- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- General Ledger - Advanced Features

General Ledger - Advanced Features

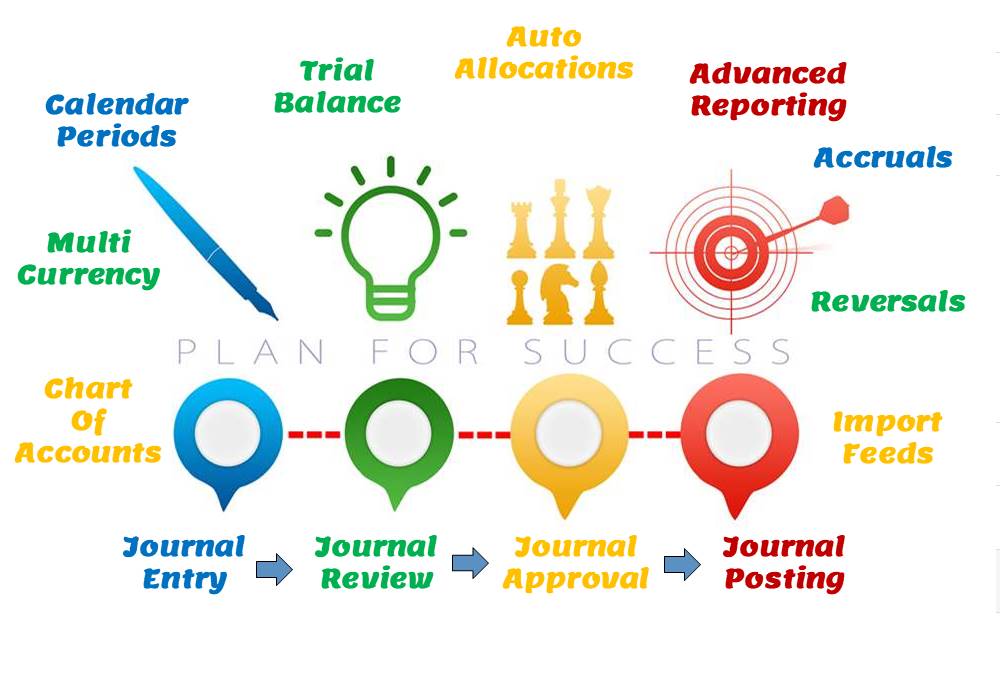

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

Enterprise General Ledger Systems:

A general ledger is the heart of a financial system, every company that needs to manage its financials needs one. It is the primary tool for recording the company's business transactions, calculating its profit or loss, and tracking its assets, liabilities, and owner's equity. Understanding and implementing built-in advanced features and controls can drive business and accounting processes leading to more accurate accounting with less manual intervention.

The modern general ledger systems that support corporations today are not the columnar ledgers of our ancestors. They are robust and provide in-depth insight into an organization—only if one can figure out what they do and how to do it. Users of these modern enterprise suites often feel frustrated by the lack of information surrounding specific functionality or features. This article will introduce the learner to concepts that are commonly used by most of them and in the subsequent articles, we will expand on each of these concepts.

Advanced Features in General Ledger

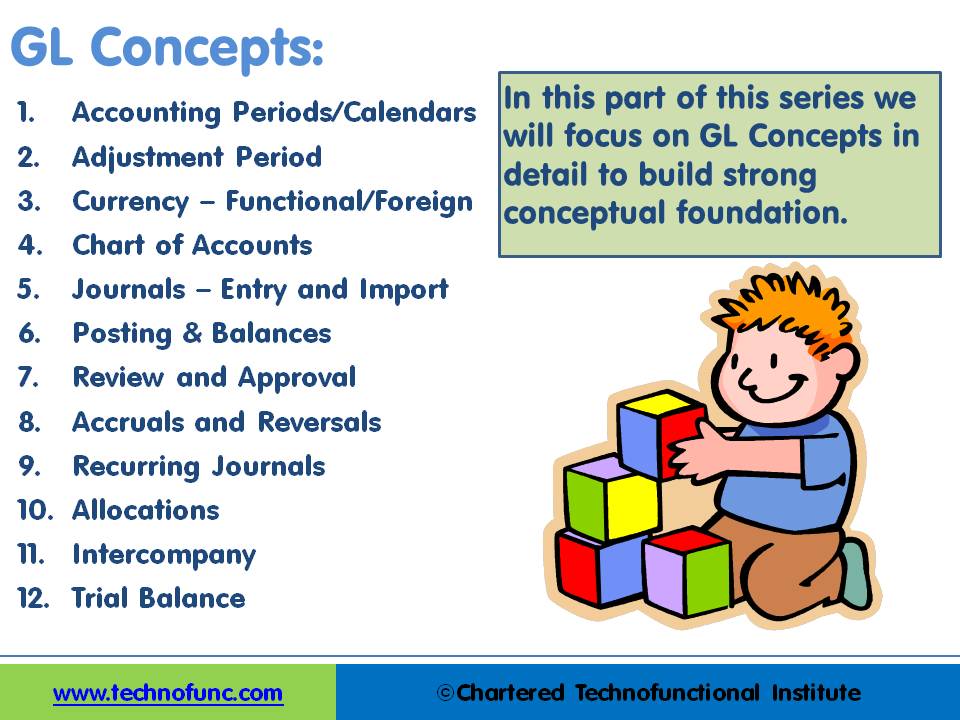

Given below are some of the advanced, general ledger concepts, understanding of which is a must for any user of modern general ledger systems.

1. Accounting Periods and Calendars

The accounting entity is viewed as a going concern and is expected to have a fairly long life. To determine the exact profit or loss of a business enterprise one needs to find that realizable difference between the end value of equity at closure and the investment into the business by the owners. The real value can be determined only when the enterprise is liquidated. But the owners need to know the profitability of the business on an ongoing basis to make informed business decisions. Hence, to overcome this problem, the accountants have developed the “Concept of Periodicity” for reporting the periodical progress of a business entity. This period for which the enterprise is determining and reporting its operating profit is the accounting period.

Generally, the accounting period consists of 12 months but we see differences in the way different organizations define their accounting period. There exist multiple reasons for the same. Some industries like banking need to maintain their average daily balances. They need to define their transaction calendars specifying each valid business day for which the average balances need to be calculated and maintained in General Ledger.

2. Adjustment Period

Adjustment Entries and period end entries add complexity to consolidation processes and automated general ledgers help manage these complicated adjustments. ERP tools provide you with the flexibility to define more than 12 accounting periods in a financial year. As a best practice companies using automated general ledgers define adjustment periods in their accounting calendars. They put one accounting period as the "Year Open" period to clear carried over balances from last financial year and the last period as "Year Close" where adjustment transactions are made for the same financial year. These periods are generally known as “Adjustment Periods”.

3. Currency – Functional and Foreign

Currency is the generally accepted form of money that is issued by a government and circulated within an economy. Currency is used as a medium of exchange for goods and services. Every nation has its own currency and global trade results in the exchange of currencies of different countries. Currency is the basis for trade and when the trade involves two different countries, generally two different currencies come to play. To obtain another country’s currency, it is necessary to buy it using the appropriate exchange rate, and the price of a currency compared to another is called the exchange rate.

For companies or accounting users managing multiple currencies, the interplay of foreign exchange rates and conversions can make the maintenance of the books a complicated task. Translation of statements may result in translation differences, which are accounted for as a cumulative translation adjustment. Businesses using the accrual method of accounting may recognize revenue or expense in one period and receive or pay it in another. In the intervening period, the exchange rate may have changed. When an accrued item is settled, the difference due to exchange rate movement in the amount accrued and the amount settled is treated as foreign exchange gain or loss.

4. Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA is used to organize the finances of the entity and to segregate expenditures, revenue, assets, and liabilities in order to give interested parties a better understanding of the financial health of the entity. The chart of accounts is a list of all the accounts and their numbers contained in the general ledger. The accounts are listed in the order of assets, liabilities, owner's equity, revenue, and expenses. Transactions can be posted to each defined account in COA and it can capture balances in the general ledger Chart of accounts is a way to outline the accounting system of a business, the chart of accounts establishes how the business will operate, what information will be captured, and what information will subsequently be readily retrievable by the system for reporting and other needs.

In automated accounting systems and ERPs, the chart of accounts is made up of and represented as a string of numeric and alphanumeric fields that act as identifiers. The companies define different segments to capture relevant business dimensions along with the natural account associated with the transaction. Companies may define anywhere from one to dozen segments to make up their Chart of Accounts and capture granular level business information associated with the transaction.

5. Journals – Entry and Import

Recording transactions in accounts must follow certain rules. To begin analyzing the transaction, first determine what items are exchanged. Remember that a transaction is defined as the sale or exchange of goods or services. The next step in analyzing the transaction is to identify the affected accounts. The three categories of accounts in which a business records its transactions are assets, liabilities, and owner's equity. Most transactions benefit—or increase—the business's resources in one area, and create a corresponding decrease in another. But a transaction does not always cause this effect. A transaction can result in just an increase or just a decrease. The final step in the analysis is to determine whether to record the amounts on the debit side or the credit side of the affected accounts.

Modern General Ledgers provide you capabilities to enter transactions spanning multiple legal entities using a complex chart of accounts and currency conversions. You can directly import general ledger transactions from your sub-ledgers using the interface provided by the GL System.

6. Journals - Review and Approval

The internal control principle of segregation of duties requires that different individuals be assigned responsibility for different elements of related activities, particularly those involving authorization, custody, or recordkeeping. Having the journal review and approval process in place ensures that all general journal entries get reviewed. This review is done to help prevent errors such as adjusting the wrong accounts and transposing numbers. It also helps protect against fraud by making sure there is a valid reason for the journal entry and someone is not manipulating the accounts for vested interests.

In the case of journal recording the journal entered by one person needs to be approved by another person in this step. This ensures having more than one person to complete the “Journal Creation Task”. In GL the separation by getting the financial transaction approved by more than one individual prevents fraud and error. Automated accounting systems provide you with the functionality of sending the journals for approval to the designated person. The system will validate the journal batch, determine if approval is required, and submit the batch to approvers (if required), then notifies appropriate individuals of the approval results. Review and Approval must happen before the journal is posted and balances are updated. ERP Systems provide review capabilities by providing a workflow framework to route these transactions to appropriate users based on the rules defined in the system. Automatic notifications are sent to the person who needs to take action.

7. Journals - Posting & Balances

In automated accounting systems posting can be understood as the process to update (post) the details of transactions into the database, perform calculations, and update account balances impacted by the transaction(s). During the posting process, most accounting systems validate the Journal Entry for completeness and accuracy.

During the posting process, the system applies the values in the journal entry to the database resulting in accounting data getting appended to the numbers in the database. Journals once posted cannot be edited or modified. The ideal business process is to reverse these entries if any corrections need to be made. To verify accounts, total balances from subsidiary ledgers are compared to the totals in each general ledger account.

8. Accruals and Reversals

There are two commonly used methods of accounting - Cash Basis and the Accruals Basis. In cash basis of accounting, income is recognized in books when it is received in cash, and expenses are offset when they are actually paid. Contrary to Cash Basis Accounting, in Accrual Basis Accounting, financial items are accounted for when they are earned and deductions are claimed when expenses are incurred, irrespective of the actual cash flow. The Accrual accounting method measures the financial performance of a company by recognizing accounting events regardless of when corresponding cash transactions occur. Accrual follows the matching principle in which the revenues are matched (or offset) to expenses in the accounting period in which the transaction occurs rather than when payment is made (or received).

At the beginning of each accounting period, there is an accounting practice to use reversing entries to cancel out the adjusting/accrual entries that were made to accrue revenues and expenses at the end of the previous accounting period. The use of Reversing Entries makes it easier to record subsequent transactions by eliminating the possibility of duplication.

9. Recurring Journals

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Each accounting period the journal should have the same accounts but the amounts could be different. A recurring journal entry enables you to automate similar or repeating entries. For users who need to post certain transactions frequently with few or no changes, it is an advantage to use recurring journals.

Users need to define recurring journal formulas for transactions that they want to repeat every accounting period, such as accruals, depreciation charges, and allocations. The formulas can be simple or complex but need to have some logic of ascertaining the amounts for each of the accounts that need to be repeated. Each formula can use fixed amounts and/or account balances and period-to-date or year-to-date balances from the current period, prior period, or same period last year.

10. Auto Allocations

Allocation is the act of distributing according to a plan. As per the dictionary allocate means to set apart for a special purpose; designate; distribute according to a plan. From an accounting context, it means a system of dividing overhead expenses between the various departments of a business. Figuratively, earmarked is often used in regard to monetary allocations although it is heard in other contexts as well. Mass allocations is a functionality offered by many automated systems and ERPs to distribute the account balances from one account to several others based on a formula or mathematic logic

11. Intercompany Accounting

An intercompany transaction occurs when one unit of an entity is involved in a transaction with another unit of the same entity. Most economic transactions involve two unrelated entities, although transactions may occur between units of one entity (intercompany transactions). An intercompany transaction is a transaction that occurs between two units of the same entity. An intercompany transaction occurs when one unit of an entity transacts with another unit of the same entity. It is a transaction between two associated companies that file a consolidated tax return or financial statement. General Ledgers can automate the intercompany process.

12. Trial Balance

The practice of recording the same debit amount to one account and an equal credit amount to another account results in total debits being equal to total credits for all accounts in the general ledger. If the accounting entries are recorded without error, the aggregate balance of all accounts having positive balances (Debit Balances) will be equal to the aggregate balance of all accounts having negative balances (Credit Balances). Trial Balance is the compilation of balances of all accounts in the general ledgers into debit and credit columns. In a double-entry accounting system the total debits equal the total credits hence a compilation of all the accounts will be balanced, that is Sum of Debits will be equal to the sum of credits and hence the sum of the trial balance will always be zero if debit balances are represented by positive amounts and credit balances are represented by negative amounts.

Bookkeeping is the act of recording transactions, while accounting includes bookkeeping activities plus the preparation, analysis, and interpretation of financial information. Once we have recorded the transactions, the next step is to convert this data into meaningful information that can provide insights to the business stakeholders. Trial Balance is usually drawn at the end of every reporting period. Trial Balance becomes the basis for advanced reports like Balance Sheet and Profit and Loss Accounts. The concept of “Balancing” and “Suspense Posting” ensures that Journals in an automated system and ERPs are always balanced resulting in a balanced trial balance. Trial Balance is used for financial reporting, management reporting, consolidation process, and reconciliation processes.

Related Links

You May Also Like

-

There are five types of core accounts to capture any accounting transaction. Apart from these fundamental accounts, some other special-purpose accounts are used to ensure the integrity of financial transactions. Some examples of such accounts are clearing accounts, suspense accounts, contra accounts, and intercompany accounts. Understand the importance and usage of these accounts.

-

Legal Structures for Multinational Companies

A multinational company generally has offices and/or factories in different countries and a centralized head office where they coordinate global management. A multinational company (MNC)is a corporate organization that owns or controls the production of goods or services in at least one country other than its home country.

-

Operational Structures in Business

Large organizations grow through subsidiaries, joint ventures, multiple divisions and departments along with mergers and acquisitions. Leaders of these organizations typically want to analyze the business based on operational structures such as industries, functions, consumers, or product lines.

-

Learn the typical accounting cycle that takes place in an automated accounting system. We will understand the perquisites for commencing the accounting cycle and the series of steps required to record transactions and convert them into financial reports. This accounting cycle is the standard repetitive process that is undertaken to record and report accounting.

-

The sole trader organization (also called proprietorship) is the oldest form of organization and the most common form of organization for small businesses even today. In a proprietorship the enterprise is owned and controlled only by one person. This form is one of the most popular forms because of the advantages it offers. It is the simplest and easiest to form.

-

Network Organizational Structures

The newest, and most divergent, team structure is commonly known as a Network Structure (also called "lean" structure) has central, core functions that operate the strategic business. It outsources or subcontracts non-core functions. When an organization needs to control other organizations or agencies whose participation is essential to the success, a network structure is organized.

-

Business Metrics for Management Reporting

Business metric is a quantifiable measure of an organization's behavior, activities, and performance used to access the status of the targeted business process. Traditionally many metrics were finance based, inwardly focusing on the performance of the organization. Businesses can use various metrics available to monitor, evaluate, and improve their performance across any of the focus areas like sales, sourcing, IT or operations.

-

There are two commonly used methods of accounting - Cash Basis and the Accruals Basis. Understand the difference between accruals and reversals. Recap the earlier discussion we had on accruals and reversals and see the comparison between these two different but related accounting concepts. Understand how the action of accruing results in reversals subsequently in the accounting cycle.

-

McKinsey 7S Framework is most often used as an organizational analysis tool to assess and monitor changes in the internal situation of an organization. The model is based on the theory that, for an organization to perform well, seven elements need to be aligned and mutually reinforcing.

-

Period End Accruals, Receipt Accruals, Paid Time-Off Accruals, AP Accruals, Revenue Based Cost Accruals, Perpetual Accruals, Inventory Accruals, Accruals Write Off, PO Receipt Accrual, Cost Accrual, etc. are some of the most complex and generally misconstrued terms in the context of general ledger accounting. In this article, we will explore what is the concept of accrual and how it impacts general ledger accounting.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved