sending the journals for approval to the designated person. The system will validate the journal batch, determine if approval is required, and submit the batch to approvers (if required), then notifies appropriate individuals of the approval results.

6. Analyze and Manipulate:

You can inquire about your transactions and balances once they have been entered, approved, and posted in the General Ledger System. You might need to analyze and manipulate your data to comply with accounting standards and policies. You also may need to pass adjustment entries to tie your management books with the statutory books.

The analysis and updating of accounts at the end of the period before the financial statements are prepared is called the adjusting process. The journal entries that bring the accounts up to date at the end of the accounting period are called adjusting entries. If any adjustments need to be done they can be carried out in General Ledger. All automated accounting systems and ERPs provide you with the flexibility of analyzing and manipulating accounting data to make adjustments.

7. Manage Consolidation:

Consolidation is a bringing together of the financial statements of the investor (usually called the parent company) and the investee (typically referred to as its subsidiary). Consolidation in financial accounting is a technique that summarizes a group of companies' financial statements into one. This enables the management and investors to have a holistic view of the financial affairs of the whole group together. The aim of consolidated financial statements is to show the performance of the group as if it were a single entity.

Doing consolidation typically involves a complex set of eliminating and consolidating entries to work back from individual financial statements to a group financial statement that is an accurate representation of the operations of the group as a whole. This process involves the elimination of all intra-group transactions (example: sales from one group company to another group company) and intra-group balances (example: intercompany loans).

In automated systems, the consolidation process needs to happen at the account level and all similar accounts need to be mapped to the consolidation set of accounts. One might need to adjust periods so that each of the consolidating units covers the same time periods for the consolidation to be accurate. If the currencies between various entities are different, revaluation and translation of balances must happen before the consolidation process. For this process, the prerequisite is to bring all your balances in a common format for consolidation. Every ERP supports consolidation and it is a very important step for companies that have a large number of legal entities.

8. Generate Financial Reports:

Finally, once the consolidation has happened if required, the next logical step in the accounting cycle is to prepare the business reports and provide them to the stakeholders according to their informational needs. The double-entry system enables accountants to prepare some standard reports like trial balance, profit, and loss account and balance sheet. Accounting reports are based on generally accepted accounting standards and these reports are powerful tools to help the business owner, accountant, banker, or investor analyze the results of their operations.

All ERPs and automated accounting systems come with a large number of seeded reports, as well as provide tools to perform all demand reporting. Special recurring reports can be designed once and used at the end of every accounting period.

Why Accounting Cycle?

This process is called the accounting cycle because this is an ongoing process. The accounting principle of “Going Concern” assumes that the business will remain in existence for an indefinite period of time. During this time, your accounting periods will change. At the end of the period, you will consolidate and close your books. The previous period for which the accounting process has completed and financial reports have been generated and no further adjustment entries are anticipated, is closed. Then a “New” period is opened and the steps starting from recording transactions are repeated till consolidation for the current period happens. And the accounting cycle continues forever with the business cycle!

Related Links

You May Also Like

-

When the quantum of business is expected to be moderate and the entrepreneur desires that the risk involved in the operation be shared, he or she may prefer a partnership. A partnership comes into existence when two or more persons agree to share the profits of a business, which they run together.

-

GL - Different Type of Journals

Two basic types of journals exist: general and special. In this article, the learner will understand the meaning of journalizing and the steps required to create a journal entry. This article will also discuss the types of journals and will help you understand general journals & special journals. In the end, we will explain the impact of automated ERPs on the Journalizing Process.

-

General Ledger - Advanced Features

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

-

Shared Services is the centralization of service offering at one part of an organization or group sharing funding and resourcing. The providing department effectively becomes an internal service provider. The key is the idea of 'sharing' within an organization or group.

-

What is a Business Eco System?

The goal of a business is to generate capital appreciation and profits for its owners or stakeholders by engaging in provision of goods and services to customers within the eco system/framework governed by respective laws(local/international). The eco system involves various entities that the business works with for delivery of a product or service.

-

GL - Review & Approve Journals

Review and Approval mechanisms ensure that the accounting transaction is reasonable, necessary, and comply with applicable policies. Understand why we need review and approval processes, what are they, and how they are performed in automated general ledger systems. Learn the benefits of having journal approval mechanisms in place.

-

Functional Organizational Structures

A functional organizational structure is a structure that consists of activities such as coordination, supervision and task allocation. The organizational structure determines how the organization performs or operates. The term organizational structure refers to how the people in an organization are grouped and to whom they report.

-

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

-

In most of the automated financial systems, you can define more than 12 accounting periods in a financial year. This article will explain the concept of the adjustment period and the benefits of having adjustment periods. Adjustment periods have their inherent challenges for the users of financial statements and there is a workaround for those who don’t want to use adjustment periods.

-

Funds contributed by owners in any business are different from all other types of funds. Equity is the residual value of the business enterprise that belongs to the owners or shareholders. The funds contributed by outsiders other than owners that are payable to them in the future. Liabilities are generally classified as Short Term (Current) and Long Term Liabilities. Current liabilities are debts payable within one year.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved