- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- Introduction to Legal Entities Concept

Introduction to Legal Entities Concept

Modern business organizations operate globally and leverage a large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders. Learn more about Legal Entities and their importance for businesses.

Legal Forms and Structures

In a rapidly changing national and global business environment, it has become necessary that corporate entities are organized in tune with the emerging economic trends, enable good corporate governance, and enable protection of the interests of the investors and other stakeholders. Further, due to the continuous increase in the complexities of business operation, the forms of corporate organizations are constantly changing.

This section provides an overview of some of the most commonly used legal forms and structures by corporate organizations across the globe along with a brief discussion of related laws, rules, procedures, and regulations that need compliance. How a company structures its long-term operations in a foreign country, effectively defines how it will be taxed hence the choice could have a significant potential effect on the profitability.

Regulations prevalent in most of the countries generally allow foreign entities to choose classification as a corporation (subsidiary), partnership, unincorporated branches; Limited Liability Companies (LLCs), distributor and manufacturer representatives, and joint ventures. Each choice has its own implications and complications. Generally, corporates operate as a separate legal entity with limited liability. Typical business models of foreign corporations conducting business activities in other countries involve wholly-owned Subsidiaries, Joint Ventures, Representative Offices, or Foreign Branches.

What is a Legal Entity?

A legal entity is an artificial person having separate legal standing in the eyes of law. Some of the attributes associated with a legal entity are:

- A legal entity has the legal capacity to enter into agreements or contracts, assume obligations, incur and pay debts, sue and be sued in its own right, and to be held responsible for its actions.

- Legal Entities file the accounts and take care of accounting. Legal Entity is the organizational unit for Financial Accounting for which a completely self-contained set of accounts needs to be drawn up for purposes of external reporting.

- Legal Entity possesses separate existence for tax purposes. Legal Entities pay the taxes and therefore need tax registrations.

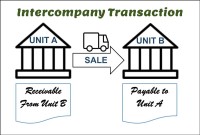

- Trade between Legal Entities needs intercompany supported by adequate legal documentation.

- Legal Entities own the money and bank accounts

- Legal Entities comply with whatever needs compliance – The “Legal” in the word “Legal Entity”. This includes recording of all relevant transactions and generating all supporting documents required for financial statements.

- Foreign Branches of such corporations can also assume obligations and have legal obligations to submit financial information to foreign governments.

- Legal entities such as parent companies own or control subsidiaries. A large corporation can own many legal entities as its subsidiaries.

Subsidiaries as Legal Entities:

Subsidiaries are a common feature of business life, and all multinational corporations organize their operations in this way. Examples include holding companies such as Berkshire Hathaway, Time Warner, or Citigroup; as well as more focused companies such as IBM or Xerox. These, and other MNCs, organize their businesses into national and functional subsidiaries, often with multiple levels of subsidiaries.

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation. The controlling entity is called its parent company, parent, or holding company.

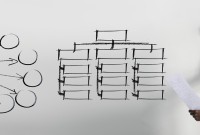

A subsidiary may itself have subsidiaries, and these, in turn, may have subsidiaries of their own. A parent and all its subsidiaries together are called a "group", although this term can also apply to cooperate companies and their subsidiaries with varying degrees of shared ownership.

Subsidiaries are separate, distinct legal entities for the purposes of taxation, regulation, and liability. For this reason, they differ from divisions, which are businesses fully integrated within the main company, and not legally or otherwise distinct from it.

For the purposes of liability, taxation, and regulation, subsidiaries are distinct legal entities. A subsidiary can sue and be sued separately from its parent and its obligations will not normally be the obligations of its parent. If a parent company owns a foreign subsidiary, the company under which the subsidiary is incorporated must follow the laws of the country where the subsidiary operates, and the parent company still carries the foreign subsidiary's financials on its books (consolidated financial statements).

Related Links

You May Also Like

-

Internally, an organization can be structured in many different ways, depending on their objectives. The internal structure of an organization will determine the modes in which it operates and performs. Organizational structure allows the expressed allocation of responsibilities for different functions and processes to different entities such as the branch, department, workgroup and individual.

-

A joint venture (JV) is a business agreement in which the parties agree to develop, for a finite time, a new entity and new assets by contributing equity. They exercise control over the enterprise and consequently share revenues, expenses and assets. A joint venture takes place when two or more parties come together to take on one project.

-

Defining Organizational Hierarchies

A hierarchy is an ordered series of related objects. You can relate hierarchy with “pyramid” - where each step of the pyramid is subordinate to the one above it. One can use drill up or down to perform multi-dimensional analysis with a hierarchy. Multi-dimensional analysis uses dimension objects organized in a meaningful order and allows users to observe data from various viewpoints.

-

In this article we will focus on and understand the accounting process which enables the accounting system to provide the necessary information to business stakeholders. We will deep dive into each of the steps of accounting and will understand how to identify accounting transactions and the process for recording accounting information and transactions.

-

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

-

Shared Services is the centralization of service offering at one part of an organization or group sharing funding and resourcing. The providing department effectively becomes an internal service provider. The key is the idea of 'sharing' within an organization or group.

-

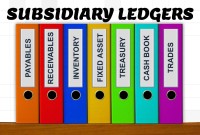

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

-

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

-

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved